Answered step by step

Verified Expert Solution

Question

1 Approved Answer

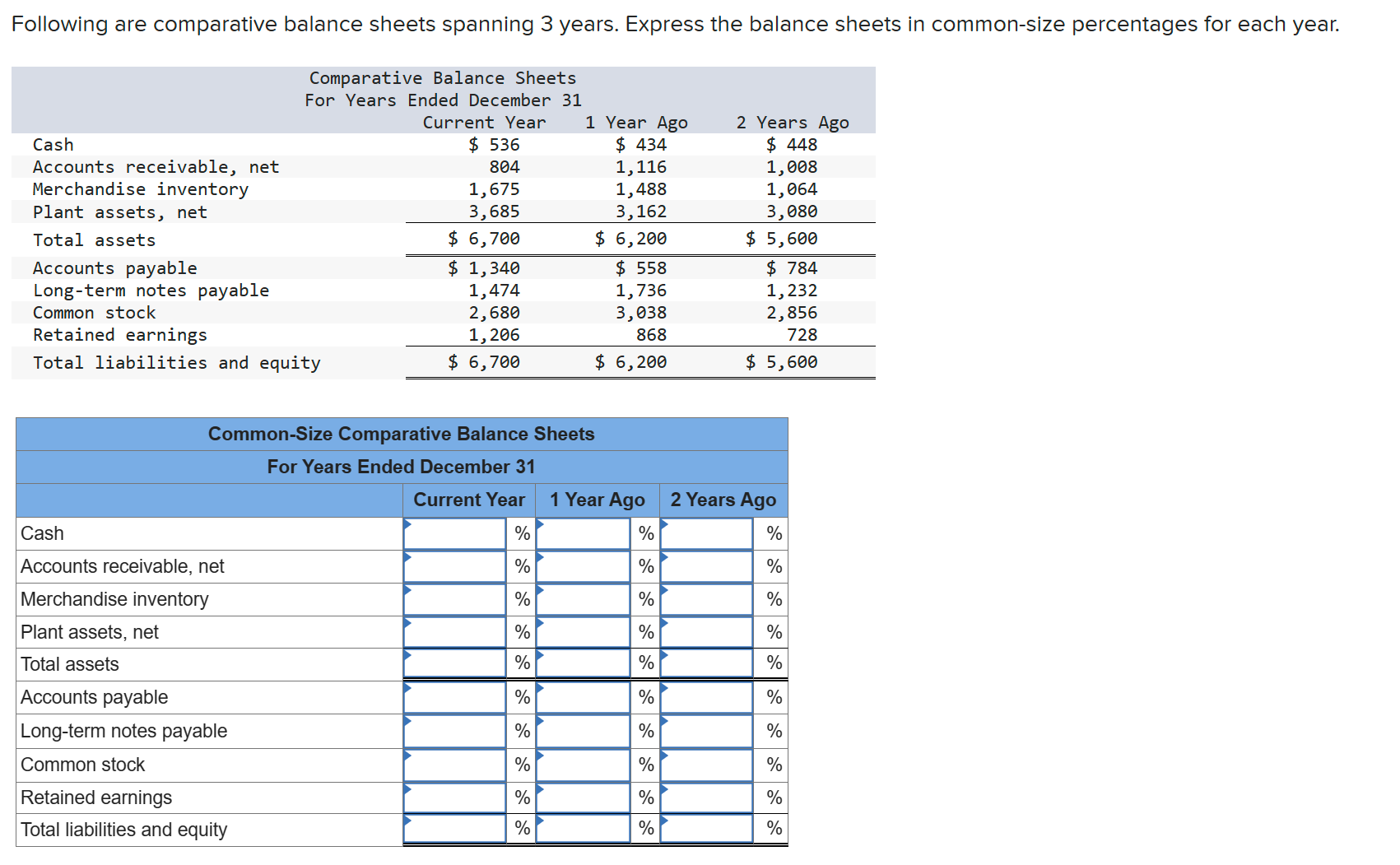

Following are comparative balance sheets spanning 3 years. Express the balance sheets in common-size percentages for each year. begin{tabular}{lccc} multicolumn{5}{c}{begin{tabular}{c} Comparative Balance Sheets For

Following are comparative balance sheets spanning 3 years. Express the balance sheets in common-size percentages for each year. \begin{tabular}{lccc} \multicolumn{5}{c}{\begin{tabular}{c} Comparative Balance Sheets \\ For Years \end{tabular}} & \begin{tabular}{c} Ended December 31 \\ Current Year \end{tabular} & 1 Year Ago & 2 Years Ago \\ Cash & $536 & $434 & $448 \\ Accounts receivable, net & 804 & 1,116 & 1,008 \\ Merchandise inventory & 1,675 & 1,488 & 1,064 \\ Plant assets, net & 3,685 & 3,162 & 3,080 \\ Total assets & $6,700 & $6,200 & $5,600 \\ Accounts payable & $1,340 & $558 & $784 \\ Long-term notes payable & 1,474 & 1,736 & 1,232 \\ Common stock & 2,680 & 3,038 & 2,856 \\ Retained earnings & 1,206 & 868 & 728 \\ Total liabilities and equity & $6,700 & $6,200 & $5,600 \\ \hline \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common-Size Comparative Balance Sheets } \\ \hline \multicolumn{5}{|c|}{ For Years Ended December 31} \\ \hline \multirow[b]{2}{*}{ Cash } & Current Year & \multicolumn{2}{|l|}{1 Year Ago } & 2 Years Ago \\ \hline & % & & % & % \\ \hline Accounts receivable, net & % & & % & % \\ \hline Merchandise inventory & % & & % & % \\ \hline Plant assets, net & % & & % & % \\ \hline Total assets & % & & % & % \\ \hline Accounts payable & % & & % & % \\ \hline Long-term notes payable & % & & % & % \\ \hline Common stock & % & & % & % \\ \hline Retained earnings & % & & % & % \\ \hline Total liabilities and equity & % & & % & % \\ \hline \end{tabular}

Following are comparative balance sheets spanning 3 years. Express the balance sheets in common-size percentages for each year. \begin{tabular}{lccc} \multicolumn{5}{c}{\begin{tabular}{c} Comparative Balance Sheets \\ For Years \end{tabular}} & \begin{tabular}{c} Ended December 31 \\ Current Year \end{tabular} & 1 Year Ago & 2 Years Ago \\ Cash & $536 & $434 & $448 \\ Accounts receivable, net & 804 & 1,116 & 1,008 \\ Merchandise inventory & 1,675 & 1,488 & 1,064 \\ Plant assets, net & 3,685 & 3,162 & 3,080 \\ Total assets & $6,700 & $6,200 & $5,600 \\ Accounts payable & $1,340 & $558 & $784 \\ Long-term notes payable & 1,474 & 1,736 & 1,232 \\ Common stock & 2,680 & 3,038 & 2,856 \\ Retained earnings & 1,206 & 868 & 728 \\ Total liabilities and equity & $6,700 & $6,200 & $5,600 \\ \hline \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common-Size Comparative Balance Sheets } \\ \hline \multicolumn{5}{|c|}{ For Years Ended December 31} \\ \hline \multirow[b]{2}{*}{ Cash } & Current Year & \multicolumn{2}{|l|}{1 Year Ago } & 2 Years Ago \\ \hline & % & & % & % \\ \hline Accounts receivable, net & % & & % & % \\ \hline Merchandise inventory & % & & % & % \\ \hline Plant assets, net & % & & % & % \\ \hline Total assets & % & & % & % \\ \hline Accounts payable & % & & % & % \\ \hline Long-term notes payable & % & & % & % \\ \hline Common stock & % & & % & % \\ \hline Retained earnings & % & & % & % \\ \hline Total liabilities and equity & % & & % & % \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started