Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please need all 3 respond asap. thanks a lot. i will up vote Your venture has signed a new consulting contract that will require you

please need all 3 respond asap. thanks a lot. i will up vote

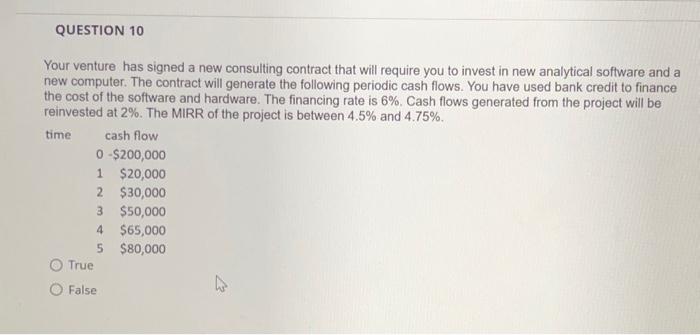

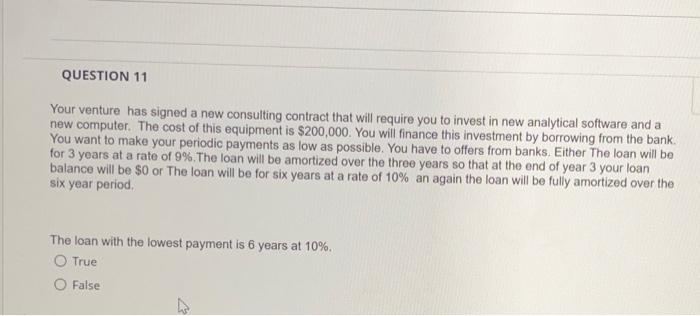

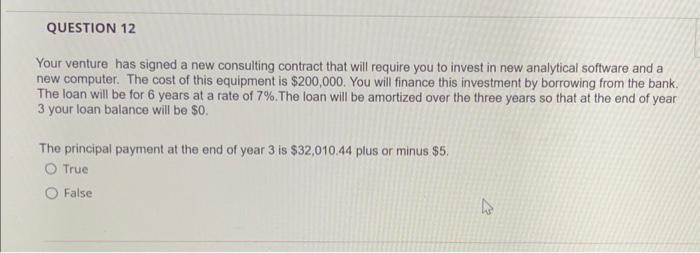

Your venture has signed a new consulting contract that will require you to invest in new analytical software and a new computer. The contract will generate the following periodic cash flows. You have used bank credit to finance the cost of the software and hardware. The financing rate is 6%. Cash flows generated from the project will be reinvested at 2%. The MIRR of the project is between 4.5% and 4.75%. True False Your venture has signed a new consulting contract that will require you to invest in new analytical software and a new computer. The cost of this equipment is $200,000. You will finance this investment by borrowing from the bank: You want to make your periodic payments as low as possible. You have to offers from banks. Either The loan will be for 3 years at a rate of 9%. The loan will be amortized over the three years so that at the end of year 3 your loan balance will be $0 or The loan will be for six years at a rate of 10% an again the loan will be fully amortized over the six year period. The loan with the lowest payment is 6 years at 10%. True False Your venture has signed a new consulting contract that will require you to invest in new analytical software and a new computer. The cost of this equipment is $200,000. You will finance this investment by borrowing from the bank. The loan will be for 6 years at a rate of 7%. The loan will be amortized over the three years so that at the end of year 3 your loan balance will be $0. The principal payment at the end of year 3 is $32,010.44 plus or minus $5. True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started