Answered step by step

Verified Expert Solution

Question

1 Approved Answer

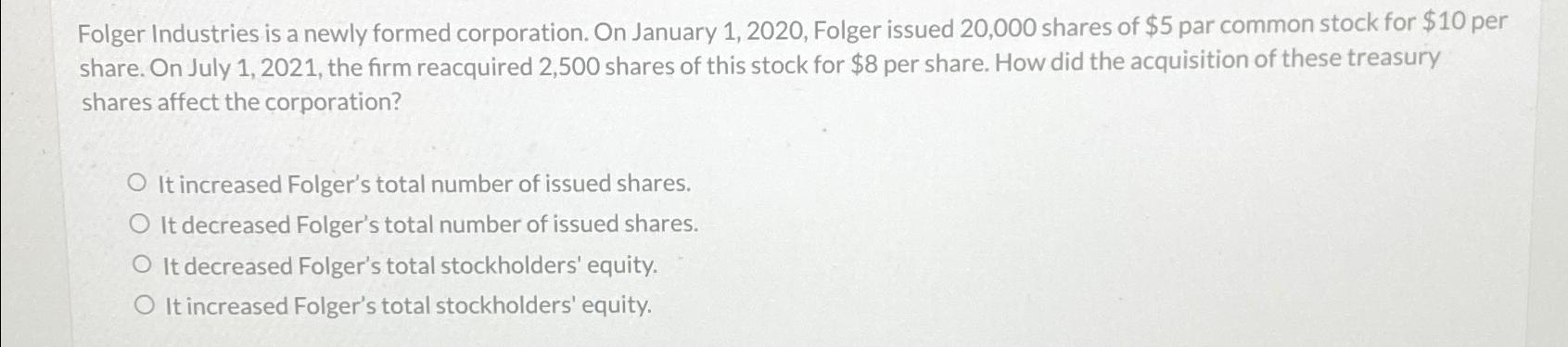

Folger Industries is a newly formed corporation. On January 1,2020 , Folger issued 20,000 shares of $5 par common stock for $10 per share. On

Folger Industries is a newly formed corporation. On January 1,2020 , Folger issued 20,000 shares of

$5par common stock for

$10per share. On July 1, 2021, the firm reacquired 2,500 shares of this stock for

$8per share. How did the acquisition of these treasury shares affect the corporation?\ It increased Folger's total number of issued shares.\ It decreased Folger's total number of issued shares.\ It decreased Folger's total stockholders' equity.\ It increased Folger's total stockholders' equity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started