Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following are the particulars taken from the books of Keraniganj Manufacturing Company for the year ended 31 December 2020: Raw materials purchased, Tk. 250,000;

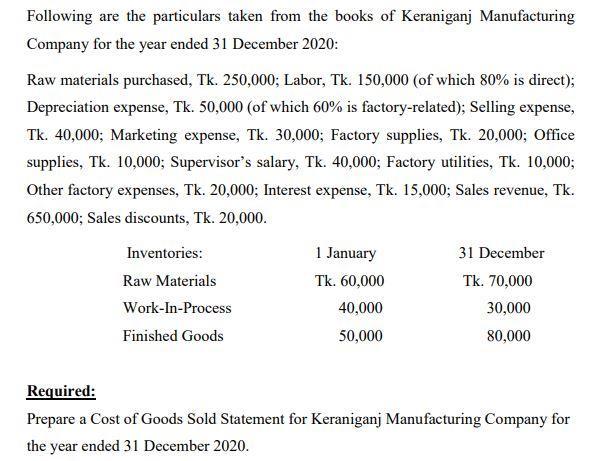

Following are the particulars taken from the books of Keraniganj Manufacturing Company for the year ended 31 December 2020: Raw materials purchased, Tk. 250,000; Labor, Tk. 150,000 (of which 80% is direct); Depreciation expense, Tk. 50,000 (of which 60% is factory-related); Selling expense, Tk. 40,000; Marketing expense, Tk. 30,000; Factory supplies, Tk. 20,000; Office supplies, Tk. 10,000; Supervisor's salary, Tk. 40,000; Factory utilities, Tk. 10,000; Other factory expenses, Tk. 20,000; Interest expense, Tk. 15,000; Sales revenue, Tk. 650,000; Sales discounts, Tk. 20,000. Inventories: Raw Materials Work-In-Process Finished Goods 1 January Tk. 60,000 40,000 50,000 31 December Tk. 70,000 30,000 80,000 Required: Prepare a Cost of Goods Sold Statement for Keraniganj Manufacturing Company for the year ended 31 December 2020.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Amwer First Pre Pare Particulars Cost of goods manufactured schedule ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started