Answered step by step

Verified Expert Solution

Question

1 Approved Answer

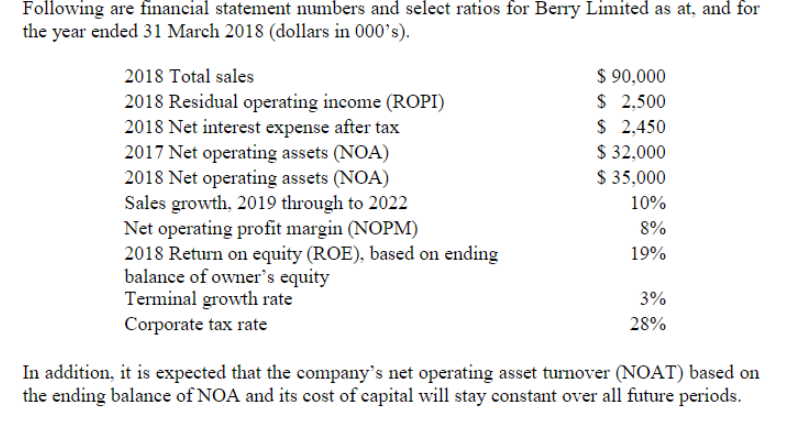

Following are financial statement numbers and select ratios for Berry Limited as at, and for the year ended 31 March 2018 (dollars in 000's) 2018

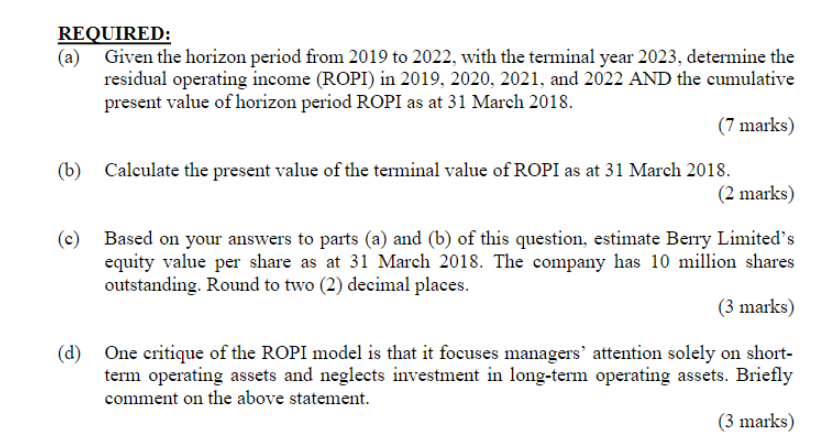

Following are financial statement numbers and select ratios for Berry Limited as at, and for the year ended 31 March 2018 (dollars in 000's) 2018 Total sales 90,000 2018 Residual operating income (ROPI) 2018 Net interest expense after tax 2017 Net operating assets (NOA) 2018 Net operating assets (NOA) Sales growth, 2019 through to 2022 Net operating profit margin (NOPM) 2018 Return on equity (ROE), based on ending balance of owner's equity Terminal growth rate Corporate tax rate 2,500 2,450 $ 32,000 $ 35,000 10% 8% 19% 3% 28% In addition, it is expected that the company's net operating asset turnover (NOAT) based on the ending balance of NOA and its cost of capital will stay constant over all future periods REQUIRED: (a) Given the horizon period from 2019 to 2022, with the terminal year 2023, determine the residual operating income (ROPI) in 2019, 2020, 2021, and 2022 AND the cumulative present value of horizon period ROPI as at 31 March 2018. (7 marks) Calculate the present value of the terminal value of ROPI as at 31 March 2018 (b) (2 marks) Based on your answers to parts (a) and (b) of this question, estimate Berry Limited's (e) equity value per share as at 31 March 2018. The company has 10 million shares outstanding. Round to two (2) decimal places (3 marks) One critique of the ROPI model is that it focuses managers attention solely on short- (d) term operating assets and neglects investment in long-term operating assets. Briefly comment on the above statement. (3 marks) Following are financial statement numbers and select ratios for Berry Limited as at, and for the year ended 31 March 2018 (dollars in 000's) 2018 Total sales 90,000 2018 Residual operating income (ROPI) 2018 Net interest expense after tax 2017 Net operating assets (NOA) 2018 Net operating assets (NOA) Sales growth, 2019 through to 2022 Net operating profit margin (NOPM) 2018 Return on equity (ROE), based on ending balance of owner's equity Terminal growth rate Corporate tax rate 2,500 2,450 $ 32,000 $ 35,000 10% 8% 19% 3% 28% In addition, it is expected that the company's net operating asset turnover (NOAT) based on the ending balance of NOA and its cost of capital will stay constant over all future periods REQUIRED: (a) Given the horizon period from 2019 to 2022, with the terminal year 2023, determine the residual operating income (ROPI) in 2019, 2020, 2021, and 2022 AND the cumulative present value of horizon period ROPI as at 31 March 2018. (7 marks) Calculate the present value of the terminal value of ROPI as at 31 March 2018 (b) (2 marks) Based on your answers to parts (a) and (b) of this question, estimate Berry Limited's (e) equity value per share as at 31 March 2018. The company has 10 million shares outstanding. Round to two (2) decimal places (3 marks) One critique of the ROPI model is that it focuses managers attention solely on short- (d) term operating assets and neglects investment in long-term operating assets. Briefly comment on the above statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started