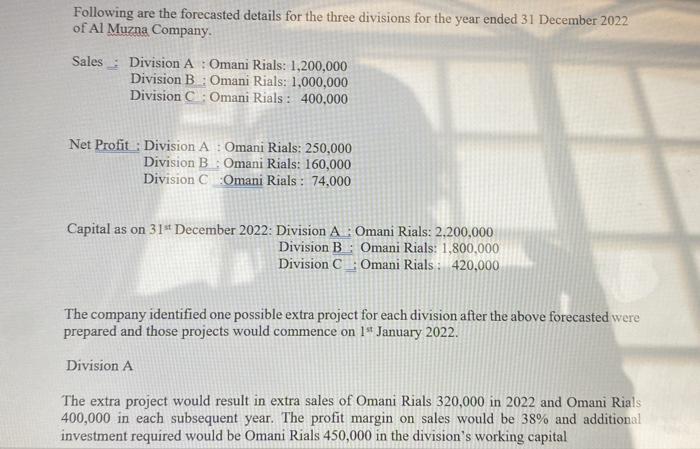

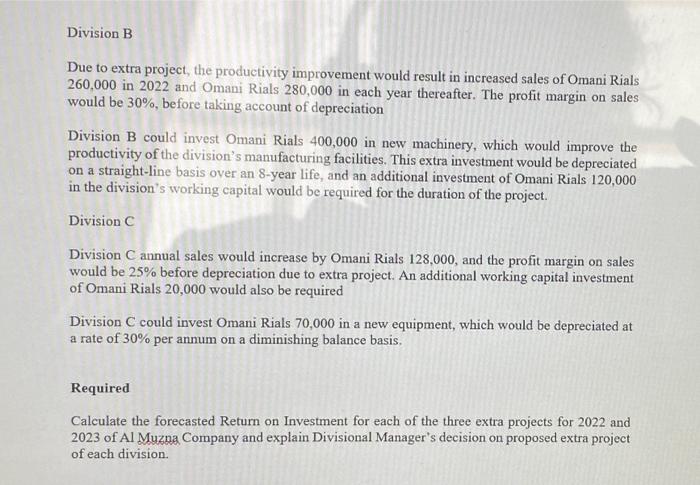

Following are the forecasted details for the three divisions for the year ended 31 December 2022 of Al Muzna Company. Sales Division A : Omani Rials: 1,200,000 Division B : Omani Rials: 1,000,000 Division C Omani Rials: 400,000 Net Profit : Division A : Omani Rials: 250,000 Division B : Omani Rials: 160,000 Division C Omani Rials : 74,000 Capital as on 31 December 2022: Division A . Omani Rials: 2.200,000 Division B: Omani Rials: 1,800,000 Division C: Omani Rials : 420,000 The company identified one possible extra project for each division after the above forecasted were prepared and those projects would commence on 14 January 2022. Division A The extra project would result in extra sales of Omani Rials 320,000 in 2022 and Omani Rials 400,000 in each subsequent year. The profit margin on sales would be 38% and additional investment required would be Omani Rials 450,000 in the division's working capital Division B Due to extra project, the productivity improvement would result in increased sales of Omani Rials 260,000 in 2022 and Omani Rials 280,000 in each year thereafter. The profit margin on sales would be 30%, before taking account of depreciation Division B could invest Omani Rials 400,000 in new machinery, which would improve the productivity of the division's manufacturing facilities. This extra investment would be depreciated on a straight-line basis over an 8-year life, and an additional investment of Omani Rials 120,000 in the division's working capital would be required for the duration of the project. Division C Division C annual sales would increase by Omani Rials 128,000, and the profit margin on sales would be 25% before depreciation due to extra project. An additional working capital investment of Omani Rials 20,000 would also be required Division C could invest Omani Rials 70,000 in a new equipment, which would be depreciated at a rate of 30% per annum on a diminishing balance basis. Required Calculate the forecasted Return on Investment for each of the three extra projects for 2022 and 2023 of Al Muzoa Company and explain Divisional Manager's decision on proposed extra project of each division Following are the forecasted details for the three divisions for the year ended 31 December 2022 of Al Muzna Company. Sales Division A : Omani Rials: 1,200,000 Division B : Omani Rials: 1,000,000 Division C Omani Rials: 400,000 Net Profit : Division A : Omani Rials: 250,000 Division B : Omani Rials: 160,000 Division C Omani Rials : 74,000 Capital as on 31 December 2022: Division A . Omani Rials: 2.200,000 Division B: Omani Rials: 1,800,000 Division C: Omani Rials : 420,000 The company identified one possible extra project for each division after the above forecasted were prepared and those projects would commence on 14 January 2022. Division A The extra project would result in extra sales of Omani Rials 320,000 in 2022 and Omani Rials 400,000 in each subsequent year. The profit margin on sales would be 38% and additional investment required would be Omani Rials 450,000 in the division's working capital Division B Due to extra project, the productivity improvement would result in increased sales of Omani Rials 260,000 in 2022 and Omani Rials 280,000 in each year thereafter. The profit margin on sales would be 30%, before taking account of depreciation Division B could invest Omani Rials 400,000 in new machinery, which would improve the productivity of the division's manufacturing facilities. This extra investment would be depreciated on a straight-line basis over an 8-year life, and an additional investment of Omani Rials 120,000 in the division's working capital would be required for the duration of the project. Division C Division C annual sales would increase by Omani Rials 128,000, and the profit margin on sales would be 25% before depreciation due to extra project. An additional working capital investment of Omani Rials 20,000 would also be required Division C could invest Omani Rials 70,000 in a new equipment, which would be depreciated at a rate of 30% per annum on a diminishing balance basis. Required Calculate the forecasted Return on Investment for each of the three extra projects for 2022 and 2023 of Al Muzoa Company and explain Divisional Manager's decision on proposed extra project of each division