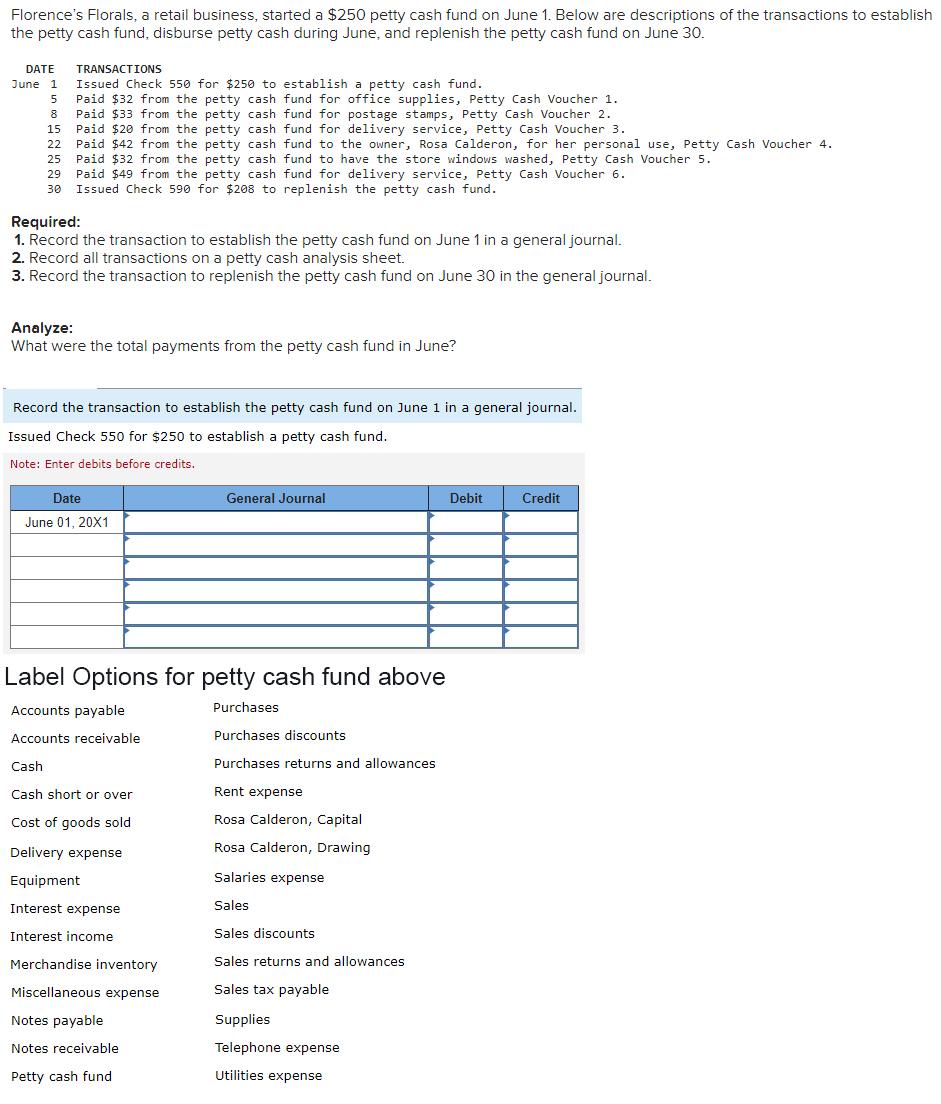

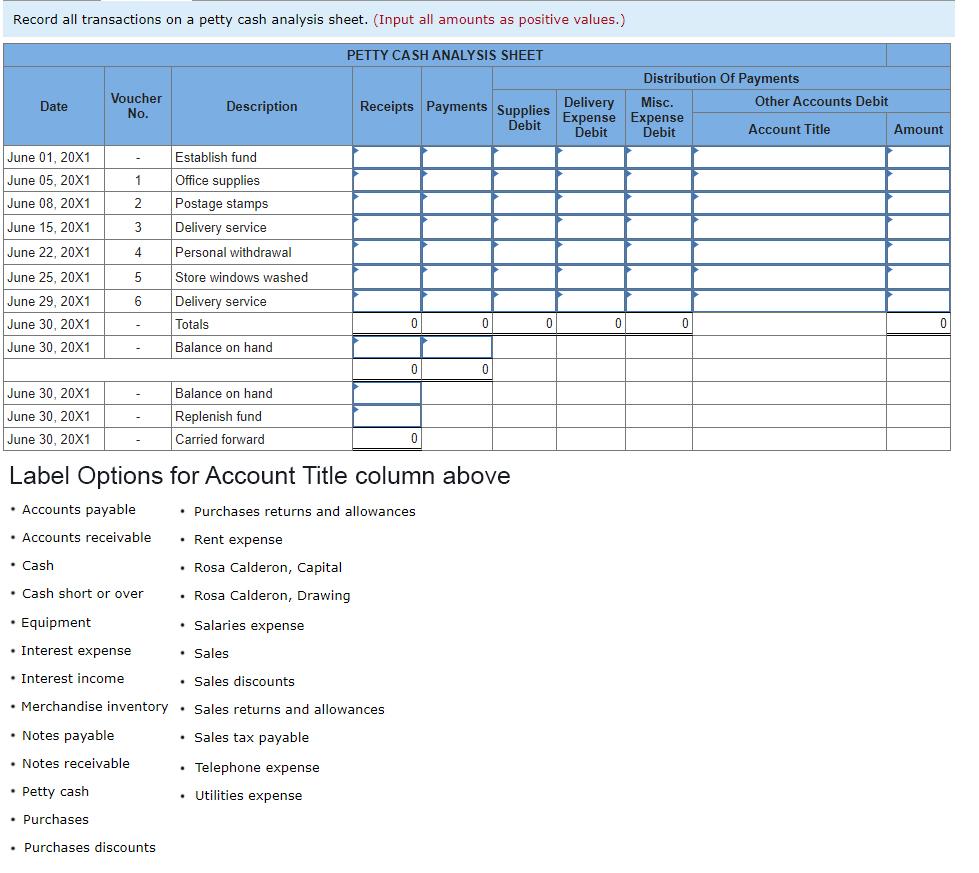

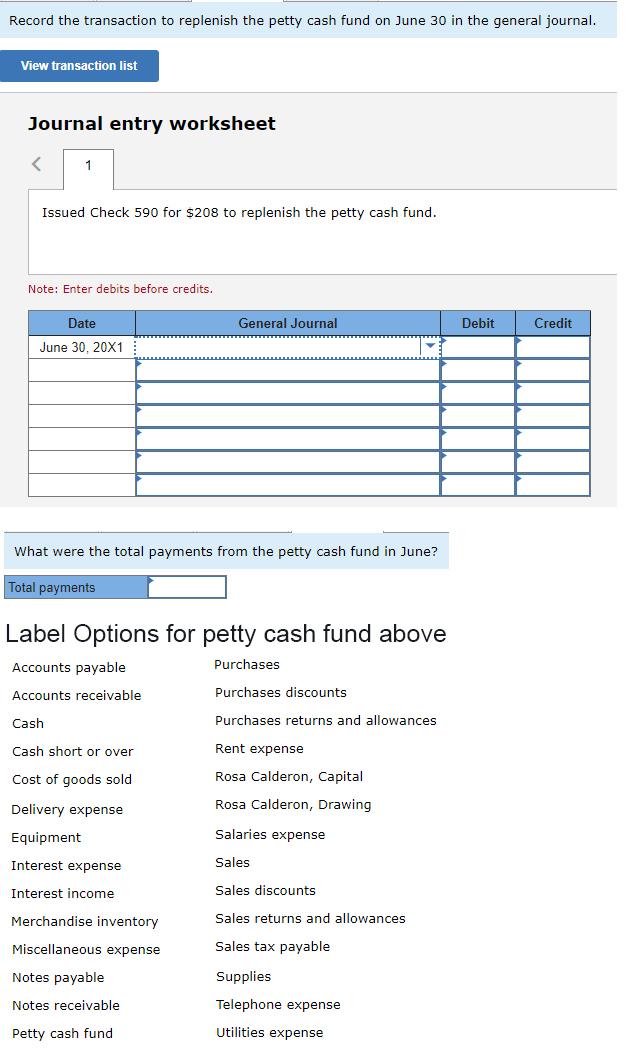

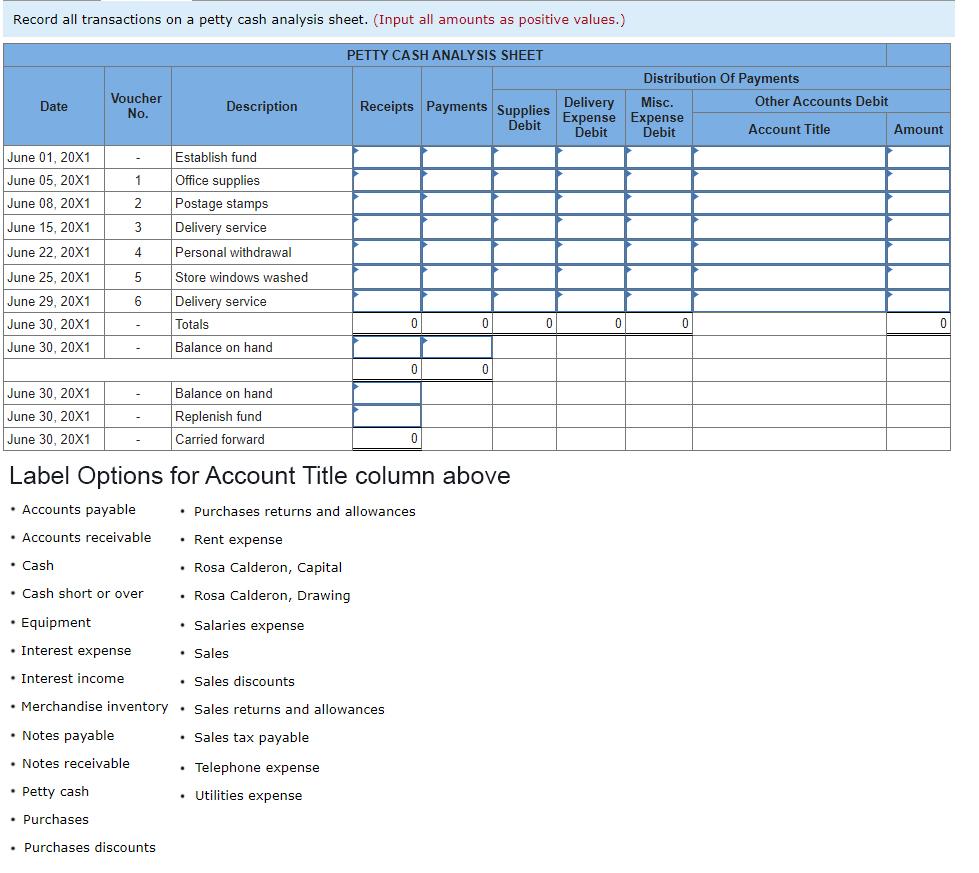

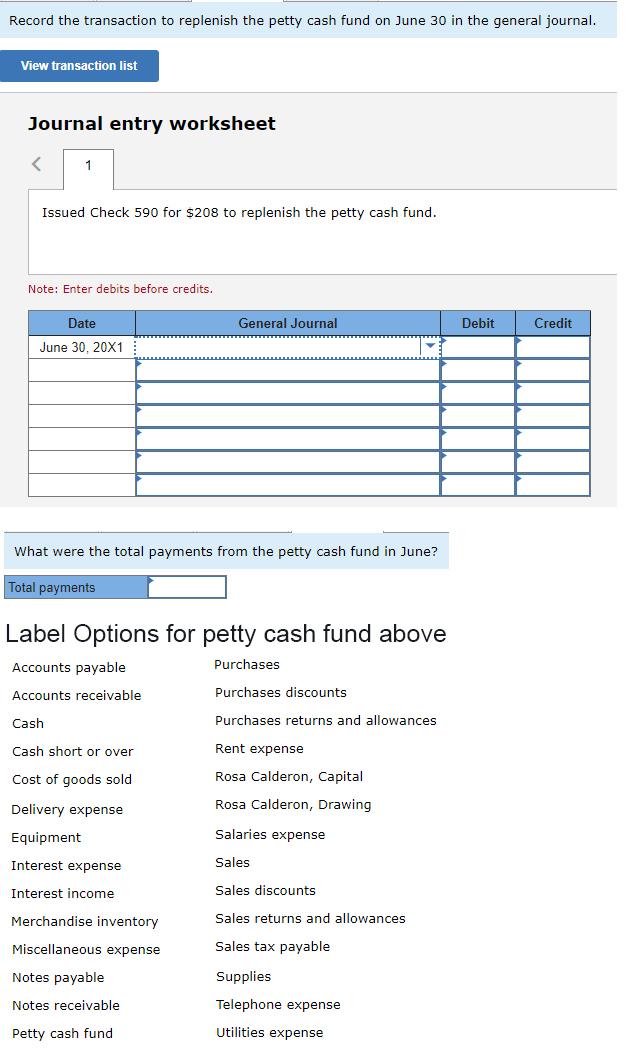

Florence's Florals, a retail business, started a $250 petty cash fund on June 1 . Below are descriptions of the transactions to establis the petty cash fund, disburse petty cash during June, and replenish the petty cash fund on June 30. DATE TRANSACTIONS June 1 Issued Check 550 for $250 to establish a petty cash fund. 5 Paid $32 from the petty cash fund for office supplies, Petty Cash Voucher 1. 8 Paid $33 from the petty cash fund for postage stamps, Petty Cash Voucher 2. 15 Paid $20 from the petty cash fund for delivery service, Petty Cash Voucher 3. 22 Paid $42 from the petty cash fund to the owner, Rosa Calderon, for her personal use, Petty Cash Voucher 4. 25 Paid $32 from the petty cash fund to have the store windows washed, Petty Cash Voucher 5. 29 Paid $49 from the petty cash fund for delivery service, Petty Cash voucher 6. 30 Issued Check 590 for $208 to replenish the petty cash fund. Required: 1. Record the transaction to establish the petty cash fund on June 1 in a general journal. 2. Record all transactions on a petty cash analysis sheet. 3. Record the transaction to replenish the petty cash fund on June 30 in the general journal. Analyze: What were the total payments from the petty cash fund in June? Record the transaction to establish the petty cash fund on June 1 in a general journal. Issued Check 550 for $250 to establish a petty cash fund. Note: Enter debits before credits. Label Options for petty cash fund above Label Options for Account Title column above - Accounts payable Purchases returns and allowances - Accounts receivable - Rent expense - Cash - Rosa Calderon, Capital - Cash short or over Rosa Calderon, Drawing - Equipment - Salaries expense - Interest expense Sales - Interest income - Sales discounts - Merchandise inventory - Sales returns and allowances - Notes payable Sales tax payable - Notes receivable - Telephone expense - Petty cash - Utilities expense - Purchases - Purchases discounts Record the transaction to replenish the petty cash fund on June 30 in the general journal. Journal entry worksheet Issued Check 590 for $208 to replenish the petty cash fund. Note: Enter debits before credits. What were the total payments from the petty cash fund in June? Total payments Label Options for petty cash fund above