Question

Focus on Financing a Corporation and raising capital, more specifically Blockchain Technology. Participants will be able to confirm transactions without the involvement of a centralized

Focus on Financing a Corporation and raising capital, more specifically Blockchain Technology. Participants will be able to confirm transactions without the involvement of a centralized authority using this technology. As mentioned in the text, this is a relatively new capital funding source, therefore it is less regulated and more prone to fraud. The question is how exactly would a situation relating to Bitcoin Fraud be dealt with according to the law since it has fewer strict regulations? Will the same laws as other fraudulent situations be applied to this?

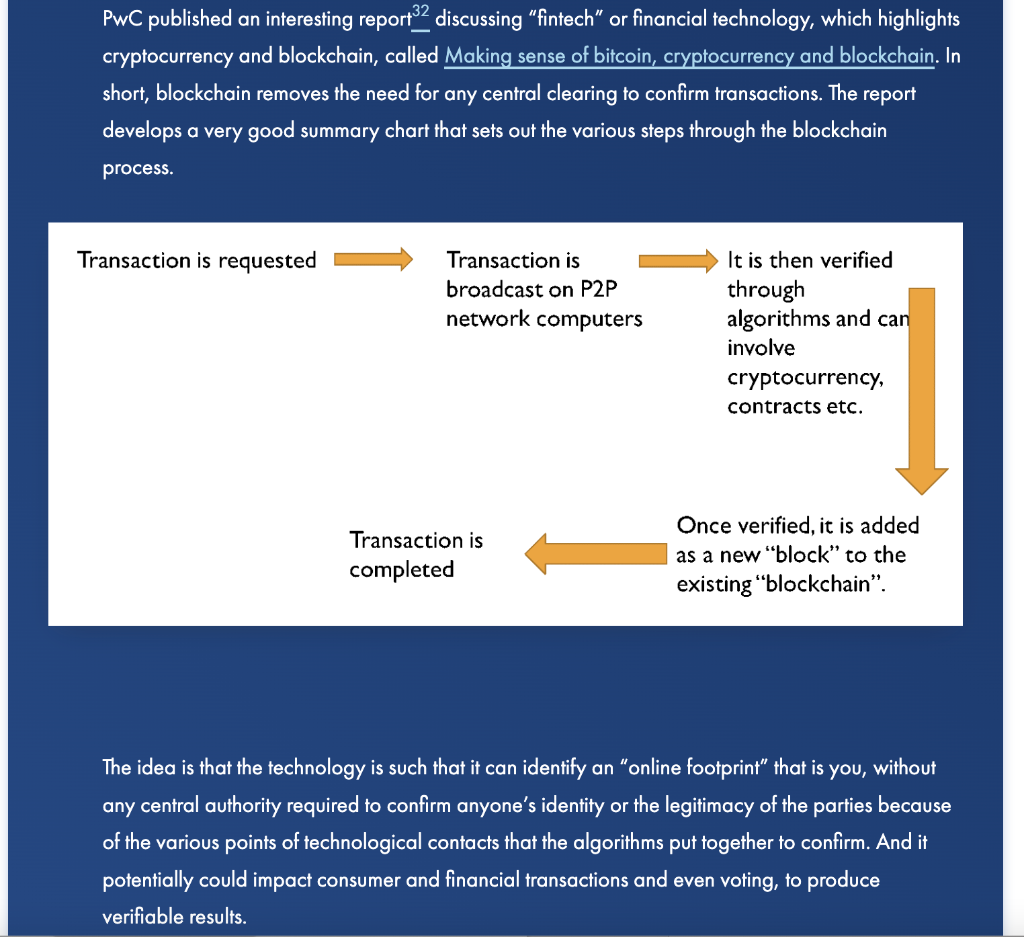

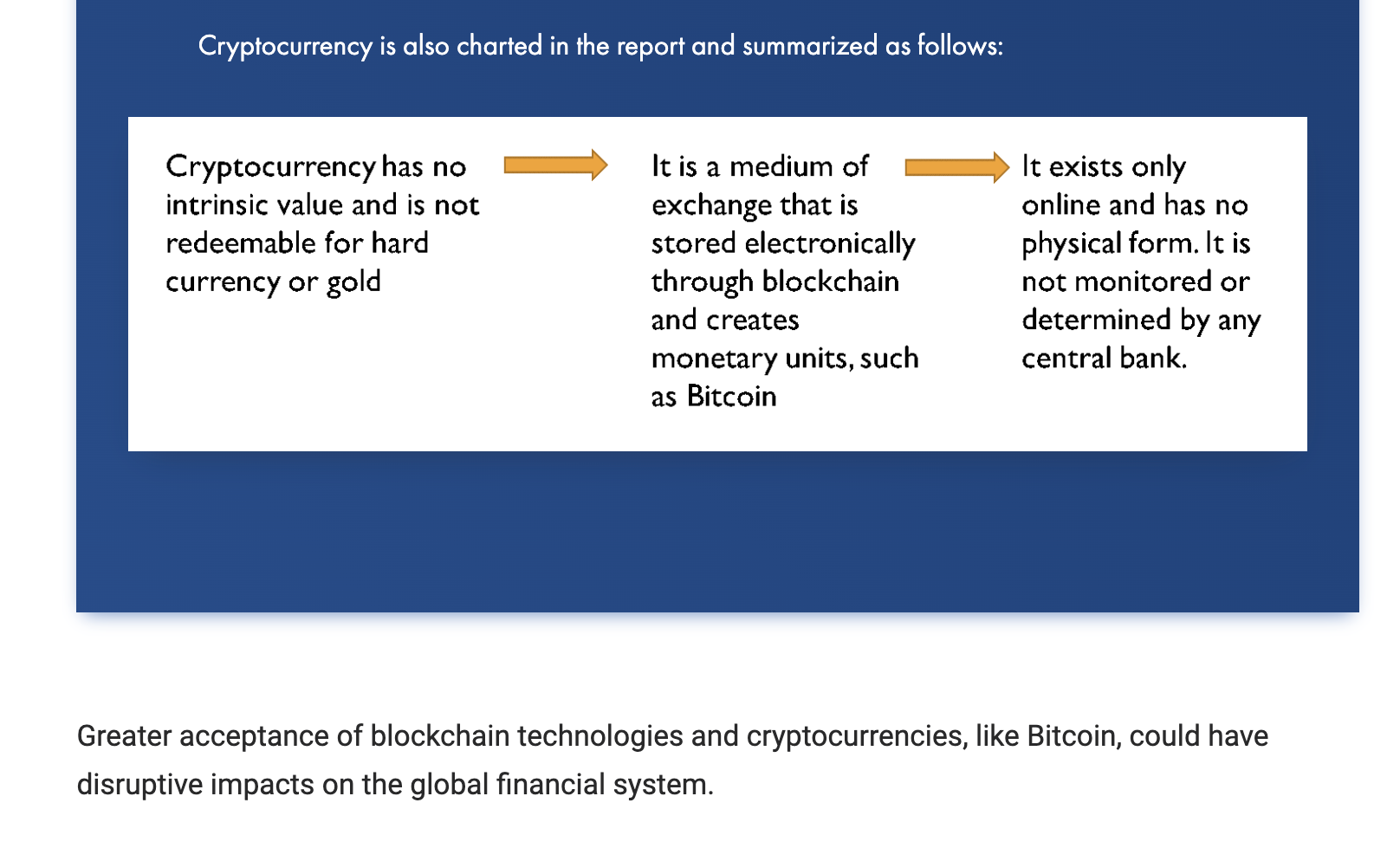

There are other ways to raise capital, such as "angel" investors and joint venture financing, and with technology, it is possible to raise funds in ways that were not possible without it. Examples of this are crowdfunding through platforms like Indiegogo, Patreon and Kickstarter. 31 Relatively new funding sources, they are less regulated and because of that may create an environment that is ripe for fraud. Another burgeoning area where legal oversight and regulation are still catching up is with cryptocurrency and/or blockchain technology. The increasing acceptance of these technologies in the global marketplace will have far-reaching implications for global currencies, sovereign nations, and the entire financial sector. Blockchain technology purports to use everyone's online "footprint" from different secured servers to confirm your identity and thereby verify the legitimacy of any transaction independent of any intermediary. This technology means to disintermediate the "middleman" banking sector in any business transaction and to have online cryptocurrency accounts linked to you through online systems. Purportedly, it would eliminate the need for credit cards or bank accounts, as your net worth would be linked to your online identity. 3.04: Of Interest PwC published an interesting report 32 discussing "fintech" or financial technology, which highlights cryptocurrency and blockchain, called Making sense of bitcoin, cryptocurrency and blockchain. In short, blockchain removes the need for any central clearing to confirm transactions. The report develops a very good summary chart that sets out the various steps through the blockchain Dur nublichod an intorestina mannt 32 Cryptocurrency is also charted in the report and summarized as follows: Greater acceptance of blockchain technologies and cryptocurrencies, like Bitcoin, could have disruptive impacts on the global financial system. There are other ways to raise capital, such as "angel" investors and joint venture financing, and with technology, it is possible to raise funds in ways that were not possible without it. Examples of this are crowdfunding through platforms like Indiegogo, Patreon and Kickstarter. 31 Relatively new funding sources, they are less regulated and because of that may create an environment that is ripe for fraud. Another burgeoning area where legal oversight and regulation are still catching up is with cryptocurrency and/or blockchain technology. The increasing acceptance of these technologies in the global marketplace will have far-reaching implications for global currencies, sovereign nations, and the entire financial sector. Blockchain technology purports to use everyone's online "footprint" from different secured servers to confirm your identity and thereby verify the legitimacy of any transaction independent of any intermediary. This technology means to disintermediate the "middleman" banking sector in any business transaction and to have online cryptocurrency accounts linked to you through online systems. Purportedly, it would eliminate the need for credit cards or bank accounts, as your net worth would be linked to your online identity. 3.04: Of Interest PwC published an interesting report 32 discussing "fintech" or financial technology, which highlights cryptocurrency and blockchain, called Making sense of bitcoin, cryptocurrency and blockchain. In short, blockchain removes the need for any central clearing to confirm transactions. The report develops a very good summary chart that sets out the various steps through the blockchain Dur nublichod an intorestina mannt 32 Cryptocurrency is also charted in the report and summarized as follows: Greater acceptance of blockchain technologies and cryptocurrencies, like Bitcoin, could have disruptive impacts on the global financial systemStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started