Answered step by step

Verified Expert Solution

Question

1 Approved Answer

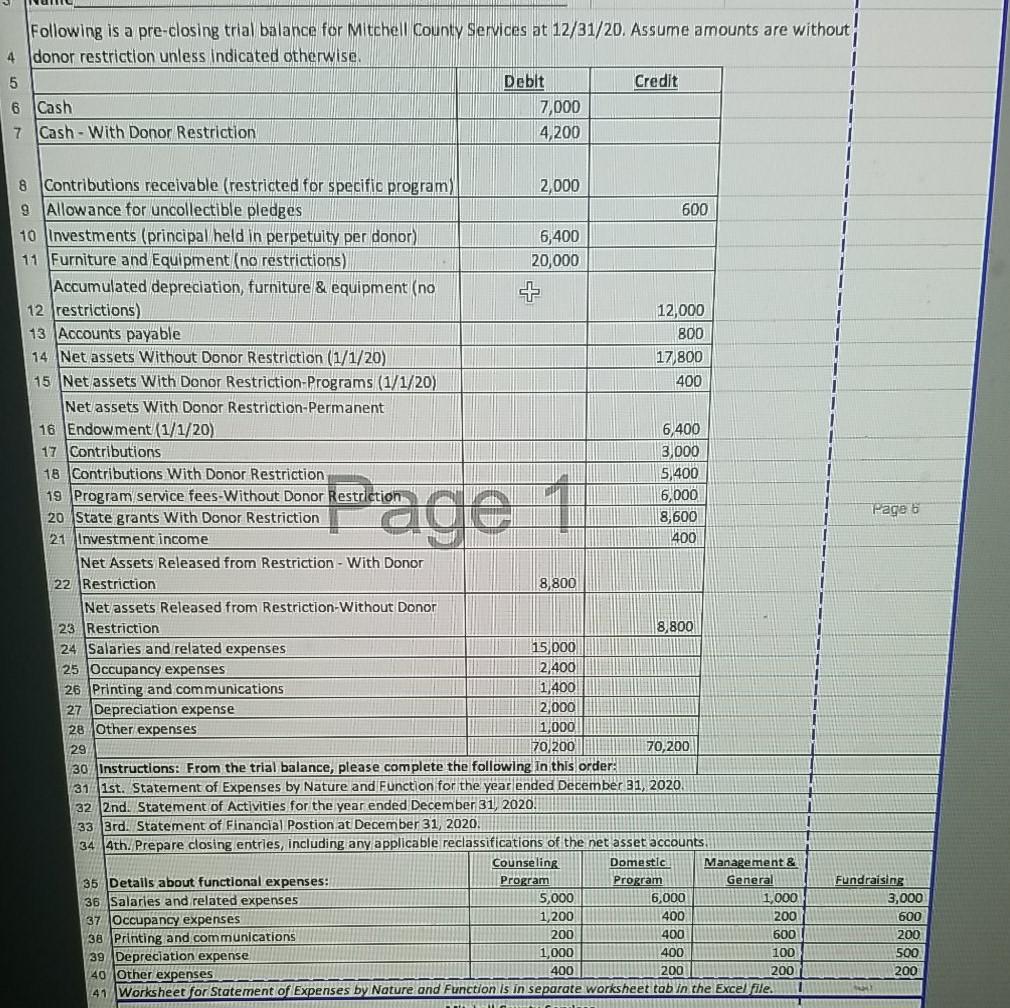

Following is a pre-closing trial balance for Mitchell County Services at 12/31/20. Assume amounts are without 4 donor restriction unless indicated otherwise 5 Debit Credit

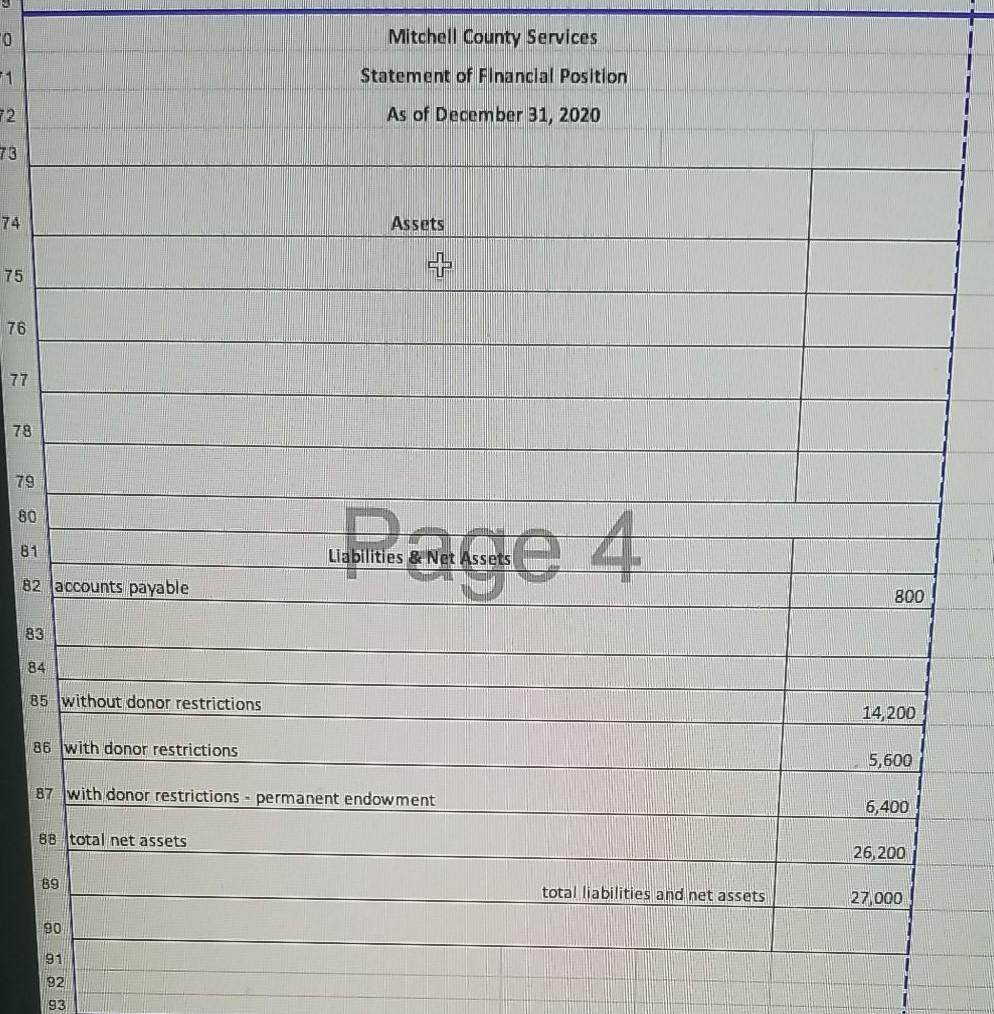

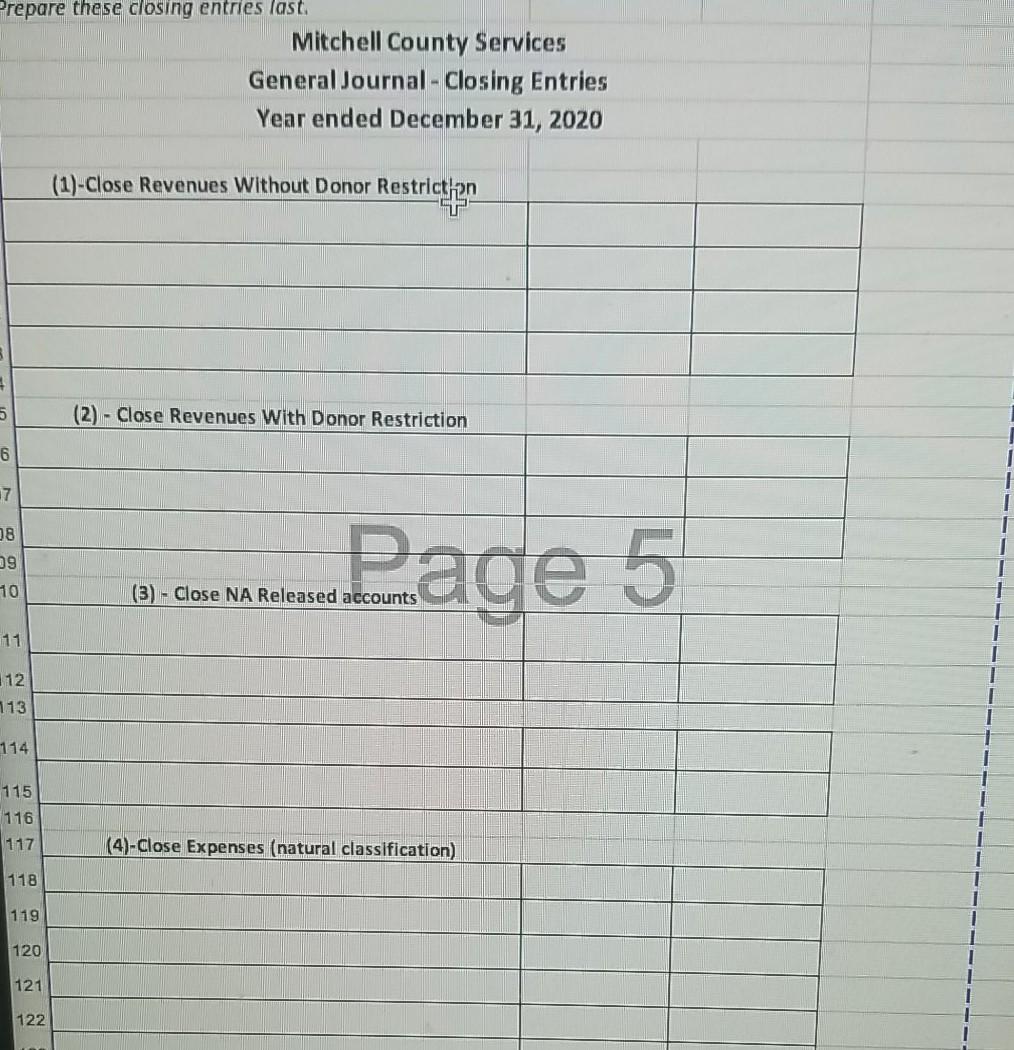

Following is a pre-closing trial balance for Mitchell County Services at 12/31/20. Assume amounts are without 4 donor restriction unless indicated otherwise 5 Debit Credit 6 Cash 7,000 7 Cash - With Donor Restriction 4,200 1 Page 1 Page 6 8 Contributions receivable (restricted for specific program) 2,000 9 Allowance for uncollectible pledges 600 10 Investments (principal held in perpetuity per donor) 6,400 11 Furniture and Equipment (no restrictions) 20,000 Accumulated depreciation, furniture & equipment (no 12 restrictions) 12,000 13 Accounts payable 800 14 Net assets Without Donor Restriction (1/1/20) 17,800 15 Net assets With Donor Restriction Programs (1/1/20) 400 Net assets With Donor Restriction-Permanent 16 Endowment (1/1/20) 6,400 17 Contributions 3,000 18 Contributions With Donor Restriction 5,400 19 Program service fees-Without Donor Restriction 16,000 20 State grants With Donor Restriction 8,600 21 Investment income 400 Net Assets Released from Restriction - With Donor 22 Restriction 8,800 Net assets Released from Restriction-Without Donor 23 Restriction 8,800 24 Salaries and related expenses 15,000 25 Occupancy expenses 2,400 26 Printing and communications 1,400 27 Depreciation expense 2,000 28 Other expenses 1,000 29 70,200 70,200 30 Instructions: From the trial balance, please complete the following in this order: 31 ist. Statement of Expenses by Nature and Function for the year ended December 31, 2020 32 2nd. Statement of Activities for the year ended December 31, 2020. 33 Brd. Statement of Financial Postion at December 31, 2020. 34 4th. Prepare closing entries, including any applicable reclassifications of the net asset accounts Counseling Domestic Management & 35 Details about functional expenses: Program Prorram Prora General 36 Salaries and related expenses 5,000 6,000 1,000 37 Occupancy expenses 1,200 400 200 38 Printing and communications 200 400 600 39 Depreciation expense 1,000 400 100 40 Other expenses 400 200 200 45 Worksheet for Statement of Expenses by Nature and Function is in separate worksheet tab in the Excel file. 1 1 Fundraising 3,000 600 200 500 200 CA 0 Mitchell County Services 11 Statement of Financial Position 2 As of December 31, 2020 73 74 Assets 75 76 77 78 79 BO 81 Liabilities & Net 82 accounts payable 800 33 84 85 without donor restrictions 14,200 86 with donor restrictions 5,600 87 with donor restrictions - permanent endowment 6,400 BB total net assets 26,200 89 total liabilities and net assets 27,000 90 91 92 1 93 Prepare these closing entries last. Mitchell County Services General Journal - Closing Entries Year ended December 31, 2020 (1)-Close Revenues Without Donor Restrictan ST (2) - Close Revenues With Donor Restriction 6 17 08 09 10 Page 5 (3) - Close NA Released accounts 11 12 113 114 115 116 117 (4) Close Expenses (natural classification) 1 1 118 119 120 121 1 1 1 1 1 122 Following is a pre-closing trial balance for Mitchell County Services at 12/31/20. Assume amounts are without 4 donor restriction unless indicated otherwise 5 Debit Credit 6 Cash 7,000 7 Cash - With Donor Restriction 4,200 1 Page 1 Page 6 8 Contributions receivable (restricted for specific program) 2,000 9 Allowance for uncollectible pledges 600 10 Investments (principal held in perpetuity per donor) 6,400 11 Furniture and Equipment (no restrictions) 20,000 Accumulated depreciation, furniture & equipment (no 12 restrictions) 12,000 13 Accounts payable 800 14 Net assets Without Donor Restriction (1/1/20) 17,800 15 Net assets With Donor Restriction Programs (1/1/20) 400 Net assets With Donor Restriction-Permanent 16 Endowment (1/1/20) 6,400 17 Contributions 3,000 18 Contributions With Donor Restriction 5,400 19 Program service fees-Without Donor Restriction 16,000 20 State grants With Donor Restriction 8,600 21 Investment income 400 Net Assets Released from Restriction - With Donor 22 Restriction 8,800 Net assets Released from Restriction-Without Donor 23 Restriction 8,800 24 Salaries and related expenses 15,000 25 Occupancy expenses 2,400 26 Printing and communications 1,400 27 Depreciation expense 2,000 28 Other expenses 1,000 29 70,200 70,200 30 Instructions: From the trial balance, please complete the following in this order: 31 ist. Statement of Expenses by Nature and Function for the year ended December 31, 2020 32 2nd. Statement of Activities for the year ended December 31, 2020. 33 Brd. Statement of Financial Postion at December 31, 2020. 34 4th. Prepare closing entries, including any applicable reclassifications of the net asset accounts Counseling Domestic Management & 35 Details about functional expenses: Program Prorram Prora General 36 Salaries and related expenses 5,000 6,000 1,000 37 Occupancy expenses 1,200 400 200 38 Printing and communications 200 400 600 39 Depreciation expense 1,000 400 100 40 Other expenses 400 200 200 45 Worksheet for Statement of Expenses by Nature and Function is in separate worksheet tab in the Excel file. 1 1 Fundraising 3,000 600 200 500 200 CA 0 Mitchell County Services 11 Statement of Financial Position 2 As of December 31, 2020 73 74 Assets 75 76 77 78 79 BO 81 Liabilities & Net 82 accounts payable 800 33 84 85 without donor restrictions 14,200 86 with donor restrictions 5,600 87 with donor restrictions - permanent endowment 6,400 BB total net assets 26,200 89 total liabilities and net assets 27,000 90 91 92 1 93 Prepare these closing entries last. Mitchell County Services General Journal - Closing Entries Year ended December 31, 2020 (1)-Close Revenues Without Donor Restrictan ST (2) - Close Revenues With Donor Restriction 6 17 08 09 10 Page 5 (3) - Close NA Released accounts 11 12 113 114 115 116 117 (4) Close Expenses (natural classification) 1 1 118 119 120 121 1 1 1 1 1 122

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started