Question

Michael is thinking of investing in a limited liability company called Trident Ltd. He has asked for your help to calculate some of the

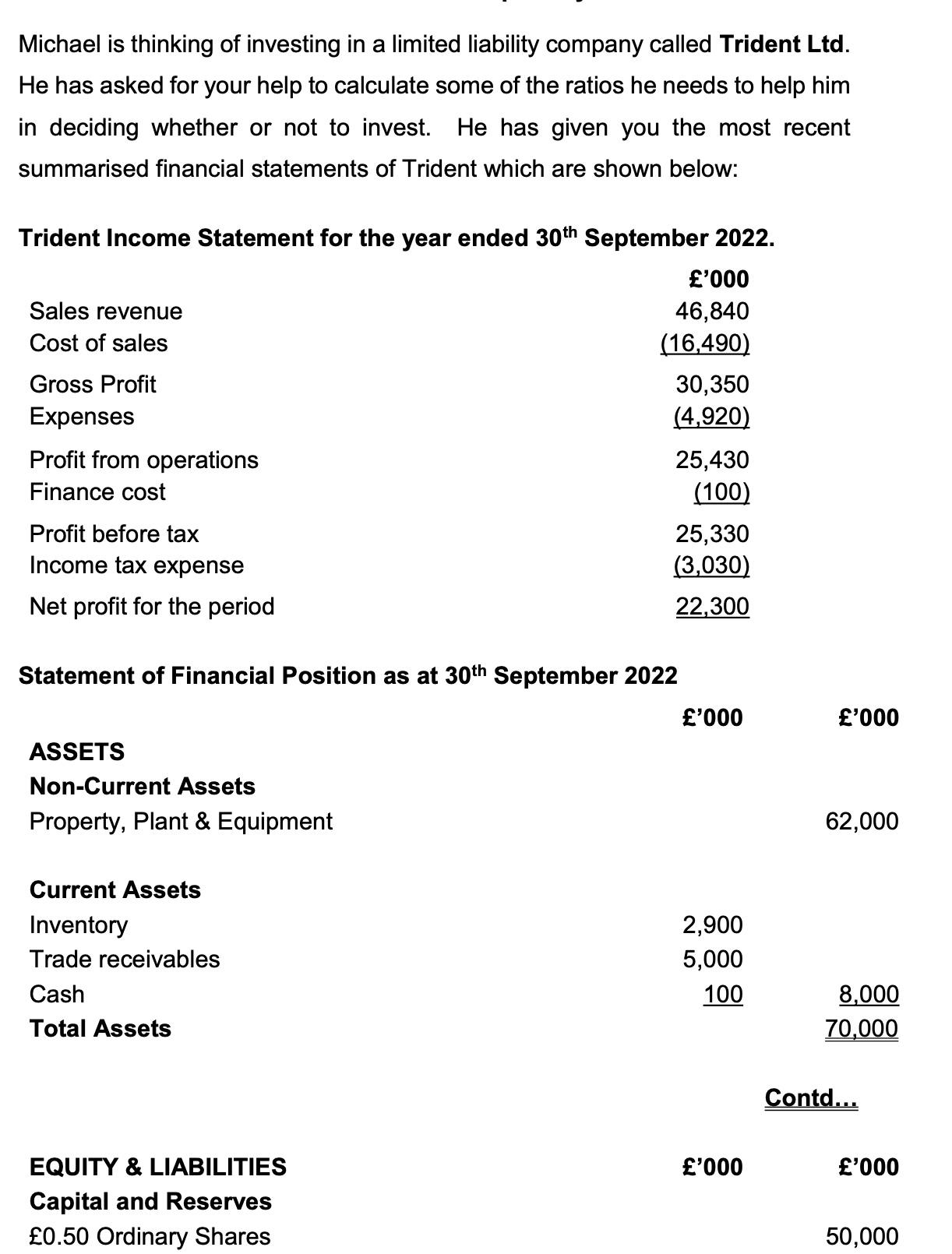

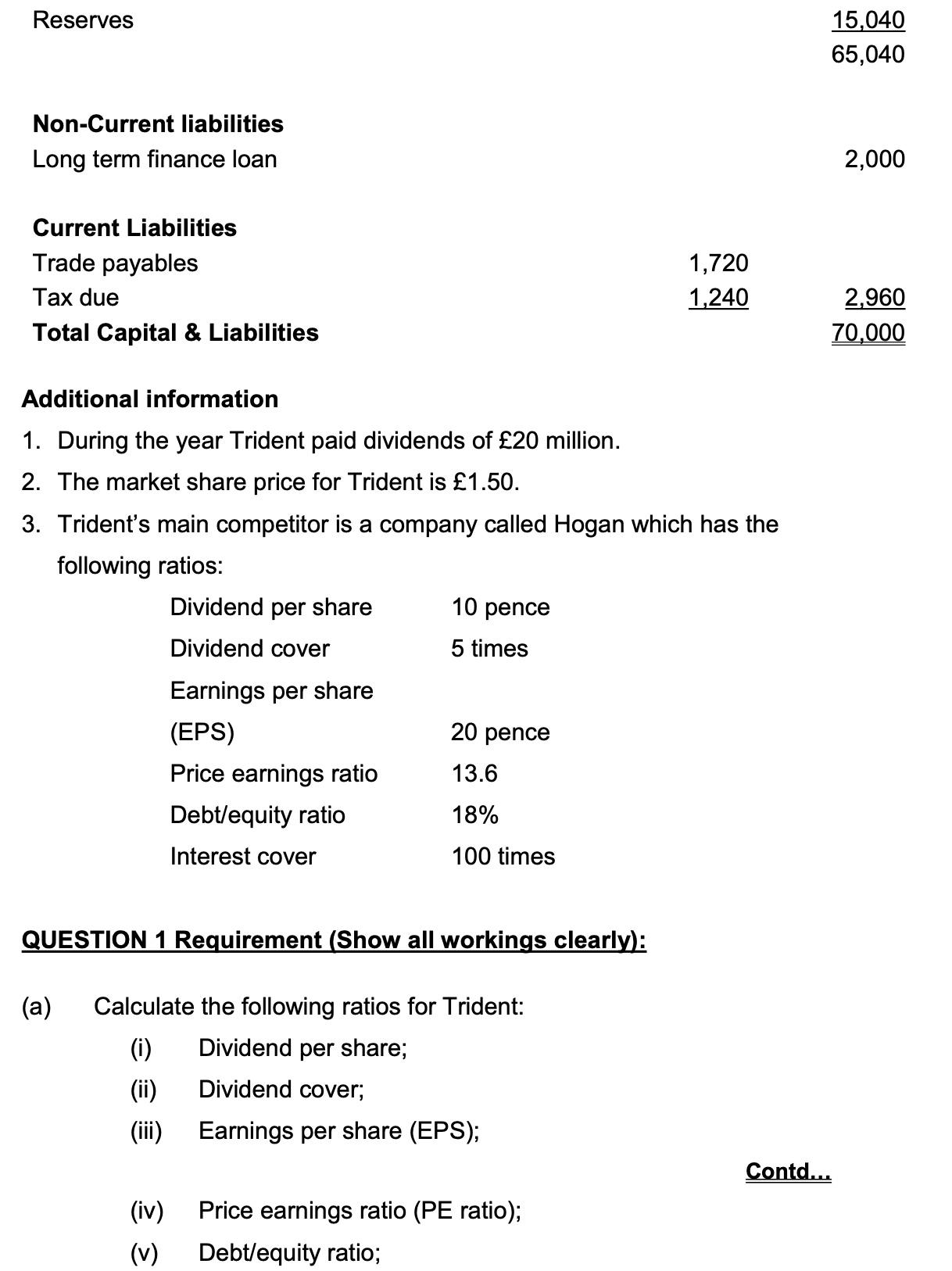

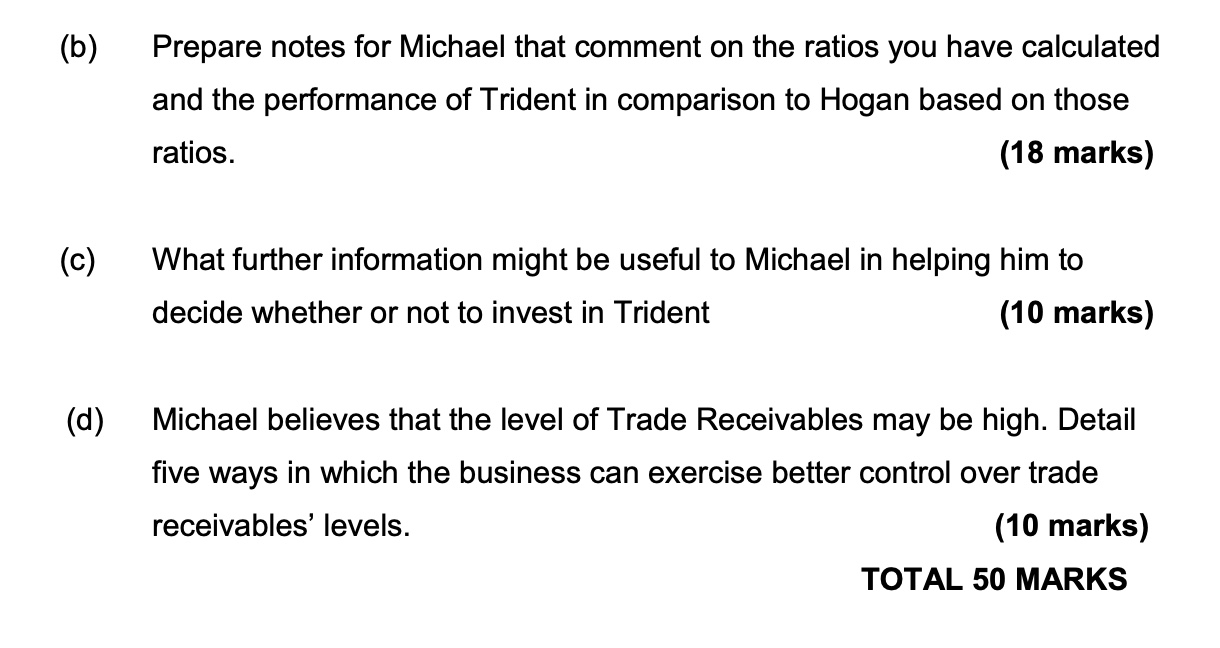

Michael is thinking of investing in a limited liability company called Trident Ltd. He has asked for your help to calculate some of the ratios he needs to help him in deciding whether or not to invest. He has given you the most recent summarised financial statements of Trident which are shown below: Trident Income Statement for the year ended 30th September 2022. '000 46,840 (16,490) Sales revenue Cost of sales Gross Profit Expenses Profit from operations Finance cost ASSETS Non-Current Assets Property, Plant & Equipment Profit before tax Income tax expense Net profit for the period Statement of Financial Position as at 30th September 2022 Current Assets Inventory Trade receivables Cash Total Assets 30,350 (4,920) EQUITY & LIABILITIES Capital and Reserves 0.50 Ordinary Shares 25,430 (100) 25,330 (3,030) 22,300 '000 2,900 5,000 100 '000 '000 62,000 8,000 70,000 Contd... '000 50,000 Reserves Non-Current liabilities Long term finance loan Current Liabilities Trade payables Tax due Total Capital & Liabilities Additional information 1. During the year Trident paid dividends of 20 million. 2. The market share price for Trident is 1.50. 3. Trident's main competitor is a company called Hogan which has the following ratios: Dividend per share Dividend cover Earnings per share (EPS) Price earnings ratio Debt/equity ratio Interest cover (iv) (v) 10 pence 5 times 20 pence 13.6 18% 100 times QUESTION 1 Requirement (Show all workings clearly): (a) Calculate the following ratios for Trident: (i) Dividend per share; (ii) Dividend cover; (iii) Earnings per share (EPS); 1,720 1,240 Price earnings ratio (PE ratio); Debt/equity ratio; Contd... 15,040 65,040 2,000 2,960 70,000 (b) (c) (d) Prepare notes for Michael that comment on the ratios you have calculated and the performance of Trident in comparison to Hogan based on those ratios. (18 marks) What further information might be useful to Michael in helping him to decide whether or not to invest in Trident (10 marks) Michael believes that the level of Trade Receivables may be high. Detail five ways in which the business can exercise better control over trade receivables' levels. (10 marks) TOTAL 50 MARKS

Step by Step Solution

3.46 Rating (133 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started