Answered step by step

Verified Expert Solution

Question

1 Approved Answer

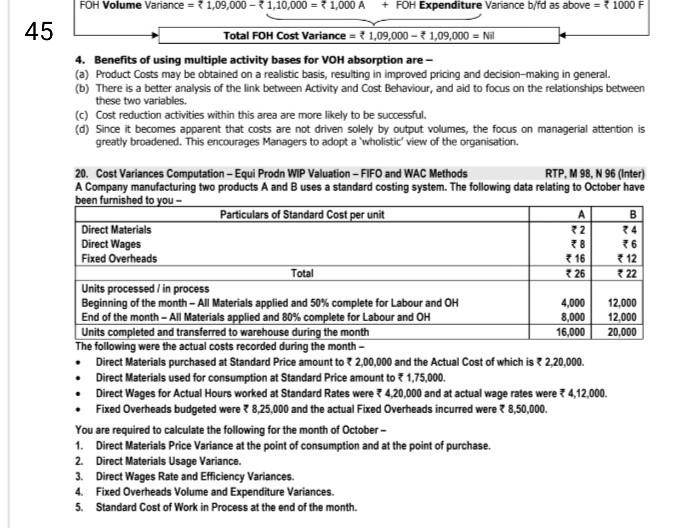

FOH Volume Variance - = { 1,09,000 - 1,10,000 = { 1,000 A + FOH Expenditure Variance b/fd as above = { 1000 F 45

FOH Volume Variance - = { 1,09,000 - 1,10,000 = { 1,000 A + FOH Expenditure Variance b/fd as above = { 1000 F 45 B 34 36 Total FOH Cost Variance = { 1,09,000 - 1,09,000 = Nil 4. Benefits of using multiple activity bases for VOH absorption are - (a) Product Costs may be obtained on a realistic basis, resulting in improved pricing and decision-making in general. (b) There is a better analysis of the link between Activity and Cost Behaviour, and aid to focus on the relationships between these two variables. (C) Cost reduction activities within this area are more likely to be successful. (d) Since it becomes apparent that costs are not driven solely by output volumes, the focus on managerial attention is greatly broadened. This encourages Managers to adopt a wholistic' view of the organisation. 20. Cost Variances Computation - Equi Prodn WIP Valuation - FIFO and WAC Methods RTP, M 98, N 96 (Inter) A Company manufacturing two products A and B uses a standard costing system. The following data relating to October have been furnished to you - Particulars of Standard Cost per unit Direct Materials 2 Direct Wages 8 Fixed Overheads 16 *12 Total 26 22 Units processed / in process Beginning of the month - All Materials applied and 50% complete for Labour and OH 4,000 12,000 End of the month - All Materials applied and 80% complete for Labour and OH 8,000 12,000 Units completed and transferred to warehouse during the month 16,000 20,000 The following were the actual costs recorded during the month - Direct Materials purchased at Standard Price amount to 2,00,000 and the Actual Cost of which is 2,20,000 Direct Materials used for consumption at Standard Price amount to 1,75,000. Direct Wages for Actual Hours worked at Standard Rates were 4,20,000 and at actual wage rates were ? 4,12,000. Fixed Overheads budgeted were ? 8,25,000 and the actual Fixed Overheads incurred were ? 8,50,000. You are required to calculate the following for the month of October - 1. Direct Materials Price Variance at the point of consumption and at the point of purchase. 2. Direct Materials Usage Variance. 3. Direct Wages Rate and Efficiency Variances. 4. Fixed Overheads Volume and Expenditure Variances. 5. Standard Cost of Work in Process at the end of the month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started