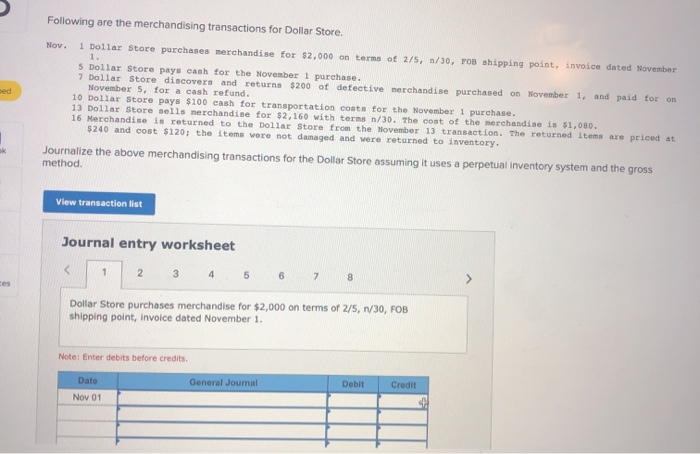

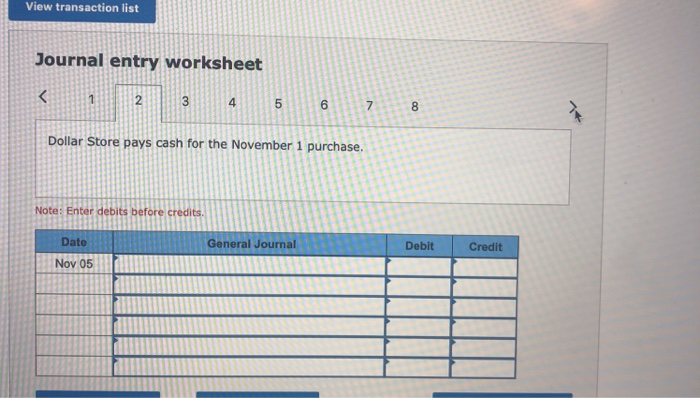

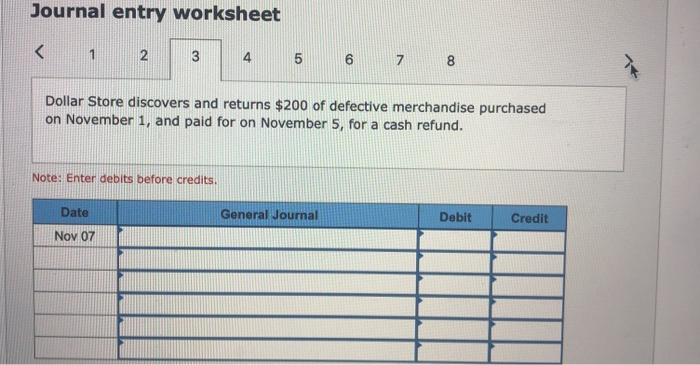

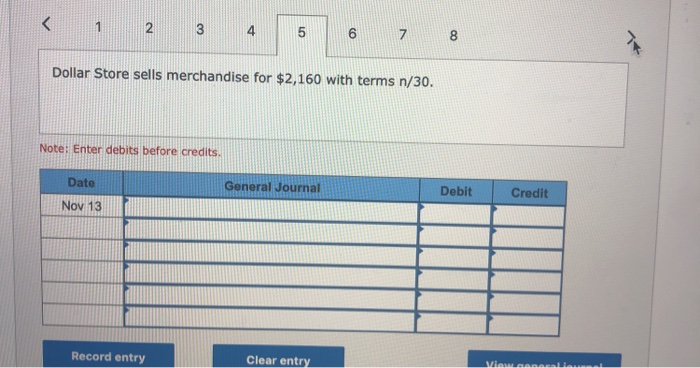

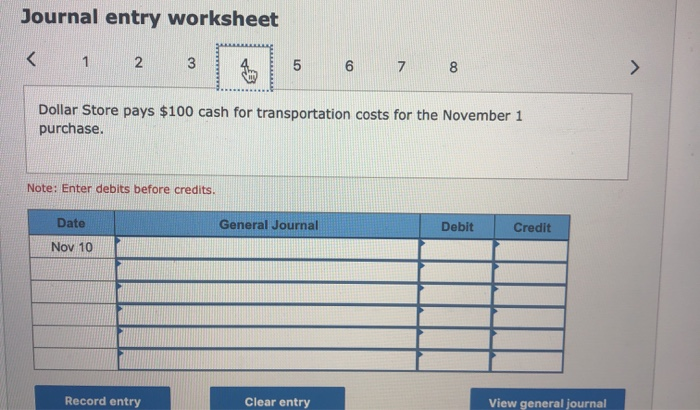

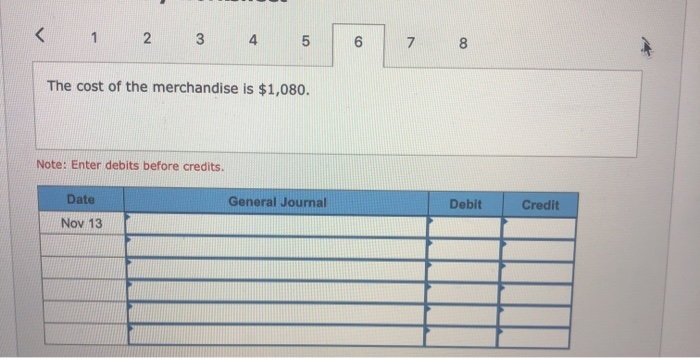

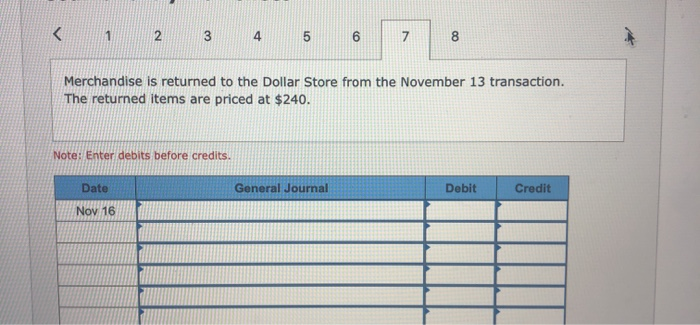

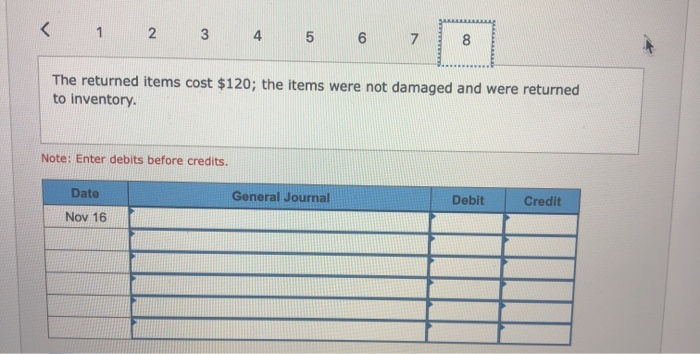

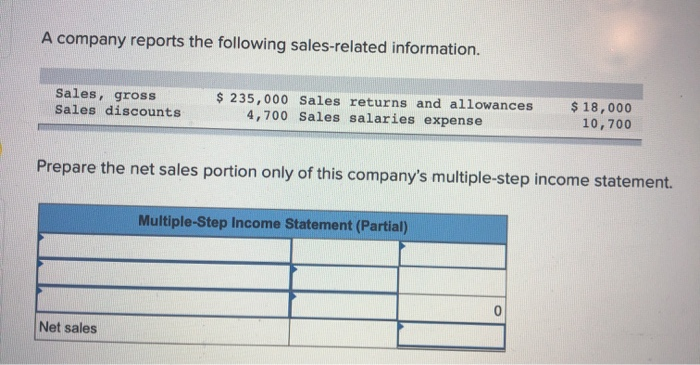

Following are the merchandising transactions for Dollar Store. 1 Dollar Store purchases merchandise for $2,000 on terms of 2/5, n/30, FOB shipping point, invoice dated November 1. 5 Dollar Store pays cash for the November 1 purchase. 7 Dollar Store discovers and returns $200 of defective merchandise purchased on November 1, and paid for on November 5, for a cash refund. 10 Dollar Store pays $100 cash for transportation costa for the November 1 purchase 13 Dollar Store sells nerchandise for $2,160 with terms n/30, The cost of the merchandise is $1,080. 16 Merchandise is returned to the Dollar Store from the Sovember 13 transaction. The returned items are priced at $240 and cost $120: the items vere not damaged and vere returned to inventory. Nov. ed Journalize the above merchandising transactions for the Dollar Store assuming it uses a perpetual inventory system and the gross method. View transaction list Journal entry worksheet 6 1 3 4 7 8 2 ces Dollar Store purchases merchandise for $2,000 on terms of 2/5, n/30, FOB shipping point, invoice dated November 1. Note: Enter debits before credits Credit Debit General Journal Date Nov 01 View transaction list Journal entry worksheet 1 2 5 6 7 Dollar Store pays cash for the November 1 purchase. Note: Enter debits before credits. Date General Journal Debit Credit Nov 05 co LO st Journal entry worksheet 2 4 6 7 Dollar Store discovers and returns $200 of defective merchandise purchased on November 1, and paid for on November 5, for a cash refund. Note: Enter debits before credits. Credit Debit General Journal Date Nov 07 Journal entry worksheet 1 2 3 6 7 Dollar Store pays $100 cash for transportation costs for the November 1 purchase. Note: Enter debits before creditS. Date General Journal Debit Credit Nov 10 View general journal Record entry Clear entry LO 1 2 3 5 8 7 The cost of the merchandise is $1,080. Note: Enter debits before credits. Date General Journal Debit Credit Nov 13 1 2 7 Merchandise is returned to the Dollar Store from the November 13 transaction. priced at $240. The returned items are Note: Enter debits before credits. Date General Journal Debit Credit Nov 16 CC 1 2 3 4 5 6 7 The returned items cost $120; the items were not damaged and were returned to inventory Note: Enter debits before credits. Date General Journal Debit Credit Nov 16 LO A company reports the following sales-related information. Sales, gross Sales discounts $18,000 10,700 235,000 Sales returns and allowances 4,700 Sales salaries expense Prepare the net sales portion only of this company's multiple-step income statement. Multiple-Step Income Statement (Partial) Net sales