fix the error for each problem

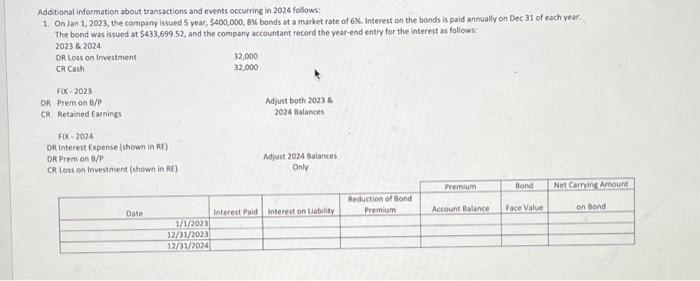

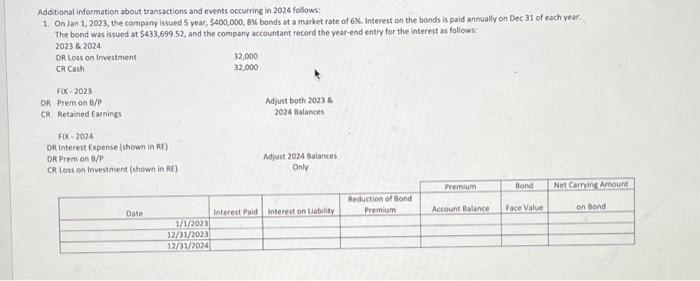

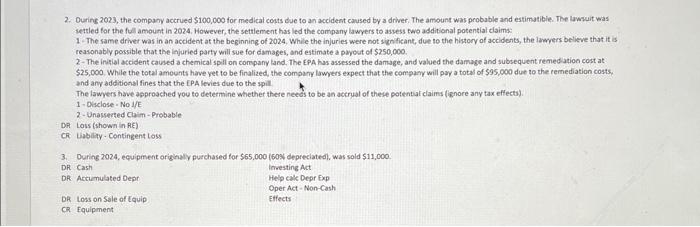

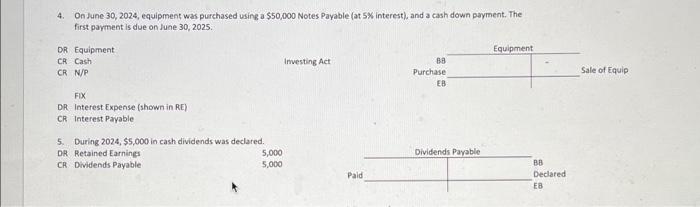

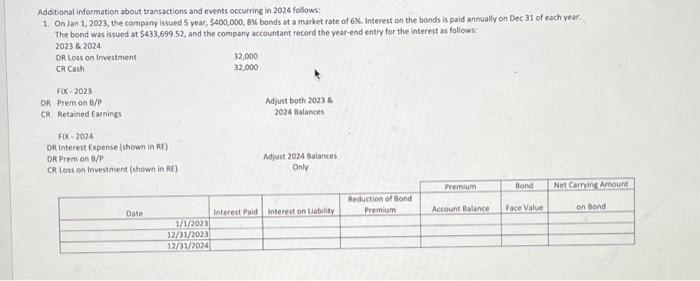

Additionat information about transactions and events occurring in 2024 follows: 1. On lan 1, 2023, the company lssued 5 year, $400,000,8% bonds at market rate of 6%. Interest on the bends is paid annually on Dec 31 of each year. The bond was issued at $433,699.52, and the company accountant record the year-end entry for the interest as follows: 2. During 2023, the company accrued $100,000 for medical coats dje to an accident caused by a drwer. The amsount was probable and estimatibie. The lawiuit was ietsled for the full amount in 2024. However, the settlement has led the company lawyers to assess nwo additional potential ciaims: 1. The same dfiver was in an accident at the beginning of 2024. While the injuries were not significant, due to the history of accidents, the larerers believe that it is reasonably possible that the injuried party will sue for damages, and estimate a payout of $250,000. 2 - The inisial accident caved a chemical spil on company land. The EPA has assessed the damage, and yalued the damage and subsequent remed ation cost at 525,000 . While the total amounts have yet to be finalized, the compamy lowwers expect that the compamy will pay a total of $95,000 due to the remediation costs. and any additional fines that the LPA levies due to the spill. The lawyers have approached you to determine whether there needs to be an acerual of these potential claims (ignore any tax effects). 1 - Disclose - No 1/ 2- Unaserted Claim-Probable DA Loss (shown in RE) CF biability-Contingent Loss 3. During 2024, equipment origtialy purchased for $65,000 (60\% depreciated), was sold $11,000. DR. Cash DR Accumulated Depr ieresting Act. Help cak Depr Exp Dper Act - Non-Cash DR Loss on Sale of tquip Etfects CR Fquipment 4. On June 30, 2024, equipment was purchased using a $50,000 Notes Payable (at 5% interest), and a cash down payment. The first payment is due on June 30,2025 . Additionat information about transactions and events occurring in 2024 follows: 1. On lan 1, 2023, the company lssued 5 year, $400,000,8% bonds at market rate of 6%. Interest on the bends is paid annually on Dec 31 of each year. The bond was issued at $433,699.52, and the company accountant record the year-end entry for the interest as follows: 2. During 2023, the company accrued $100,000 for medical coats dje to an accident caused by a drwer. The amsount was probable and estimatibie. The lawiuit was ietsled for the full amount in 2024. However, the settlement has led the company lawyers to assess nwo additional potential ciaims: 1. The same dfiver was in an accident at the beginning of 2024. While the injuries were not significant, due to the history of accidents, the larerers believe that it is reasonably possible that the injuried party will sue for damages, and estimate a payout of $250,000. 2 - The inisial accident caved a chemical spil on company land. The EPA has assessed the damage, and yalued the damage and subsequent remed ation cost at 525,000 . While the total amounts have yet to be finalized, the compamy lowwers expect that the compamy will pay a total of $95,000 due to the remediation costs. and any additional fines that the LPA levies due to the spill. The lawyers have approached you to determine whether there needs to be an acerual of these potential claims (ignore any tax effects). 1 - Disclose - No 1/ 2- Unaserted Claim-Probable DA Loss (shown in RE) CF biability-Contingent Loss 3. During 2024, equipment origtialy purchased for $65,000 (60\% depreciated), was sold $11,000. DR. Cash DR Accumulated Depr ieresting Act. Help cak Depr Exp Dper Act - Non-Cash DR Loss on Sale of tquip Etfects CR Fquipment 4. On June 30, 2024, equipment was purchased using a $50,000 Notes Payable (at 5% interest), and a cash down payment. The first payment is due on June 30,2025