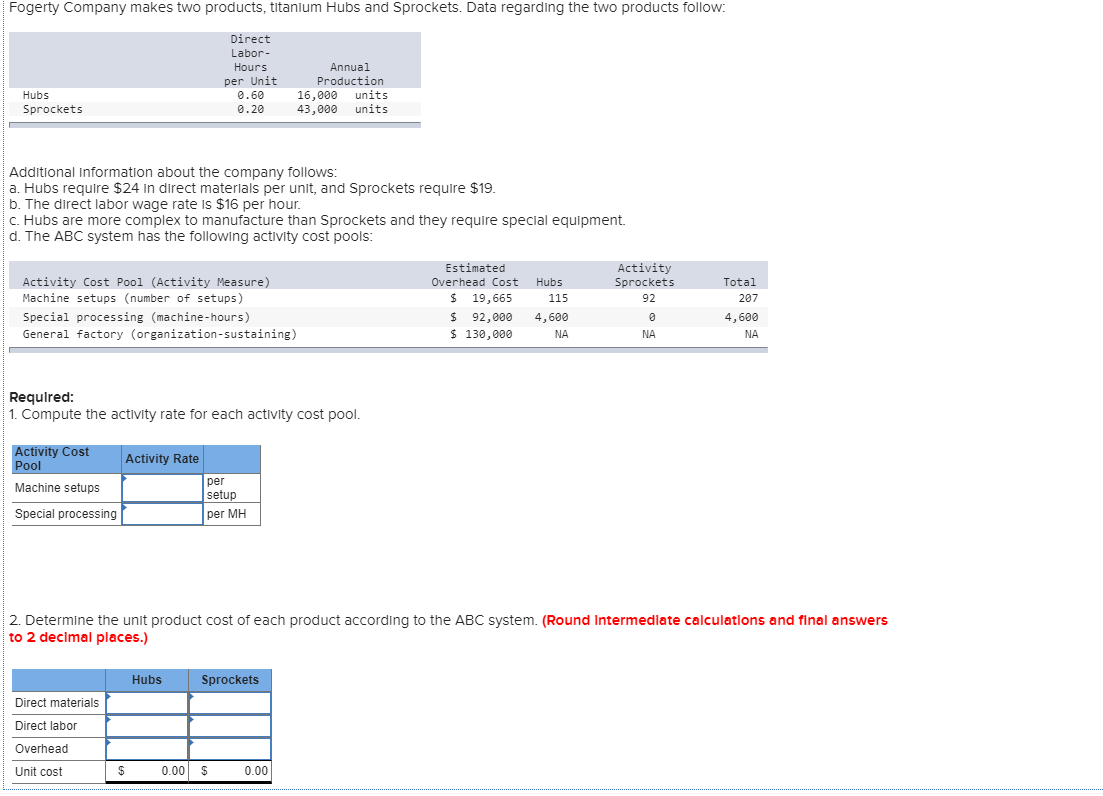

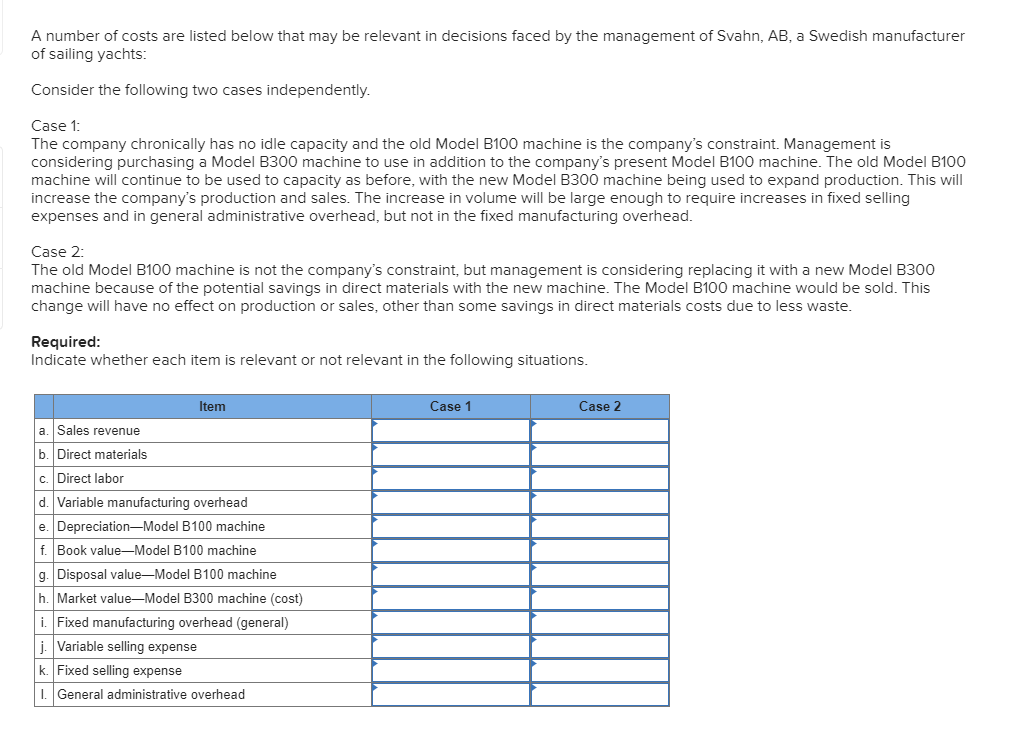

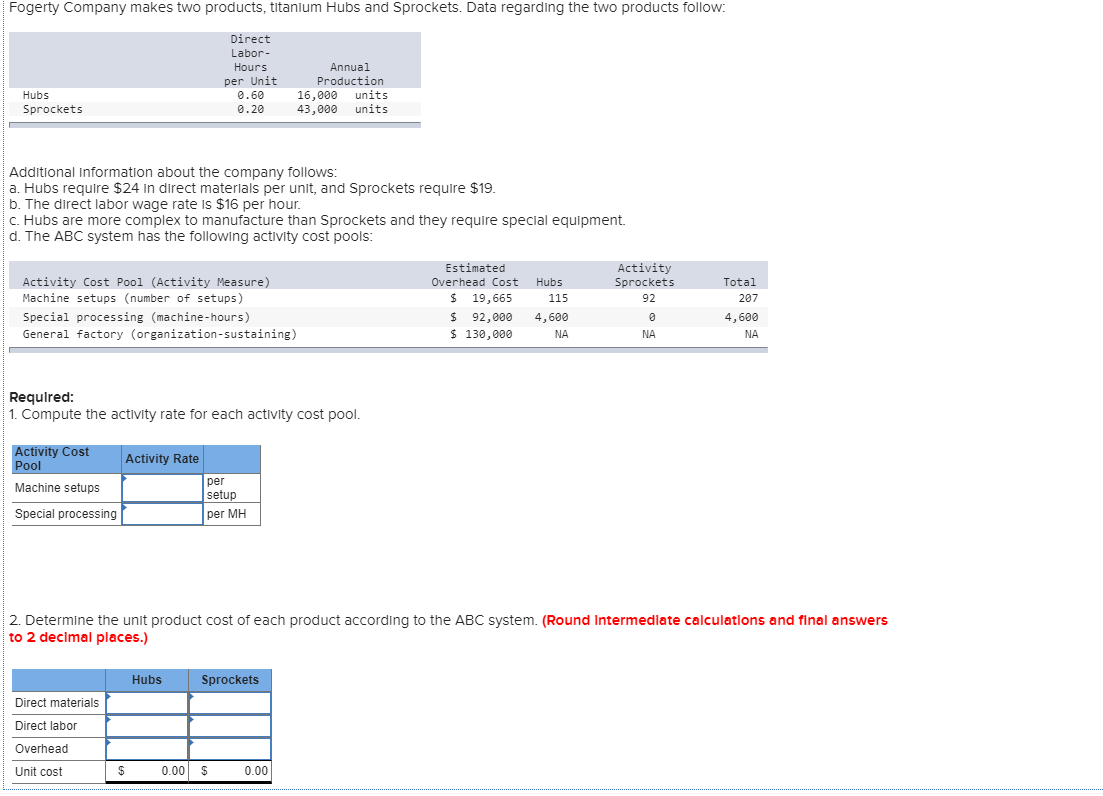

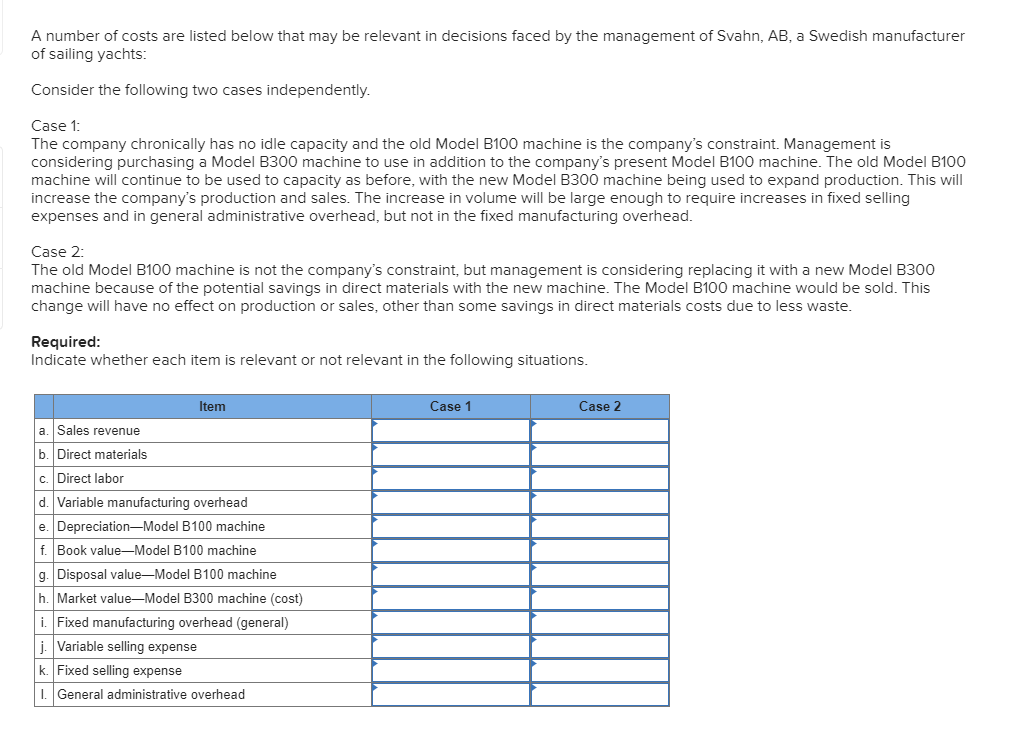

Fogerty Company makes two products, titanium Hubs and Sprockets. Data regarding the two products follow: Direct Labor- Hours per Unit 0.60 0.20 Annual Production 16,000 units 43,000 units Hubs Sprockets Additional Information about the company follows: a. Hubs require $24 in direct materials per unit, and Sprockets require $19. b. The direct labor wage rate is $16 per hour. C. Hubs are more complex to manufacture than Sprockets and they require special equipment d. The ABC system has the following activity cost pools: Estimated Overhead Cost Hubs $ 19,665 115 $ 92,000 4,600 $ 130,000 NA Activity Sprockets 92 Activity Cost Pool (Activity Measure) Machine setups (number of setups) Special processing machine-hours) General factory (organization-sustaining) Total 207 4,600 NA NA Required: 1. Compute the activity rate for each activity cost pool. Activity Rate Activity Cost Pool Machine setups per setup per MH Special processing 2. Determine the unit product cost of each product according to the ABC system. (Round Intermediate calculations and final answers to 2 decimal places.) Hubs Sprockets Direct materials Direct labor Overhead Unit cost $ 0.00 $ 0.00 A number of costs are listed below that may be relevant in decisions faced by the management of Svahn, AB, a Swedish manufacturer of sailing yachts: Consider the following two cases independently. Case 1: The company chronically has no idle capacity and the old Model B100 machine is the company's constraint. Management is considering purchasing a Model B300 machine to use in addition to the company's present Model B100 machine. The old Model B100 machine will continue to be used to capacity as before, with the new Model B300 machine being used to expand production. This will increase the company's production and sales. The increase in volume will be large enough to require increases in fixed selling expenses and in general administrative overhead, but not in the fixed manufacturing overhead. Case 2: The old Model B100 machine is not the company's constraint, but management is considering replacing it with a new Model B300 machine because of the potential savings in direct materials with the new machine. The Model B100 machine would be sold. This change will have no effect on production or sales, other than some savings in direct materials costs due to less waste. Required: Indicate whether each item is relevant or not relevant in the following situations. Case 1 Case 2 Item a. Sales revenue b. Direct materials c. Direct labor d. Variable manufacturing overhead e. DepreciationModel B100 machine Book valueModel B100 machine g. Disposal valueModel B100 machine h. Market valueModel B300 machine (cost) i. Fixed manufacturing overhead (general) j. Variable selling expense k. Fixed selling expense 1. General administrative overhead