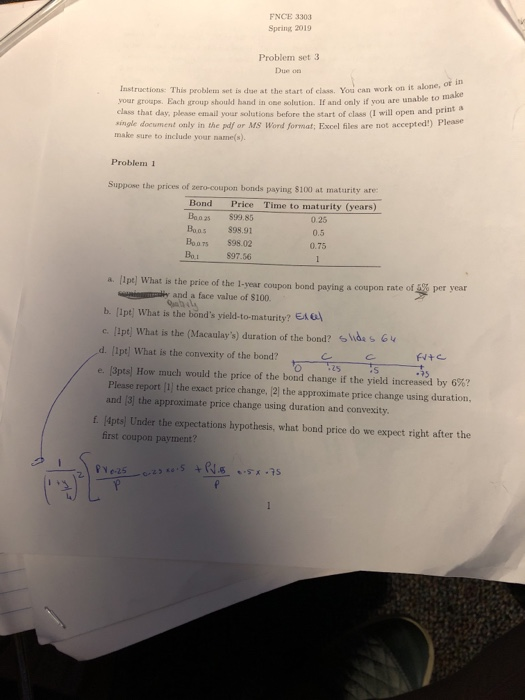

FNCE 3303 Spring 2015 Problem set 3 Due on ot in lastructions This problea set is dae at the start of class. You can work on it alone, your groups. Each group should hand in one solution. If and only if you are unable to tma class that day, plesse email your solutions before the start of class (I will open and print a single document only in the pdf or MS Wond format: Excel files are not accepted!) Please make sure to include your name(s). Problem 1 Suppose the prices of zero-coupon bonds paying S100 at maturity sre Bond Price Time to maturity (years) Booas $99.85 Buas $98.91 Boors $98.02 Boi 97.56 0.25 0.5 0.75 a. II pel What is the price of the 1-year coupon bond paying a coupon rate of per year ismpy and a face value of $100 b. [Ipt What is the bond's yield-to-maturity? EAal c. [ipt What is the (Macaulay's) duration of the bond? ies G d. [Ipt What is the convexity of the bond? e (3pts How much would the price of the bond changeif the yield increas si by 6%? Please report [1 the exact price change, [2) the approximate price change using duration, and [3 the approximate price change using duration and convexity. 25 .75 E. [4pts) Under the expectations hypothesis, what bond price do we expect right after the first coupon payment? 2. FNCE 3303 Spring 2015 Problem set 3 Due on ot in lastructions This problea set is dae at the start of class. You can work on it alone, your groups. Each group should hand in one solution. If and only if you are unable to tma class that day, plesse email your solutions before the start of class (I will open and print a single document only in the pdf or MS Wond format: Excel files are not accepted!) Please make sure to include your name(s). Problem 1 Suppose the prices of zero-coupon bonds paying S100 at maturity sre Bond Price Time to maturity (years) Booas $99.85 Buas $98.91 Boors $98.02 Boi 97.56 0.25 0.5 0.75 a. II pel What is the price of the 1-year coupon bond paying a coupon rate of per year ismpy and a face value of $100 b. [Ipt What is the bond's yield-to-maturity? EAal c. [ipt What is the (Macaulay's) duration of the bond? ies G d. [Ipt What is the convexity of the bond? e (3pts How much would the price of the bond changeif the yield increas si by 6%? Please report [1 the exact price change, [2) the approximate price change using duration, and [3 the approximate price change using duration and convexity. 25 .75 E. [4pts) Under the expectations hypothesis, what bond price do we expect right after the first coupon payment? 2