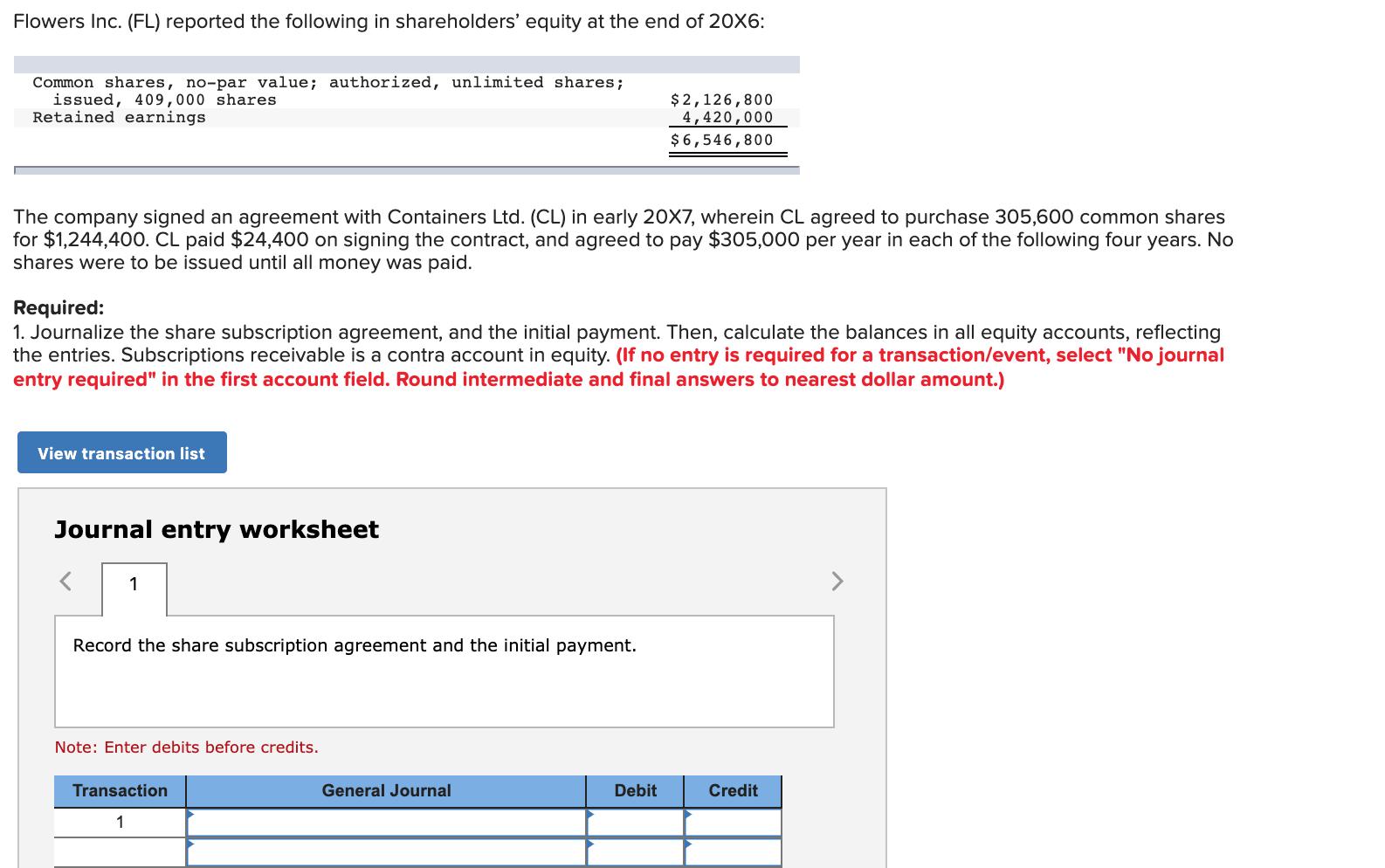

Flowers Inc. (FL) reported the following in shareholders' equity at the end of 20X6: Common shares, no-par value; authorized, unlimited shares; issued, 409,000 shares

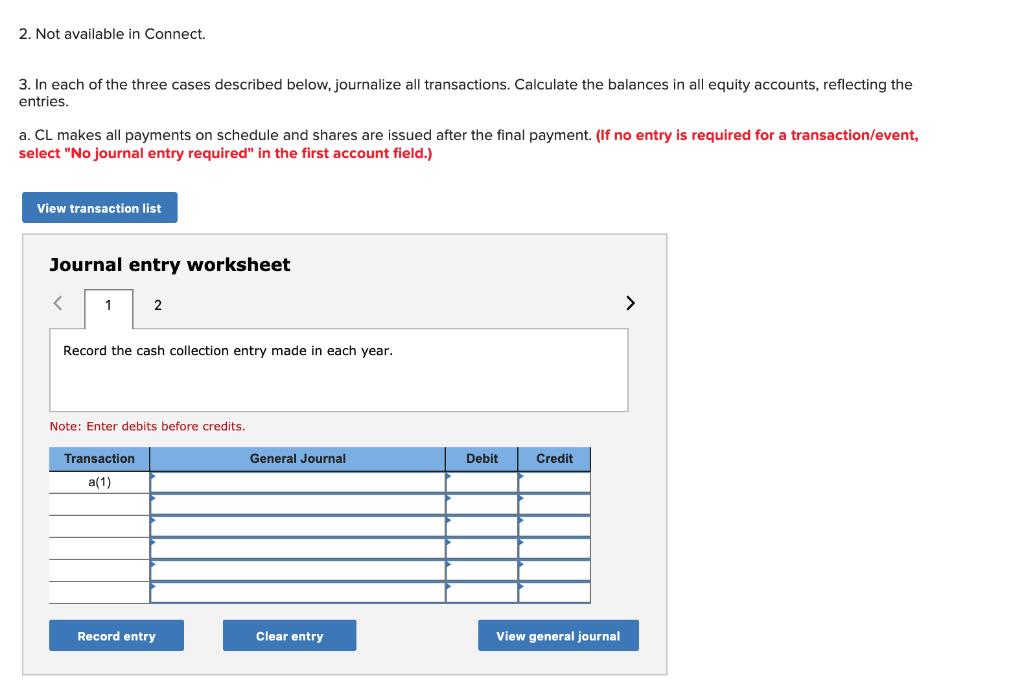

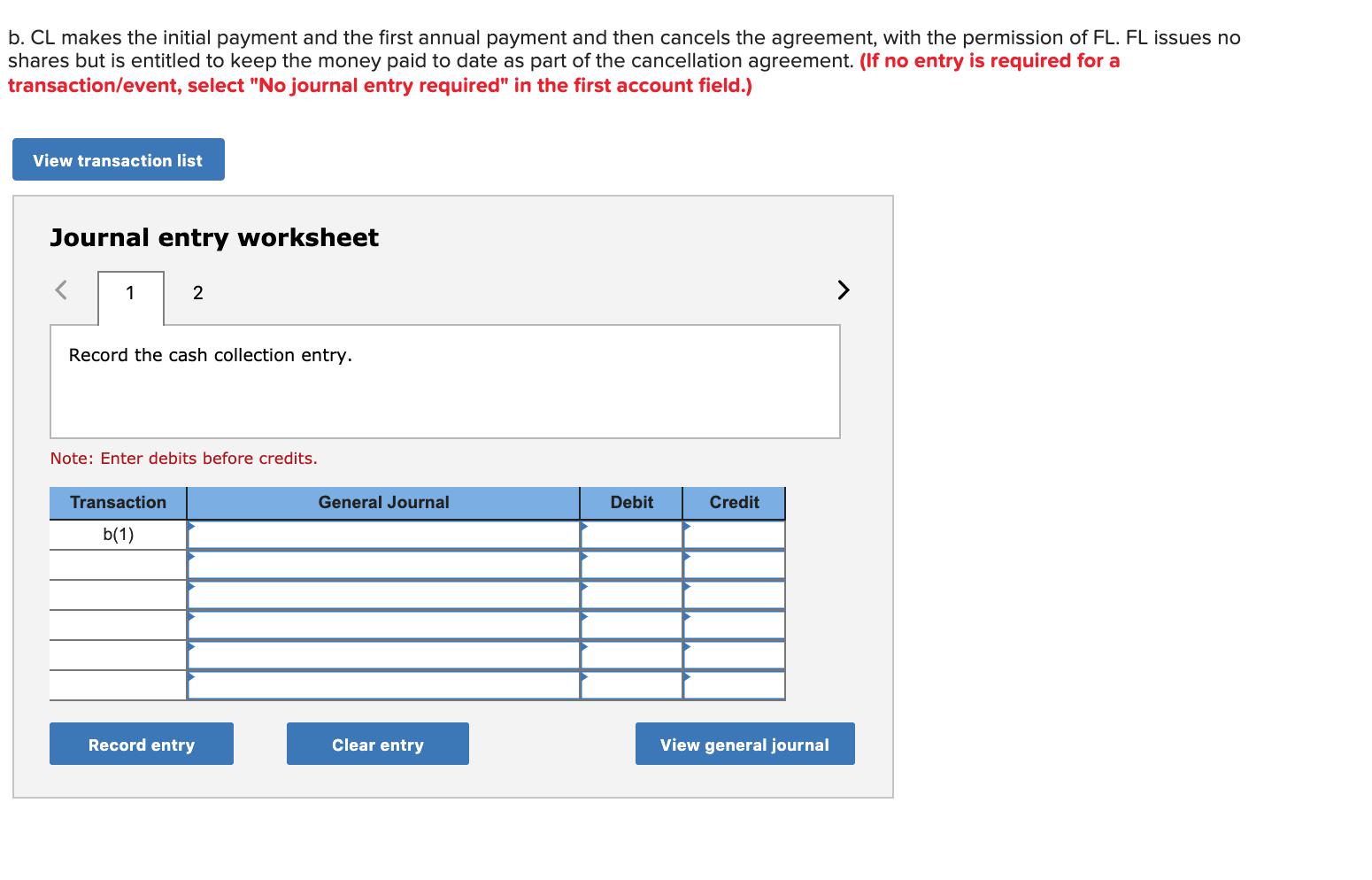

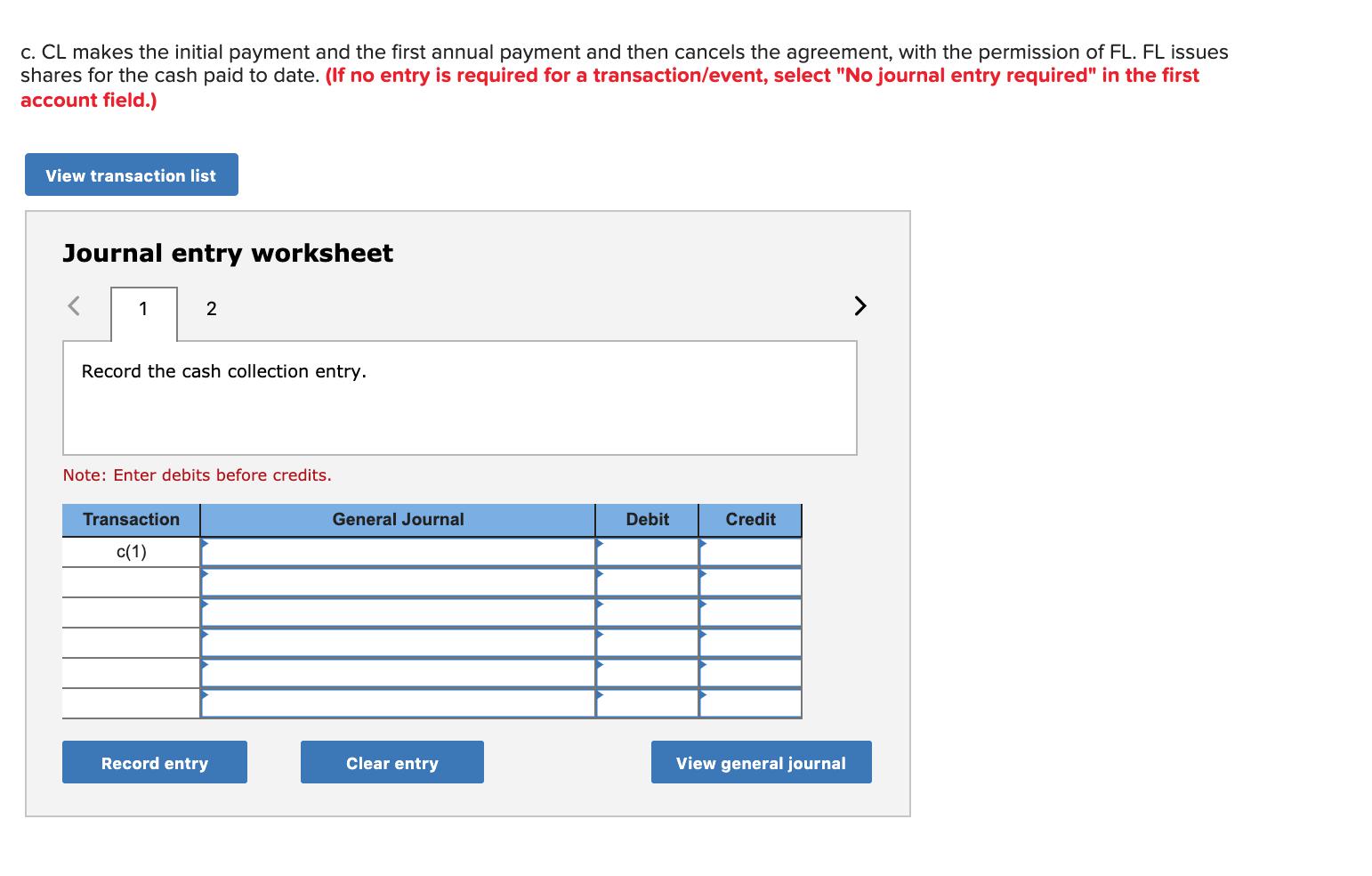

Flowers Inc. (FL) reported the following in shareholders' equity at the end of 20X6: Common shares, no-par value; authorized, unlimited shares; issued, 409,000 shares Retained earnings $2,126,800 4,420,000 $6,546,800 The company signed an agreement with Containers Ltd. (CL) in early 20X7, wherein CL agreed to purchase 305,600 common shares for $1,244,40O. CL paid $24,400 on signing the contract, and agreed to pay $305,000 per year in each of the following four years. No shares were to be issued until all money was paid. Required: 1. Journalize the share subscription agreement, and the initial payment. Then, calculate the balances in all equity accounts, reflecting the entries. Subscriptions receivable is a contra account in equity. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate and final answers to nearest dollar amount.) View transaction list Journal entry worksheet 1 Record the share subscription agreement and the initial payment. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 2. Not available in Connect. 3. In each of the three cases described below, journalize all transactions. Calculate the balances in all equity accounts, reflecting the entries. a. CL makes all payments on schedule and shares are issued after the final payment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 > Record the cash collection entry made in each year. Note: Enter debits before credits. Transaction General Journal Debit Credit a(1) Record entry Clear entry View general journal b. CL makes the initial payment and the first annual payment and then cancels the agreement, with the permission of FL. FL issues no shares but is entitled to keep the money paid to date as part of the cancellation agreement. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 > Record the cash collection entry. Note: Enter debits before credits. Transaction General Journal Debit Credit b(1) Record entry Clear entry View general journal c. CL makes the initial payment and the first annual payment and then cancels the agreement, with the permission of FL. FL issues shares for the cash paid to date. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 > Record the cash collection entry. Note: Enter debits before credits. Transaction General Journal Debit Credit c(1) Record entry Clear entry View general journal

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

PART1 JOURNAL ENTRY CASHDR 24400 SUBSCRIPTION RECEIVABLEDR 1220000 TO COMMON SHARES SUBSCRIBED 12444...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started