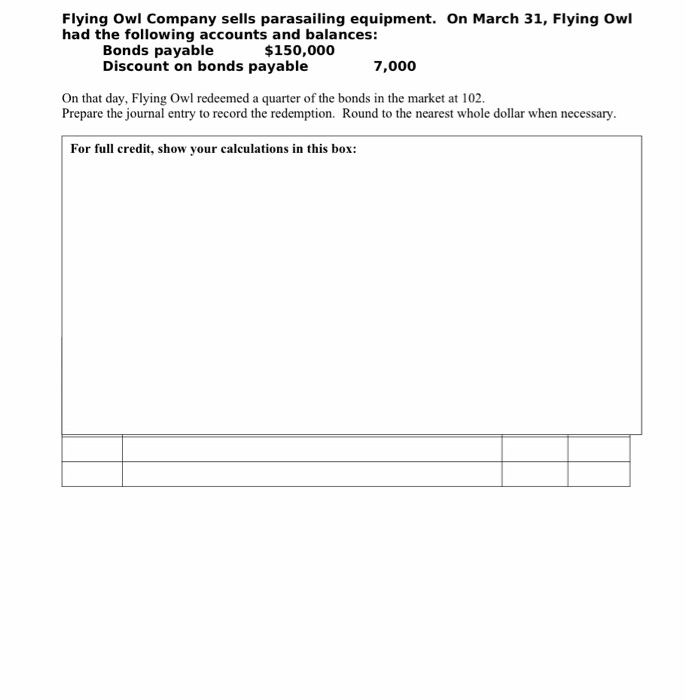

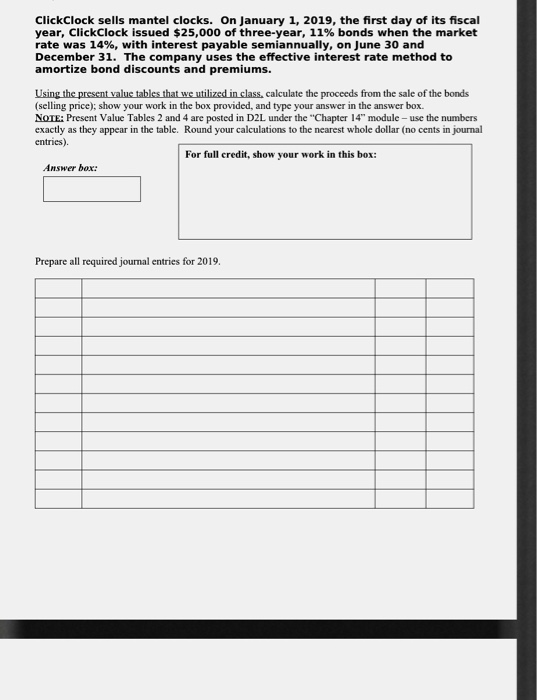

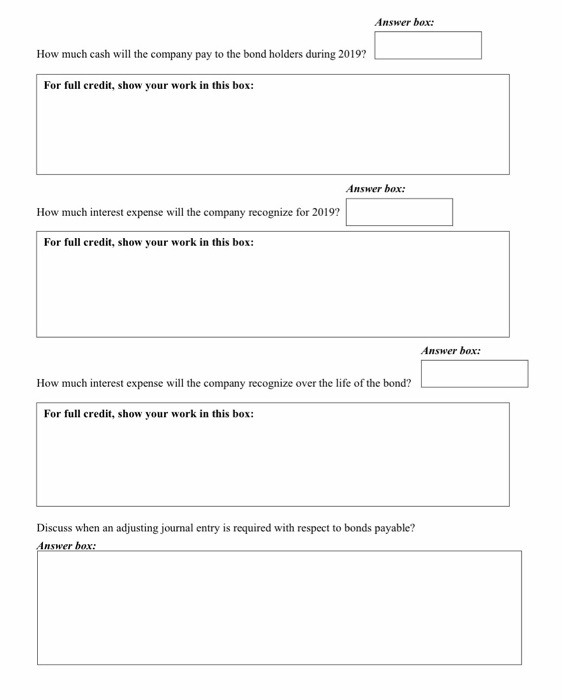

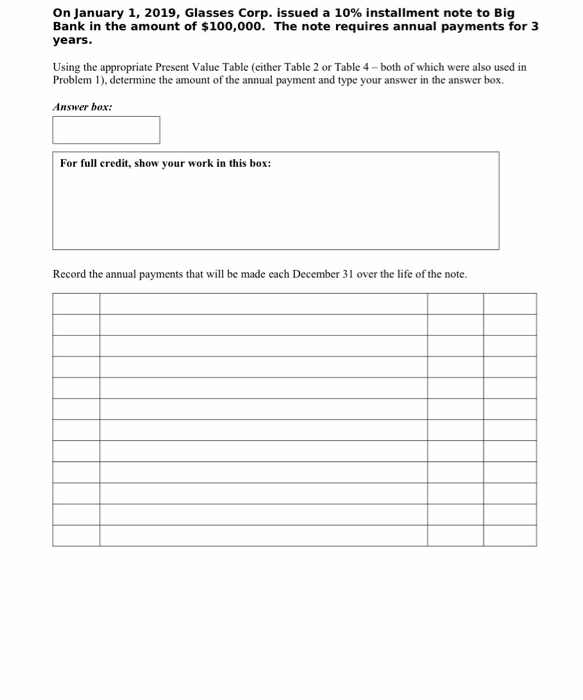

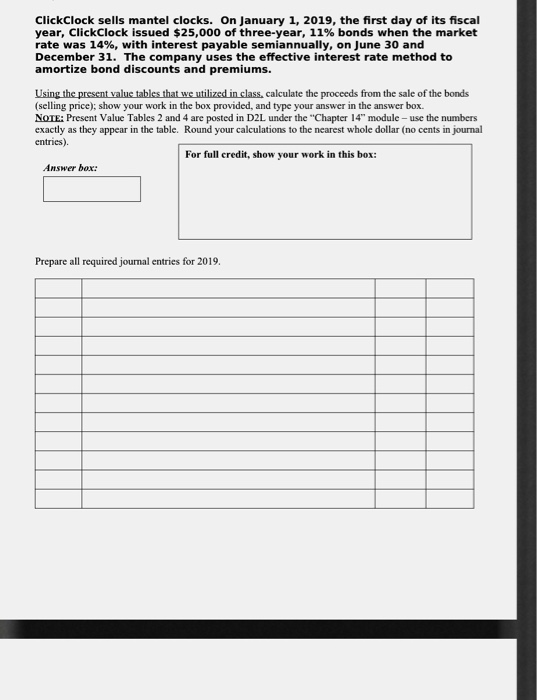

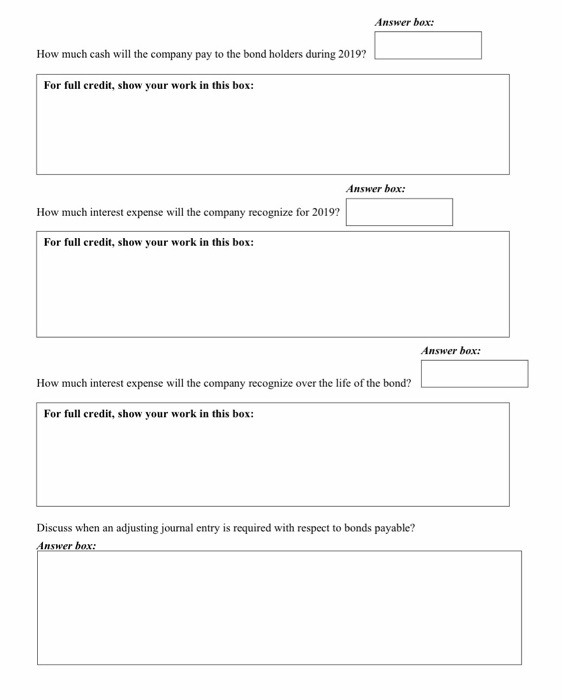

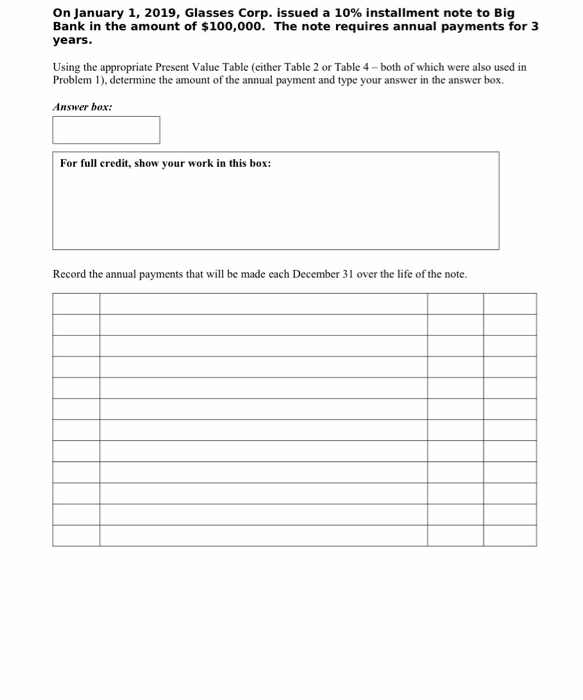

Flying Owl Company sells parasailing equipment. On March 31, Flying Owl had the following accounts and balances: Bonds payable $150,000 Discount on bonds payable 7,000 On that day, Flying Owl redeemed a quarter of the bonds in the market at 102. Prepare the journal entry to record the redemption. Round to the nearest whole dollar when necessary. For full credit, show your calculations in this box: ClickClock sells mantel clocks. On January 1, 2019, the first day of its fiscal year, ClickClock issued $25,000 of three-year, 11% bonds when the market rate was 14%, with interest payable semiannually, on June 30 and December 31. The company uses the effective interest rate method to amortize bond discounts and premiums. Using the present value tables that we utilized in class. calculate the proceeds from the sale of the bonds (selling price); show your work in the box provided, and type your answer in the answer box. NOTE: Present Value Tables 2 and 4 are posted in D2L under the "Chapter 14" module - use the numbers exactly as they appear in the table. Round your calculations to the nearest whole dollar (no cents in journal entries) For full credit, show your work in this box: Answer box: Prepare all required journal entries for 2019. Answer box: How much cash will the company pay to the bond holders during 2019? For full credit, show your work in this box: Answer box: How much interest expense will the company recognize for 2019? For full credit, show your work in this box: Answer box: How much interest expense will the company recognize over the life of the bond? For full credit show your work this box: Discuss when an adjusting journal entry is required with respect to bonds payable? Answer box: On January 1, 2019, Glasses Corp. issued a 10% installment note to Big Bank in the amount of $100,000. The note requires annual payments for 3 years. Using the appropriate Present Value Table (either Table 2 or Table 4 - both of which were also used in Problem 1), determine the amount of the annual payment and type your answer in the answer box. Answer box: For full credit, show your work in this box: Record the annual payments that will be made each December 31 over the life of the