Fleur is employed as a senior analyst in London. During 2019/20, Fleur earned a salary of 63,000 and on 31 May 2020 received a bonus of 25,000 which related to the companys year end 31 March 2019.

Fleur uses the bonus to invest in properties and rents them out to generate additional income each year. She currently owns three properties, all situated in the UK, all rented out to tenants. All rental income is due in advance on the first day of the month.

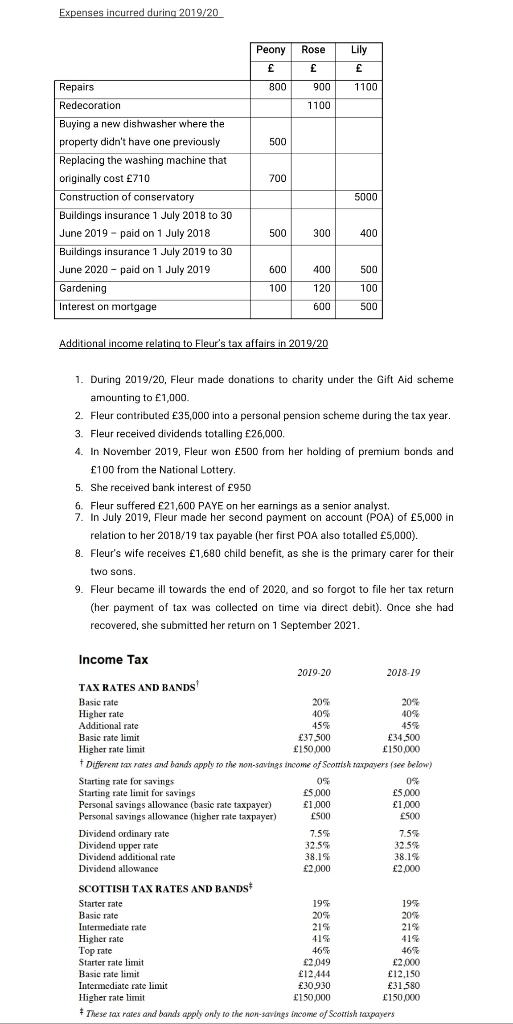

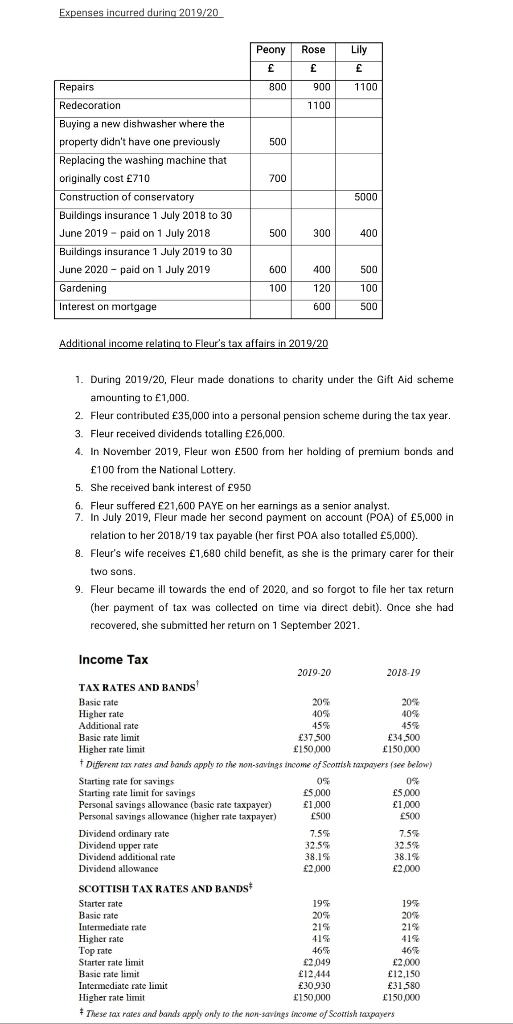

The income and expenses in relation to the properties are detailed below:

Peony The property was rented out on 1 July 2019. On this date Fleur received a lease premium of 30,000 for a 10-year lease. The property is let for an annual rent of 9,000 which was paid on 1 July 2019.

Rose The property is let throughout the year at an annual rent of 3,000.

Lily The property has been let throughout the year at an annual rent of 7,000 which increased to 9,000 on 1 September 2019.

All rents were received on their due dates, except for two payments from the tenants of Lily. They vacated the property on 1 April 2020 not having paid the last two months rent. The property has remained empty since this date.

REQUIRED

- Calculate Fleurs property income for 2019/20.

- Briefly explain the difference between the cash basis and accruals basis when calculating property income for tax purposes and state when a taxpayer would have to use the accruals basis.

- Including your answer from part (a) above, calculate Fleurs income tax payable and Class 1 Primary National Insurance Contributions for 2019/20.

- Calculate the total payment of tax to be made to HMRC on 31 January 2021.

- Explain, with supporting calculations, the penalties relating to the submission of the late tax return.

Expenses incurred during 2019/20 Rose Peony Lily 900 800 1100 1100 500 700 Repairs Redecoration Buying a new dishwasher where the property didn't have one previously Replacing the washing machine that onginally cost 710 Construction of conservatory Buildings insurance 1 July 2018 to 30 June 2019 - paid on 1 July 2018 Buildings insurance 1 July 2019 to 30 June 2020 - paid on 1 July 2019 Gardening Interest on mortgage 5000 500 300 400 600 400 500 100 100 120 600 500 Additional income relating to Fleur's tax affairs in 2019/20 1. During 2019/20, Fleur made donations to charity under the Gift Aid scheme amounting to 1,000. 2. Fleur contributed 35,000 into a personal pension scheme during the tax year. 3. Fleur received dividends totalling 26,000. 4. In November 2019, Fleur won 500 from her holding of premium bonds and 100 from the National Lottery 5. She received bank interest of 950 6. Fleur suffered 21,600 PAYE on her earnings as a senior analyst. 7. In July 2019, Fleur made her second payment on account (POA) of 5,000 in relation to her 2018/19 tax payable (her first POA also totalled 5,000). 8. Fleur's wife receives 1,680 child benefit, as she is the primary carer for their two sons. 9. Fleur became ill towards the end of 2020, and so forgot to file her tax return (her payment of tax was collected on time via direct debit). Once she had recovered, she submitted her return on 1 September 2021. Income Tax 2019.20 2018-19 TAX RATES AND BANDS Basic rate 20% 20% Higher rate 40% 40% Additional rate 45% 45% Basic rate limit 37.500 34,500 Higher rate limit 150.000 150.000 Different tax rates and bonds apply to the non-savings income of Scorsk taxpayers (see below) Starting rate for savings OS 0% Starting rate limit for savings 5.000 5,000 Personal savings allowance (basic rate taxpayer) 1,000 1,000 Personal savings allowance (higher rate taxpayer) 500 500 Dividend ordinary rate 7.59 7.5% Dividend upper rate 32.55 32.5% Dividend additional rate 38.1% 38.14 Dividend allowance 2,000 SCOTTISH TAX RATES AND BANDS Starter rate 19% 19% Basic rate 20% 20% Intermediate rate 219 21% Higher rate 419 41% Top rate 46% 46% Starter rate limit 2,049 2,000 Basic rate limit 12.444 12.150 Intermediate rate limit 30930 31.580 Higher rate limit 150,000 150XX # These tax rates and bands apply only to the non-savings income of Scottish taxpayers 2.000 Expenses incurred during 2019/20 Rose Peony Lily 900 800 1100 1100 500 700 Repairs Redecoration Buying a new dishwasher where the property didn't have one previously Replacing the washing machine that onginally cost 710 Construction of conservatory Buildings insurance 1 July 2018 to 30 June 2019 - paid on 1 July 2018 Buildings insurance 1 July 2019 to 30 June 2020 - paid on 1 July 2019 Gardening Interest on mortgage 5000 500 300 400 600 400 500 100 100 120 600 500 Additional income relating to Fleur's tax affairs in 2019/20 1. During 2019/20, Fleur made donations to charity under the Gift Aid scheme amounting to 1,000. 2. Fleur contributed 35,000 into a personal pension scheme during the tax year. 3. Fleur received dividends totalling 26,000. 4. In November 2019, Fleur won 500 from her holding of premium bonds and 100 from the National Lottery 5. She received bank interest of 950 6. Fleur suffered 21,600 PAYE on her earnings as a senior analyst. 7. In July 2019, Fleur made her second payment on account (POA) of 5,000 in relation to her 2018/19 tax payable (her first POA also totalled 5,000). 8. Fleur's wife receives 1,680 child benefit, as she is the primary carer for their two sons. 9. Fleur became ill towards the end of 2020, and so forgot to file her tax return (her payment of tax was collected on time via direct debit). Once she had recovered, she submitted her return on 1 September 2021. Income Tax 2019.20 2018-19 TAX RATES AND BANDS Basic rate 20% 20% Higher rate 40% 40% Additional rate 45% 45% Basic rate limit 37.500 34,500 Higher rate limit 150.000 150.000 Different tax rates and bonds apply to the non-savings income of Scorsk taxpayers (see below) Starting rate for savings OS 0% Starting rate limit for savings 5.000 5,000 Personal savings allowance (basic rate taxpayer) 1,000 1,000 Personal savings allowance (higher rate taxpayer) 500 500 Dividend ordinary rate 7.59 7.5% Dividend upper rate 32.55 32.5% Dividend additional rate 38.1% 38.14 Dividend allowance 2,000 SCOTTISH TAX RATES AND BANDS Starter rate 19% 19% Basic rate 20% 20% Intermediate rate 219 21% Higher rate 419 41% Top rate 46% 46% Starter rate limit 2,049 2,000 Basic rate limit 12.444 12.150 Intermediate rate limit 30930 31.580 Higher rate limit 150,000 150XX # These tax rates and bands apply only to the non-savings income of Scottish taxpayers 2.000