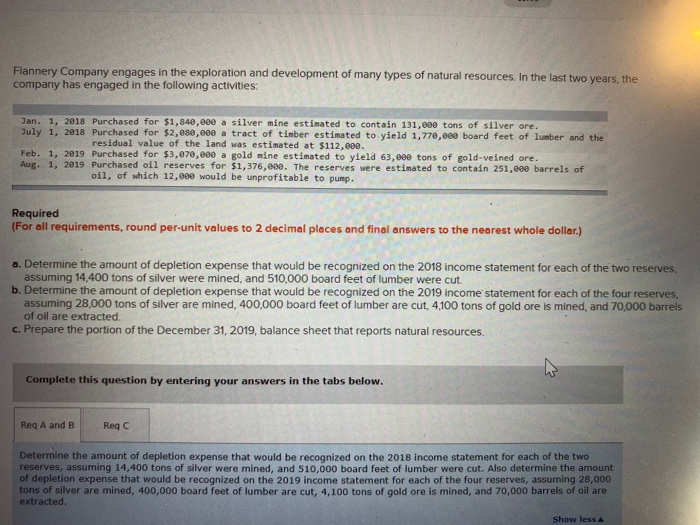

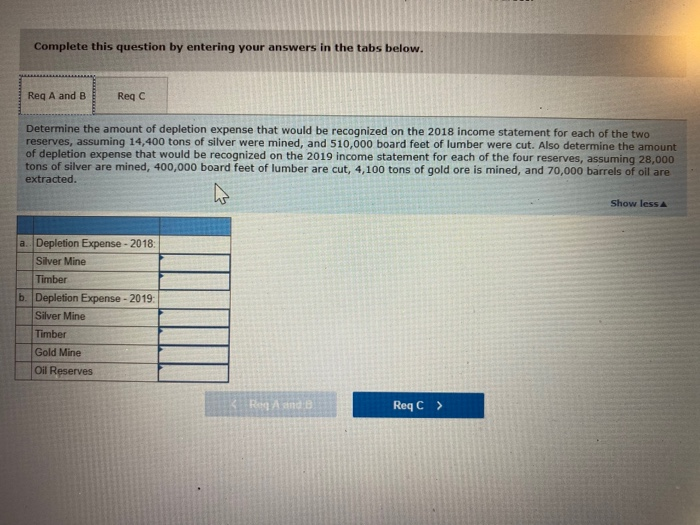

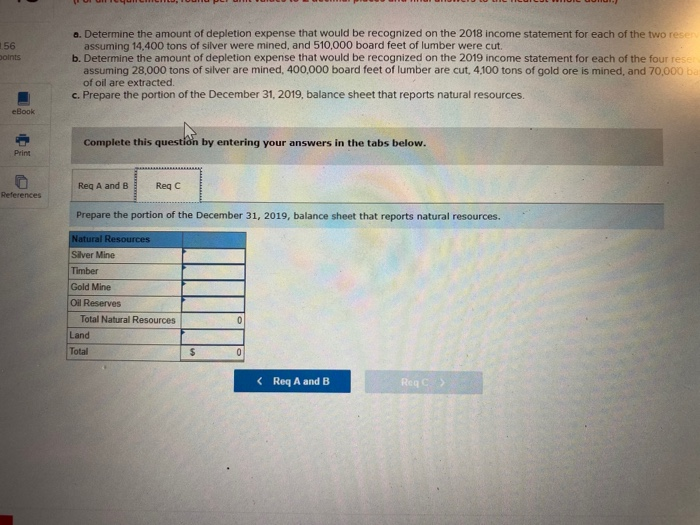

Flannery Company engages in the exploration and development of many types of natural resources. In the last two years, the company has engaged in the following activities: Jan. 1, 2018 Purchased for $1,840,000 a silver mine estimated to contain 131,000 tons of silver ore. July 1, 2018 Purchased for $2,880,000 a tract of timber estimated to yield 1,770,000 board feet of lumber and the residual value of the land was estimated at $112,000. Feb. 1, 2019 Purchased for $3,870,000 a gold mine estimated to yield 63,000 tons of gold-veined ore. Aug. 1, 2019 Purchased oil reserves for $1,376,000. The reserves were estimated to contain 251,000 barrels of oil, of which 12,000 would be unprofitable to pump. Required (For all requirements, round per-unit values to 2 decimal places and final answers to the nearest whole dollar.) a. Determine the amount of depletion expense that would be recognized on the 2018 income statement for each of the two reserves assuming 14,400 tons of silver were mined, and 510,000 board feet of lumber were cut. b. Determine the amount of depletion expense that would be recognized on the 2019 income statement for each of the four reserves, assuming 28,000 tons of silver are mined, 400,000 board feet of lumber are cut, 4100 tons of gold ore is mined, and 70,000 barrels of oil are extracted c. Prepare the portion of the December 31, 2019, balance sheet that reports natural resources. Complete this question by entering your answers in the tabs below. Req A and B Req Determine the amount of depletion expense that would be recognized on the 2018 income statement for each of the two reserves, assuming 14,400 tons of silver were mined, and 510,000 board feet of lumber were cut. Also determine the amount of depletion expense that would be recognized on the 2019 income statement for each of the four reserves, assuming 28,000 tons of silver are mined, 400,000 board feet of lumber are cut, 4,100 tons of gold ore is mined, and 70,000 barrels of oil are extracted. Show less Complete this question by entering your answers in the tabs below. Req A and B Reqc Determine the amount of depletion expense that would be recognized on the 2018 income statement for each of the two reserves, assuming 14,400 tons of silver were mined, and 510,000 board feet of lumber were cut. Also determine the amount of depletion expense that would be recognized on the 2019 income statement for each of the four reserves, assuming 28,000 tons of silver are mined, 400,000 board feet of lumber are cut, 4,100 tons of gold ore is mined, and 70,000 barrels of oil are extracted. Show less a. Depletion Expense - 2018: Silver Mine Timber b. Depletion Expense - 2019: Silver Mine Timber Gold Mine Oil Reserves Reg Ande ReqC > 156 Doints a. Determine the amount of depletion expense that would be recognized on the 2018 income statement for each of the two resen assuming 14,400 tons of silver were mined, and 510,000 board feet of lumber were cut. b. Determine the amount of depletion expense that would be recognized on the 2019 income statement for each of the four reser assuming 28,000 tons of silver are mined. 400,000 board feet of lumber are cut. 4.100 tons of gold ore is mined, and 70.000 ba of oil are extracted. c. Prepare the portion of the December 31, 2019, balance sheet that reports natural resources. eBook Complete this question by entering your answers in the tabs below. Print Reg A and B Reg C References Prepare the portion of the December 31, 2019, balance sheet that reports natural resources. Natural Resources Silver Mine Timber Gold Mine Oil Reserves Total Natural Resources Land Total 0 $ 0