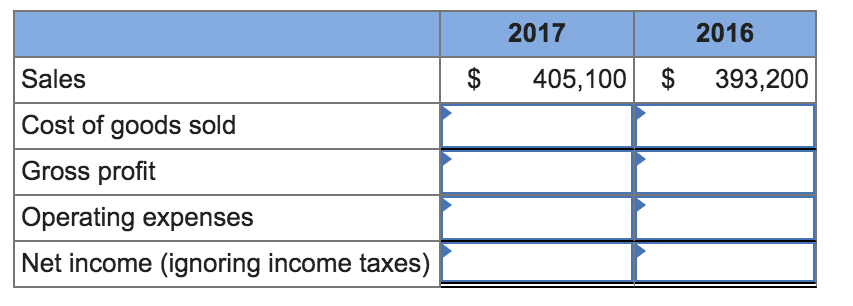

Following are condensed income statements for Uncle Bill's Home Improvement Center for the years ended December 31, 2017, and 2016: 2017 2016 Sales $ 405,100

Following are condensed income statements for Uncle Bill's Home Improvement Center for the years ended December 31, 2017, and 2016:

| 2017 | 2016 | |||||

| Sales | $ | 405,100 | $ | 393,200 | ||

| Cost of goods sold | (303,000 | ) | (270,000 | ) | ||

| Gross profit | $ | 102,100 | $ | 123,200 | ||

| Operating expenses | (78,400 | ) | (71,800 | ) | ||

| Net income (ignoring income taxes) | $ | 23,700 | $ | 51,400 | ||

Uncle Bill was concerned about the operating results for 2017 and asked his recently hired accountant, "If sales increased in 2017, why was net income less than half of what it was in 2016?" In February of 2018, Uncle Bill got his answer: "The ending inventory reported in 2016 was overstated by $17,500 for merchandise that we were holding on consignment on behalf of Kirk's Servistar. We still keep some of their appliances in stock, but the value of these items was not included in the 2017 inventory count because we don't own them."

Required:

a. Recast the 2016 and 2017 income statements to take into account the correction of the 2016 ending inventory error.

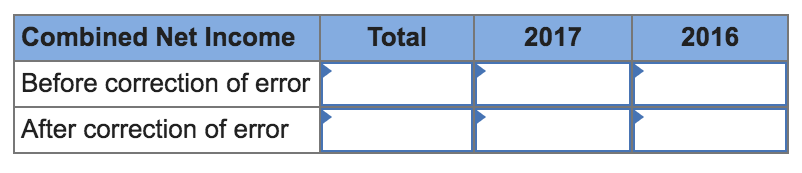

b-1. Calculate the combined net income for 2016 and 2017 before and after the correction of the error.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started