Answered step by step

Verified Expert Solution

Question

1 Approved Answer

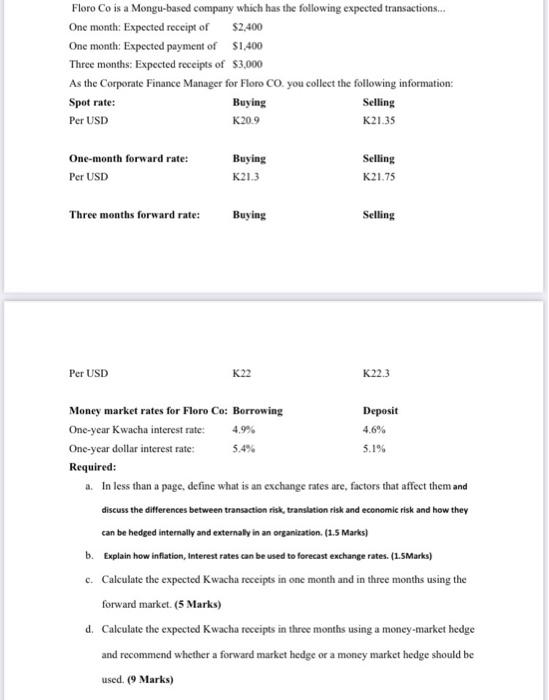

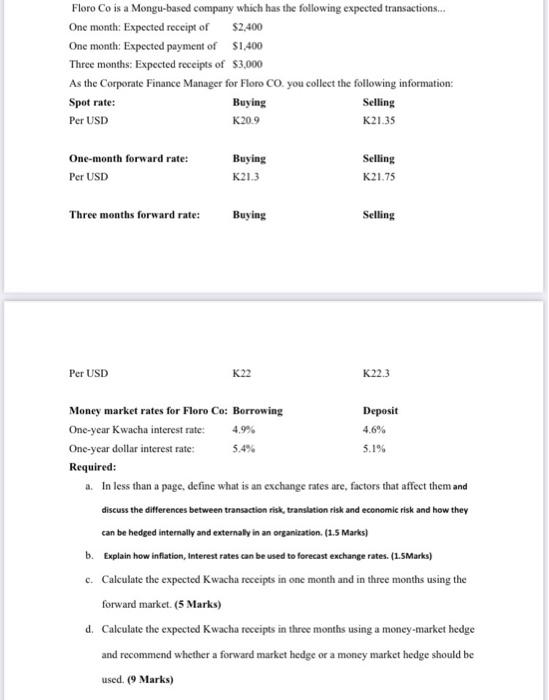

Floro Co is a Mongu-based company which has the following expected transactions... One month: Expected receipt of $2,400 One month: Expected payment of $1,400 Three

Floro Co is a Mongu-based company which has the following expected transactions... One month: Expected receipt of $2,400 One month: Expected payment of $1,400 Three months: Expected receipts of $3,000 As the Corporate Finance Manager for Floro CO. you collect the following information: Spot rate: Buying Selling Per USD K20.9 K21.35 One-month forward rate: Per USD Buying K213 Selling K21.75 Three months forward rate: Buying Selling Per USD K22 K22.3 Money market rates for Floro Co: Borrowing Deposit One-year Kwacha interest rate 4.9% 4.6% One-year dollar interest rate: 5.4% 5.1% Required: a. In less than a page.define what is an exchange rates arc, factors that affect them and discuss the differences between transaction risk, translation risk and economic risk and how they can be hedged internally and externally in an organization. (1.5 Marks) b. Explain how inflation, Interest rates can be used to forecast exchange rates. (1.5Marks) c. Calculate the expected Kwacha receipts in one month and in three months using the forward market. (5 Marks) d. Calculate the expected Kwacha receipts in three months using a money-market hedge and recommend whether a forward market hedge or a money market hedge should be used (9 Marks) a Floro Co is a Mongu-based company which has the following expected transactions... One month: Expected receipt of $2,400 One month: Expected payment of $1,400 Three months: Expected receipts of $3,000 As the Corporate Finance Manager for Floro CO. you collect the following information: Spot rate: Buying Selling Per USD K20.9 K21.35 One-month forward rate: Per USD Buying K213 Selling K21.75 Three months forward rate: Buying Selling Per USD K22 K22.3 Money market rates for Floro Co: Borrowing Deposit One-year Kwacha interest rate 4.9% 4.6% One-year dollar interest rate: 5.4% 5.1% Required: a. In less than a page.define what is an exchange rates arc, factors that affect them and discuss the differences between transaction risk, translation risk and economic risk and how they can be hedged internally and externally in an organization. (1.5 Marks) b. Explain how inflation, Interest rates can be used to forecast exchange rates. (1.5Marks) c. Calculate the expected Kwacha receipts in one month and in three months using the forward market. (5 Marks) d. Calculate the expected Kwacha receipts in three months using a money-market hedge and recommend whether a forward market hedge or a money market hedge should be used (9 Marks) a

Floro Co is a Mongu-based company which has the following expected transactions... One month: Expected receipt of $2,400 One month: Expected payment of $1,400 Three months: Expected receipts of $3,000 As the Corporate Finance Manager for Floro CO. you collect the following information: Spot rate: Buying Selling Per USD K20.9 K21.35 One-month forward rate: Per USD Buying K213 Selling K21.75 Three months forward rate: Buying Selling Per USD K22 K22.3 Money market rates for Floro Co: Borrowing Deposit One-year Kwacha interest rate 4.9% 4.6% One-year dollar interest rate: 5.4% 5.1% Required: a. In less than a page.define what is an exchange rates arc, factors that affect them and discuss the differences between transaction risk, translation risk and economic risk and how they can be hedged internally and externally in an organization. (1.5 Marks) b. Explain how inflation, Interest rates can be used to forecast exchange rates. (1.5Marks) c. Calculate the expected Kwacha receipts in one month and in three months using the forward market. (5 Marks) d. Calculate the expected Kwacha receipts in three months using a money-market hedge and recommend whether a forward market hedge or a money market hedge should be used (9 Marks) a Floro Co is a Mongu-based company which has the following expected transactions... One month: Expected receipt of $2,400 One month: Expected payment of $1,400 Three months: Expected receipts of $3,000 As the Corporate Finance Manager for Floro CO. you collect the following information: Spot rate: Buying Selling Per USD K20.9 K21.35 One-month forward rate: Per USD Buying K213 Selling K21.75 Three months forward rate: Buying Selling Per USD K22 K22.3 Money market rates for Floro Co: Borrowing Deposit One-year Kwacha interest rate 4.9% 4.6% One-year dollar interest rate: 5.4% 5.1% Required: a. In less than a page.define what is an exchange rates arc, factors that affect them and discuss the differences between transaction risk, translation risk and economic risk and how they can be hedged internally and externally in an organization. (1.5 Marks) b. Explain how inflation, Interest rates can be used to forecast exchange rates. (1.5Marks) c. Calculate the expected Kwacha receipts in one month and in three months using the forward market. (5 Marks) d. Calculate the expected Kwacha receipts in three months using a money-market hedge and recommend whether a forward market hedge or a money market hedge should be used (9 Marks) a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started