Answered step by step

Verified Expert Solution

Question

1 Approved Answer

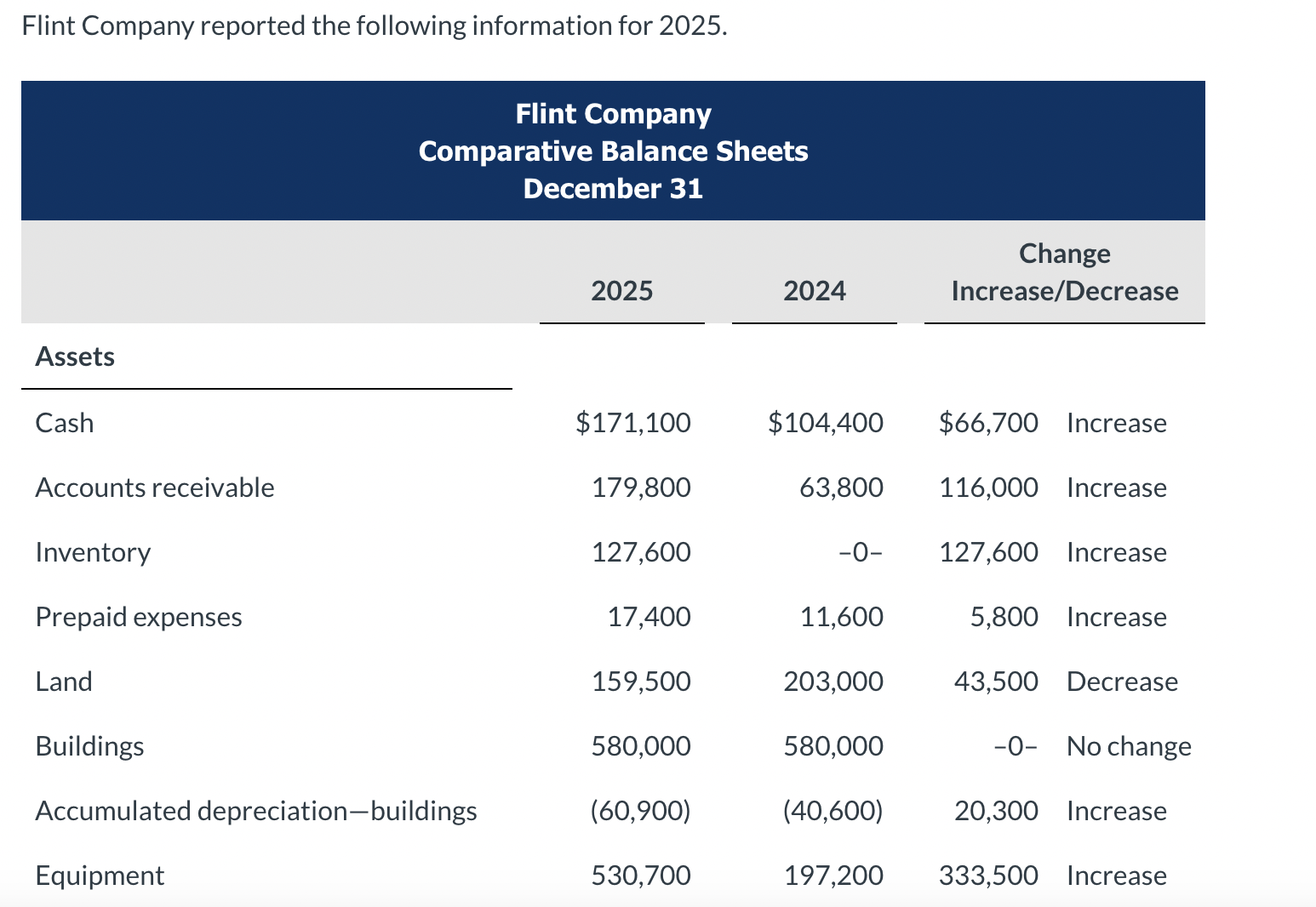

Flint Company reported the following information for 2025. Assets Cash Accounts receivable Inventory Prepaid expenses Land Flint Company Comparative Balance Sheets December 31 Buildings

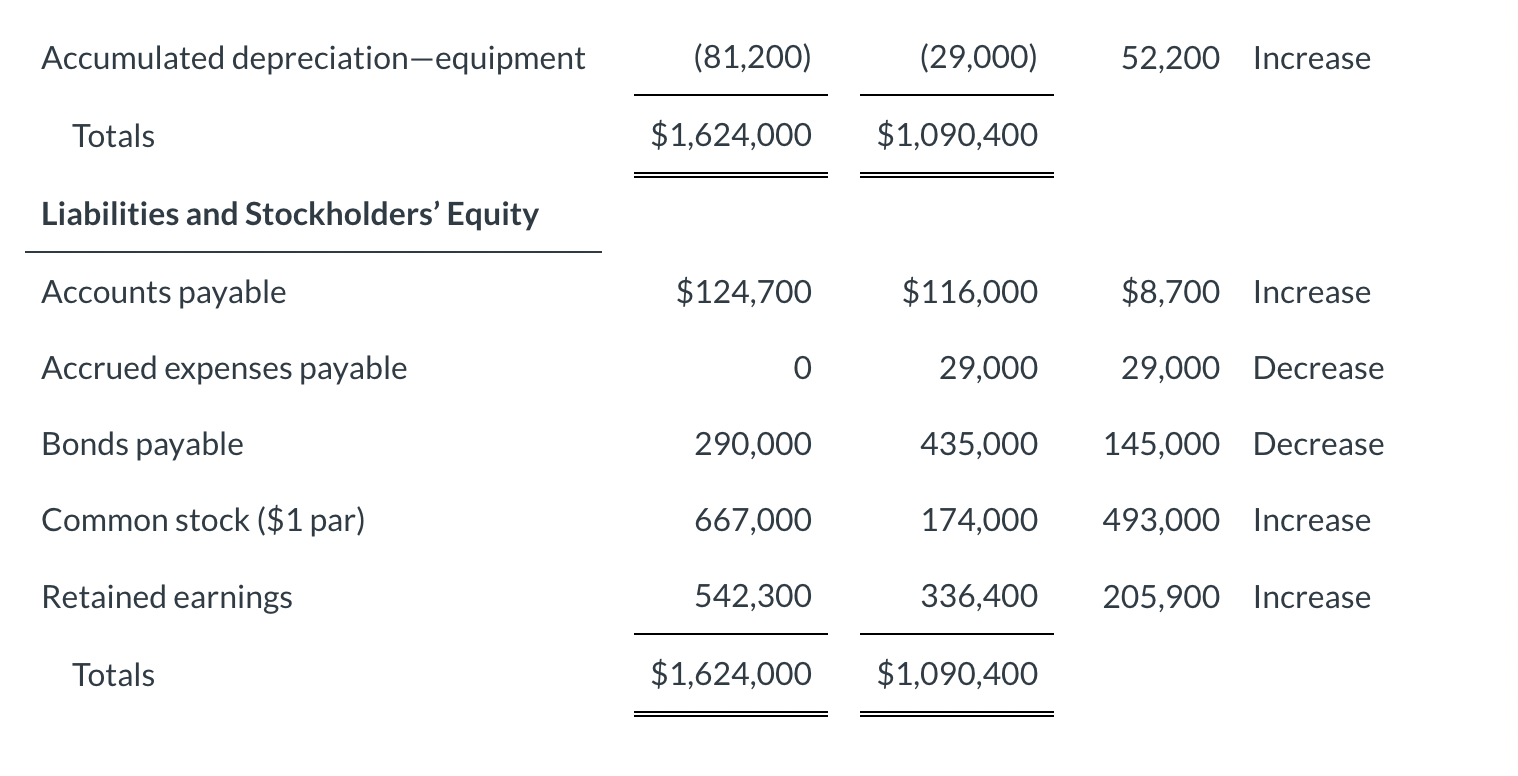

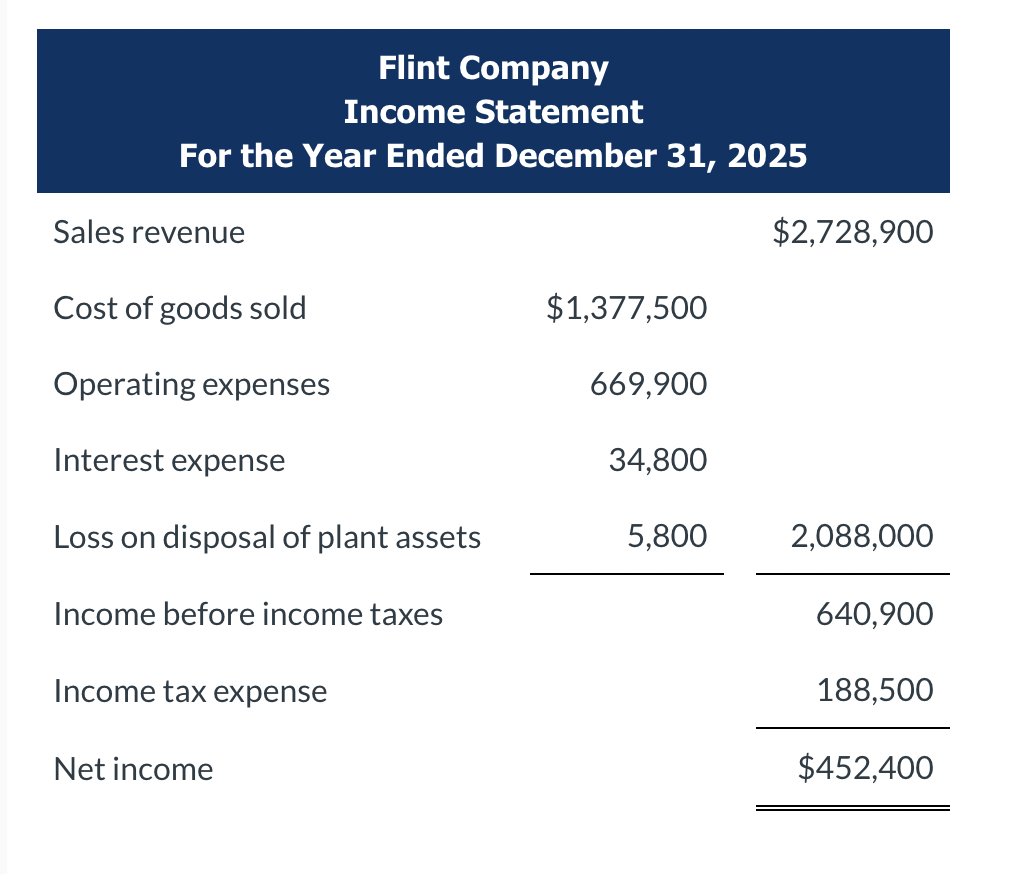

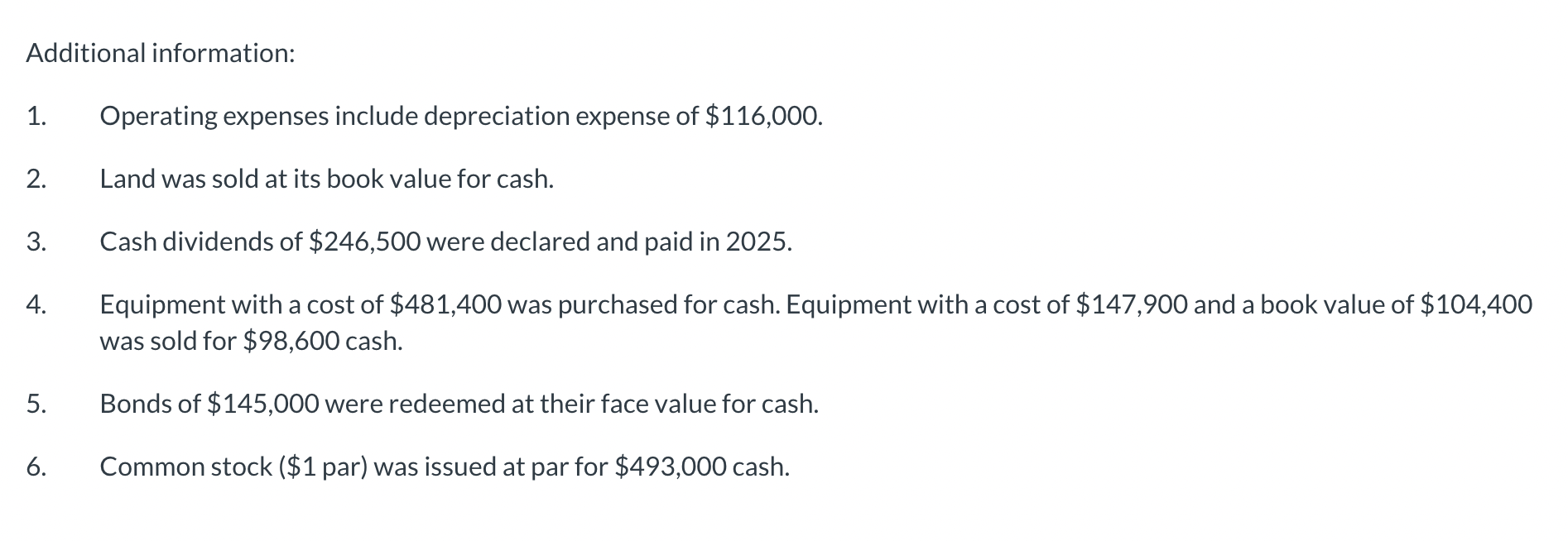

Flint Company reported the following information for 2025. Assets Cash Accounts receivable Inventory Prepaid expenses Land Flint Company Comparative Balance Sheets December 31 Buildings Accumulated depreciation-buildings Equipment 2025 $171,100 179,800 127,600 17,400 159,500 580,000 (60,900) 530,700 2024 $104,400 $66,700 Increase 63,800 116,000 Increase 127,600 Increase 5,800 Increase 43,500 Decrease -0- 11,600 203,000 580,000 (40,600) Change Increase/Decrease 197,200 -0- No change 20,300 Increase 333,500 Increase Accumulated depreciation-equipment Totals Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable Bonds payable Common stock ($1 par) Retained earnings Totals (29,000) $1,624,000 $1,090,400 (81,200) $124,700 290,000 667,000 542,300 $1,624,000 $116,000 29,000 435,000 174,000 336,400 $1,090,400 52,200 Increase $8,700 Increase 29,000 Decrease 145,000 Decrease 493,000 Increase 205,900 Increase Flint Company Income Statement For the Year Ended December 31, 2025 Sales revenue Cost of goods sold Operating expenses Interest expense Loss on disposal of plant assets Income before income taxes Income tax expense Net income $1,377,500 669,900 34,800 5,800 $2,728,900 2,088,000 640,900 188,500 $452,400 Additional information: 1. Operating expenses include depreciation expense of $116,000. Land was sold at its book value for cash. Cash dividends of $246,500 were declared and paid in 2025. Equipment with a cost of $481,400 was purchased for cash. Equipment with a cost of $147,900 and a book value of $104,400 was sold for $98,600 cash. Bonds of $145,000 were redeemed at their face value for cash. Common stock ($1 par) was issued at par for $493,000 cash. 2. 3. 4. 5. 6. Use this information to prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow wi - sign (e.g., -15,000) or in parenthesis (e.g., (15,000).)

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Certainly I can help you prepare a statement of cash flows using the indirect method based on the pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started