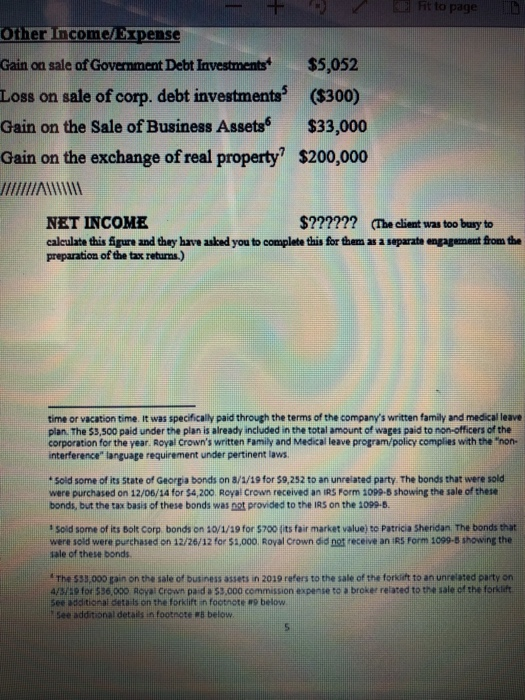

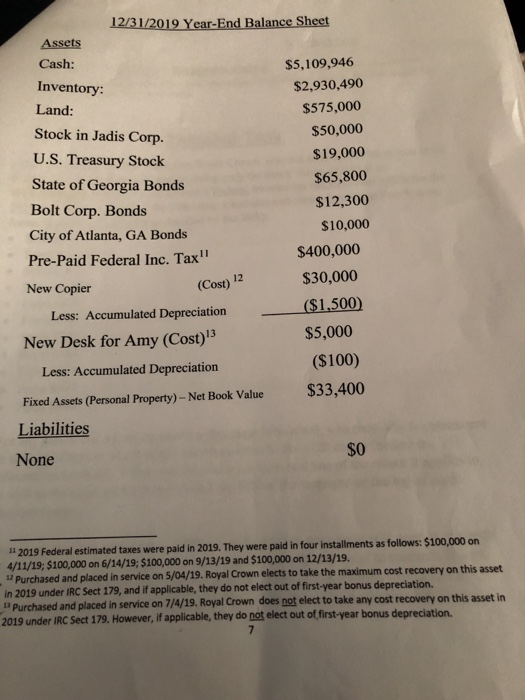

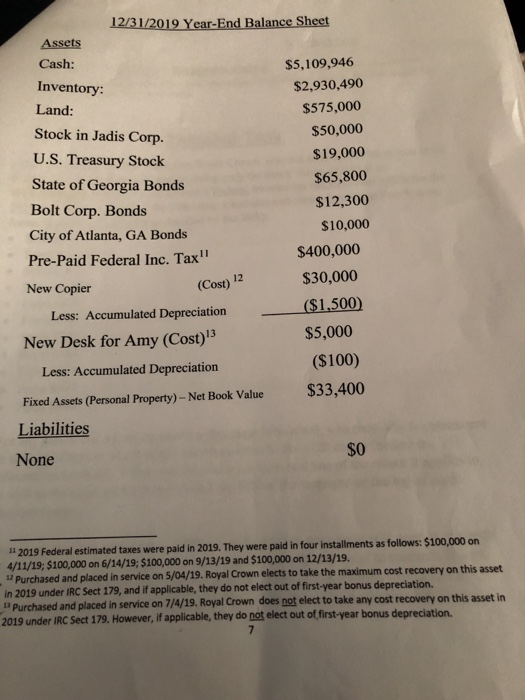

- + fit to page 1 Other Income/Expense Gain on sale of Government Debt Investments* $5,052 Loss on sale of corp. debt investments ($300) Gain on the sale of Business Assets $33,000 Gain on the exchange of real property? $200,000 JINA NET INCOME $?????? (The client was too busy to calculate this figure and they have asked you to complete this for them as a separate engagement from the preparation of the tax returns.) time or vacation time. It was specifically paid through the terms of the company's written family and medical leave plan. The $3,500 paid under the plan is already included in the total amount of wages paid to non-officers of the corporation for the year. Royal Crown's written Family and Medical leave program/policy complies with the non- interference" language requirement under pertinent laws. sold some of its state of Gerpla bonds on 8/1/19 for $9,252 to an unrelated party. The bonds that were sold were purchased on 12/06/14 for $4,200. Royal Crown received an IRS Form 1090-8 showing the sale of these bonds, but the tax basis of these bonds was not provided to the is on the 1090-8. sold some of its Bolt corp bonds on 10/1/19 for $700 (its fair market value to Patricia Sheridan The bonds that were sold were purchased on 12/26/12 for $1,000, Royal Crown did not receive an IRS Form 1099-B showing the Tale of these bonds The 53.000 in on the sale of businesses in 2019 refers to the sale of the forklift to an unrelated arton AND for $30,000 Reval Crown paid a $3.000 commission expense to broke retted to the sale of the tot See aditional details on the forklift in footnote below See additional details in footnotes below. 12/31/2019 Year-End Balance Sheet Assets Cash: $5,109,946 Inventory: $2,930,490 Land: $575,000 Stock in Jadis Corp. $50,000 U.S. Treasury Stock $19,000 State of Georgia Bonds $65,800 Bolt Corp. Bonds $12,300 City of Atlanta, GA Bonds $10,000 Pre-Paid Federal Inc. Tax" $400,000 New Copier $30,000 Less: Accumulated Depreciation ($1,500 New Desk for Amy (Cost)" $5,000 Less: Accumulated Depreciation ($100) Fixed Assets (Personal Property) - Net Book Value $33,400 Liabilities (Cost) 2 None 2019 Federal estimated taxes were paid in 2019. They were paid in four installments as follows: $100,000 on 4/11/19; $100,000 on 6/14/19; $100,000 on 9/13/19 and $100,000 on 12/13/19. Purchased and placed in service on 5/04/19. Royal Crown elects to take the maximum cost recovery on this asset in 2019 under IRC Sect 179, and if applicable, they do not elect out of first-year bonus depreciation. Purchased and placed in service on 7/4/19. Royal Crown does not elect to take any cost recovery on this asset in 2019 under IRC Sect 179. However, if applicable, they do not elect out of first-year bonus depreciation - + fit to page 1 Other Income/Expense Gain on sale of Government Debt Investments* $5,052 Loss on sale of corp. debt investments ($300) Gain on the sale of Business Assets $33,000 Gain on the exchange of real property? $200,000 JINA NET INCOME $?????? (The client was too busy to calculate this figure and they have asked you to complete this for them as a separate engagement from the preparation of the tax returns.) time or vacation time. It was specifically paid through the terms of the company's written family and medical leave plan. The $3,500 paid under the plan is already included in the total amount of wages paid to non-officers of the corporation for the year. Royal Crown's written Family and Medical leave program/policy complies with the non- interference" language requirement under pertinent laws. sold some of its state of Gerpla bonds on 8/1/19 for $9,252 to an unrelated party. The bonds that were sold were purchased on 12/06/14 for $4,200. Royal Crown received an IRS Form 1090-8 showing the sale of these bonds, but the tax basis of these bonds was not provided to the is on the 1090-8. sold some of its Bolt corp bonds on 10/1/19 for $700 (its fair market value to Patricia Sheridan The bonds that were sold were purchased on 12/26/12 for $1,000, Royal Crown did not receive an IRS Form 1099-B showing the Tale of these bonds The 53.000 in on the sale of businesses in 2019 refers to the sale of the forklift to an unrelated arton AND for $30,000 Reval Crown paid a $3.000 commission expense to broke retted to the sale of the tot See aditional details on the forklift in footnote below See additional details in footnotes below. 12/31/2019 Year-End Balance Sheet Assets Cash: $5,109,946 Inventory: $2,930,490 Land: $575,000 Stock in Jadis Corp. $50,000 U.S. Treasury Stock $19,000 State of Georgia Bonds $65,800 Bolt Corp. Bonds $12,300 City of Atlanta, GA Bonds $10,000 Pre-Paid Federal Inc. Tax" $400,000 New Copier $30,000 Less: Accumulated Depreciation ($1,500 New Desk for Amy (Cost)" $5,000 Less: Accumulated Depreciation ($100) Fixed Assets (Personal Property) - Net Book Value $33,400 Liabilities (Cost) 2 None 2019 Federal estimated taxes were paid in 2019. They were paid in four installments as follows: $100,000 on 4/11/19; $100,000 on 6/14/19; $100,000 on 9/13/19 and $100,000 on 12/13/19. Purchased and placed in service on 5/04/19. Royal Crown elects to take the maximum cost recovery on this asset in 2019 under IRC Sect 179, and if applicable, they do not elect out of first-year bonus depreciation. Purchased and placed in service on 7/4/19. Royal Crown does not elect to take any cost recovery on this asset in 2019 under IRC Sect 179. However, if applicable, they do not elect out of first-year bonus depreciation