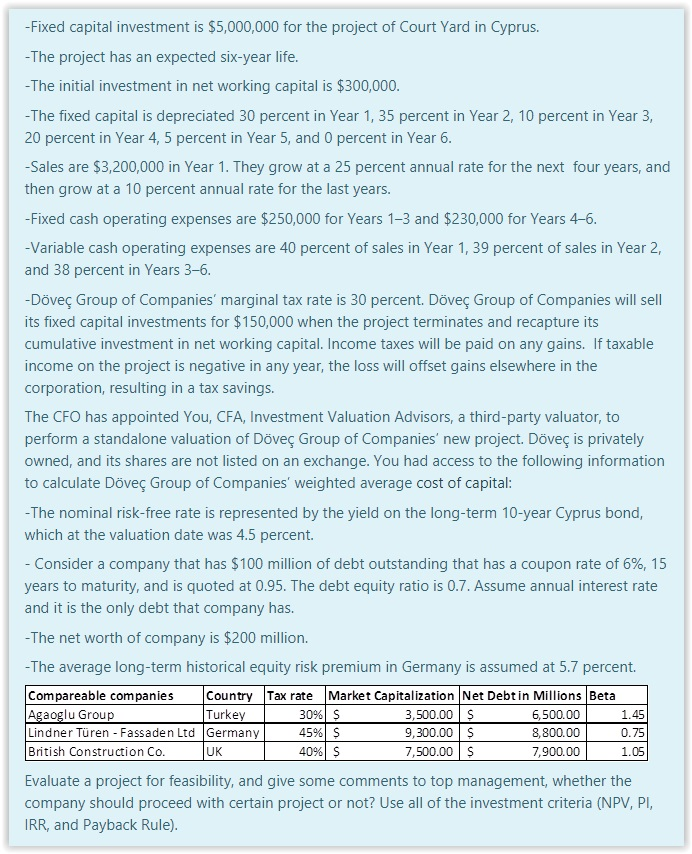

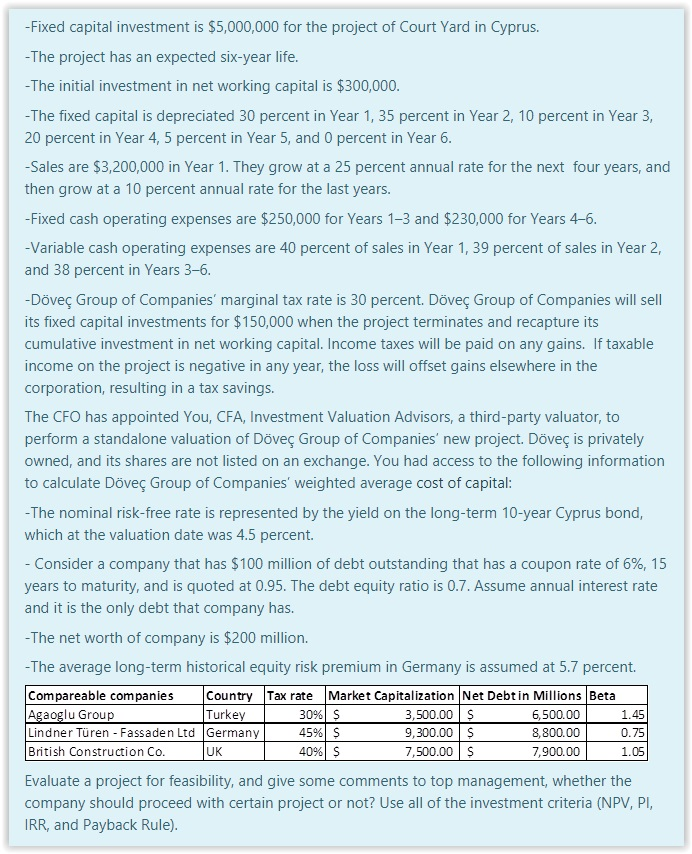

- Fixed capital investment is $5,000,000 for the project of Court Yard in Cyprus. -The project has an expected six-year life. -The initial investment in net working capital is $300,000. -The fixed capital is depreciated 30 percent in Year 1, 35 percent in Year 2, 10 percent in Year 3, 20 percent in Year 4,5 percent in Year 5, and 0 percent in Year 6. -Sales are $3,200,000 in Year 1. They grow at a 25 percent annual rate for the next four years, and then grow at a 10 percent annual rate for the last years. - Fixed cash operating expenses are $250,000 for Years 1-3 and $230,000 for Years 4-6. -Variable cash operating expenses are 40 percent of sales in Year 1, 39 percent of sales in Year 2, and 38 percent in Years 3-6. - Dve Group of Companies' marginal tax rate is 30 percent. Dve Group of Companies will sell its fixed capital investments for $150,000 when the project terminates and recapture its cumulative investment in net working capital. Income taxes will be paid on any gains. If taxable income on the project is negative in any year, the loss will offset gains elsewhere in the corporation, resulting in a tax savings. The CFO has appointed You, CFA, Investment Valuation Advisors, a third-party valuator, to perform a standalone valuation of Dve Group of Companies' new project. Dve is privately owned, and its shares are not listed on an exchange. You had access to the following information to calculate Dve Group of Companies' weighted average cost of capital: -The nominal risk-free rate is represented by the yield on the long-term 10-year Cyprus bond, which at the valuation date was 4.5 percent. - Consider a company that has $100 million of debt outstanding that has a coupon rate of 6%, 15 years to maturity, and is quoted at 0.95. The debt equity ratio is 0.7. Assume annual interest rate and it is the only debt that company has. -The net worth of company is $200 million. -The average long-term historical equity risk premium in Germany is assumed at 5.7 percent. Compareable companies Country Tax rate Market Capitalization Net Debt in Millions Beta Agaoglu Group Turkey 3,500.00 6,500.00 Lindner Tren - Fassaden Ltd Germany 9,300.00 $ 8,800.00 British Construction Co. 40% $ 7,500.00 7,900.00 Evaluate a project for feasibility, and give some comments to top management, whether the company should proceed with certain project or not? Use all of the investment criteria (NPV, PI, IRR, and Payback Rule). 30% $ 45% S 1.45 0.75 UK 1.05 - Fixed capital investment is $5,000,000 for the project of Court Yard in Cyprus. -The project has an expected six-year life. -The initial investment in net working capital is $300,000. -The fixed capital is depreciated 30 percent in Year 1, 35 percent in Year 2, 10 percent in Year 3, 20 percent in Year 4,5 percent in Year 5, and 0 percent in Year 6. -Sales are $3,200,000 in Year 1. They grow at a 25 percent annual rate for the next four years, and then grow at a 10 percent annual rate for the last years. - Fixed cash operating expenses are $250,000 for Years 1-3 and $230,000 for Years 4-6. -Variable cash operating expenses are 40 percent of sales in Year 1, 39 percent of sales in Year 2, and 38 percent in Years 3-6. - Dve Group of Companies' marginal tax rate is 30 percent. Dve Group of Companies will sell its fixed capital investments for $150,000 when the project terminates and recapture its cumulative investment in net working capital. Income taxes will be paid on any gains. If taxable income on the project is negative in any year, the loss will offset gains elsewhere in the corporation, resulting in a tax savings. The CFO has appointed You, CFA, Investment Valuation Advisors, a third-party valuator, to perform a standalone valuation of Dve Group of Companies' new project. Dve is privately owned, and its shares are not listed on an exchange. You had access to the following information to calculate Dve Group of Companies' weighted average cost of capital: -The nominal risk-free rate is represented by the yield on the long-term 10-year Cyprus bond, which at the valuation date was 4.5 percent. - Consider a company that has $100 million of debt outstanding that has a coupon rate of 6%, 15 years to maturity, and is quoted at 0.95. The debt equity ratio is 0.7. Assume annual interest rate and it is the only debt that company has. -The net worth of company is $200 million. -The average long-term historical equity risk premium in Germany is assumed at 5.7 percent. Compareable companies Country Tax rate Market Capitalization Net Debt in Millions Beta Agaoglu Group Turkey 3,500.00 6,500.00 Lindner Tren - Fassaden Ltd Germany 9,300.00 $ 8,800.00 British Construction Co. 40% $ 7,500.00 7,900.00 Evaluate a project for feasibility, and give some comments to top management, whether the company should proceed with certain project or not? Use all of the investment criteria (NPV, PI, IRR, and Payback Rule). 30% $ 45% S 1.45 0.75 UK 1.05