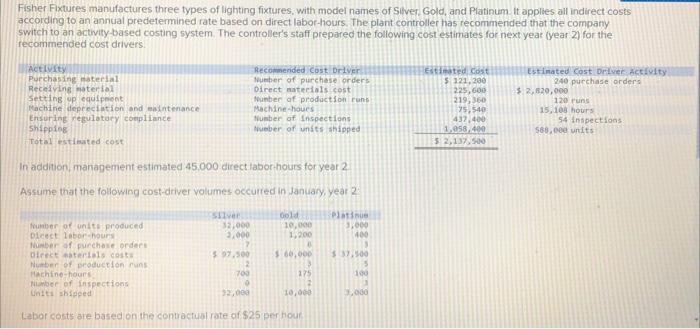

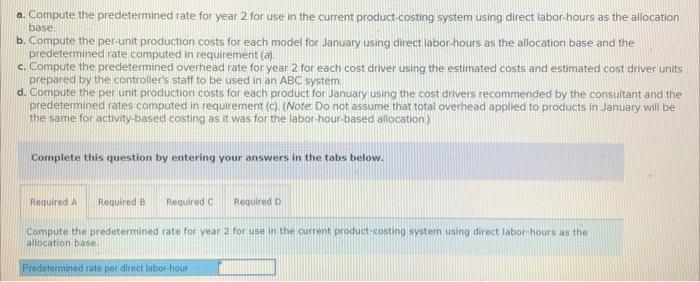

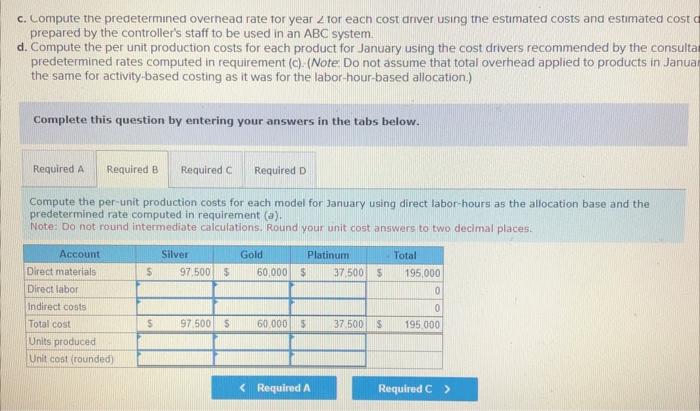

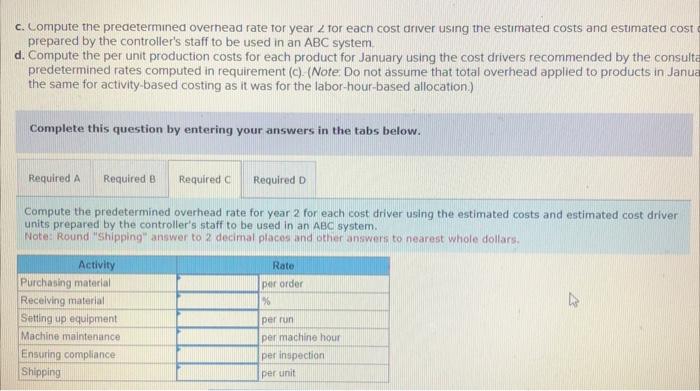

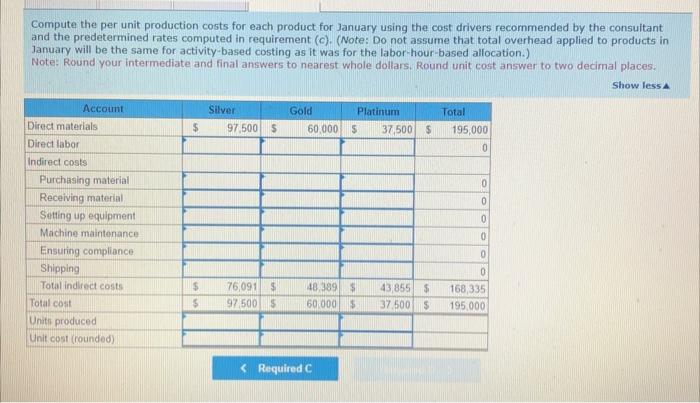

Fisher Fixtures manufactures three types of lighting fixtures, with model names of Siver, Gold, and Platinum it applies all indirect costs according to an annual predetermined rate based on direct labor-hours. The plant controller has recommended that the company switch to an activity-based costing system. The controller's staff prepared the following cost estimates for next year (year 2 ) for the recommended cost drivers. In addition, management estimated 45.000 direct labor hours for year 2 Assume that the following cost-driver volumes occurred in Janciary, year 2 . Labor costs are based on the convactual rote of $25 per hour a. Compute the predetermined rate for year 2 for use in the current product-costing system using direct labor-hours as the allocation base: b. Compute the per-unit production costs for each model for January using direct labor-hours as the allocation base and the predetermined rate computed in requirement (a). c. Compute the predetermined overhead rate for year 2 for each cost driver using the estimated costs and estimated cost driver units prepared by the controller's staff to be used in an ABC system. d. Compute the per unit production costs for each product for January using the cost drivers recommended by the consultant and the predetermined rates computed in requirement (c). (Note: Do not assume that total overhead applied to products in January will be the same for activity-based costing as it was for the fabor-hour-based allocation) Complete this question by entering your answers in the tabs below. Compute the predetermined rate for year 2 for use in the current product costing system using direct labor-hours as the aliocation base. c. Lompute the predetermined overnead rate for year tor each cost anver using the estimated costs and estimated cost prepared by the controller's staff to be used in an ABC system. d. Compute the per unit production costs for each product for January using the cost drivers recommended by the consulta predetermined rates computed in requirement (c). (Note Do not assume that total overhead applied to products in Janua the same for activity-based costing as it was for the labor-hour-based allocation.) Complete this question by entering your answers in the tabs below. Compute the per-unit production costs for each model for January using direct labor-hours as the allocation base and the predetermined rate computed in requirement (a). Note: Do not round intermediate calculations. Round your unit cost answers to two decimal places. c. Compute the predetermined overhead rate tor year tor each cost ariver using the estimated costs and estumated cost prepared by the controller's staff to be used in an ABC system. d. Compute the per unit production costs for each product for January using the cost drivers recommended by the consult: predetermined rates computed in requirement (c). (Note. Do not assume that total overhead applied to products in Janua the same for activity-based costing as it was for the labor-hour-based allocation.) Complete this question by entering your answers in the tabs below. Compute the predetermined overhead rate for year 2 for each cost driver using the estimated costs and estimated cost driver units prepared by the controller's staff to be used in an ABC system. Note: Round "Shipping" answer to 2 decimal places and other answers to nearest whole dollars. Compute the per unit production costs for each product for January using the cost drivers recommended by the consuitant and the predetermined rates computed in requirement (c ). (Note: Do not assume that total overhead applied to products in January will be the same for activity-based costing as it was for the labor-hour-based allocation.) Note: Round your intermediate and final answers to nearest whole dollars. Round unit cost answer to two decimal places