Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following are financial statement numbers and select ratios for Target Corp. for the fiscal year 2011 (ending January 28, 2012). Current Forecast Horizon 2011

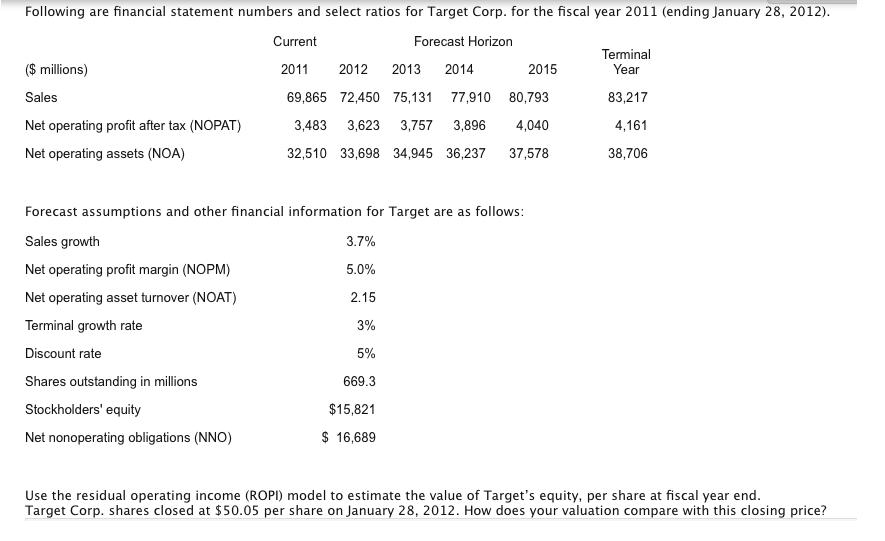

Following are financial statement numbers and select ratios for Target Corp. for the fiscal year 2011 (ending January 28, 2012). Current Forecast Horizon 2011 ($ millions) Sales Net operating profit after tax (NOPAT) Net operating assets (NOA) 2012 2013 2014 2015 69,865 72,450 75,131 77,910 80,793 3,483 3,623 3,757 3,896 4,040 32,510 33,698 34,945 36,237 37,578 Forecast assumptions and other financial information for Target are as follows: Sales growth 3.7% Net operating profit margin (NOPM) 5.0% Net operating asset turnover (NOAT) 2.15 3% 5% 669.3 $15,821 $ 16,689 Terminal growth rate Discount rate Shares outstanding in millions Stockholders' equity Net nonoperating obligations (NNO) Terminal Year 83,217 4,161 38,706 Use the residual operating income (ROPI) model to estimate the value of Target's equity, per share at fiscal year end. Target Corp. shares closed at $50.05 per share on January 28, 2012. How does your valuation compare with this closing price?

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answer sales Net operating profil after NOPAT Net operating Assest NOA ROP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started