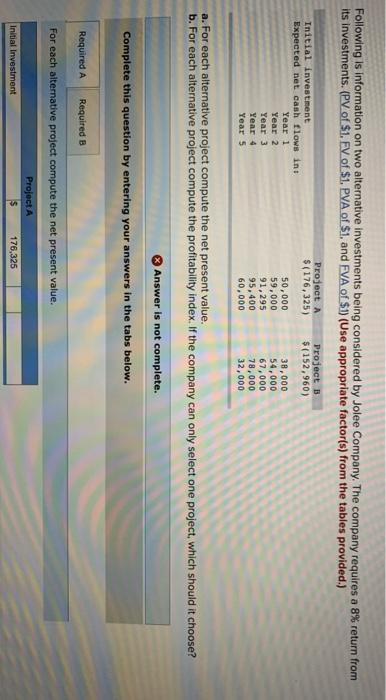

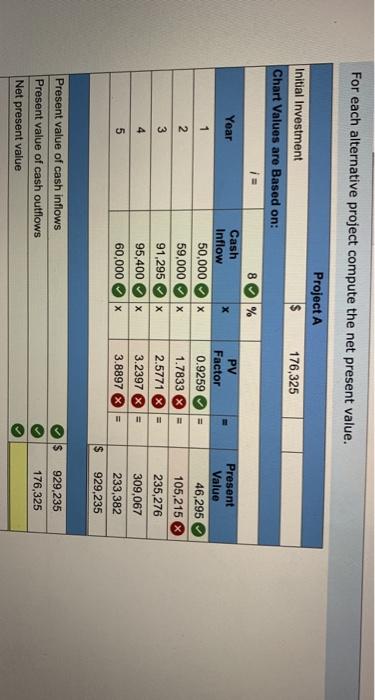

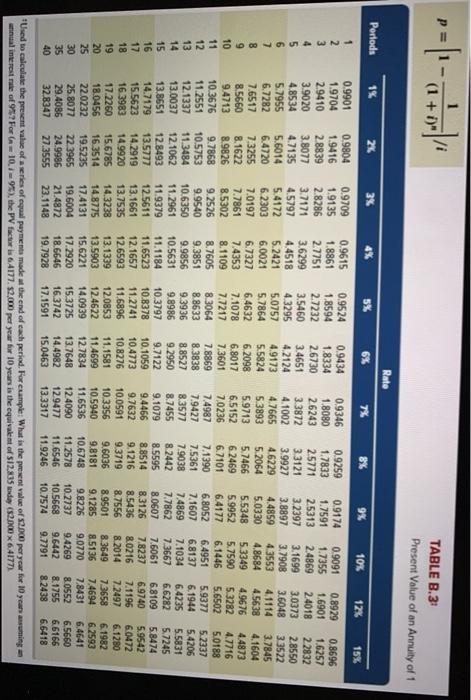

Following is information on two alternative investments being considered by Jolee Company. The company requires a 8% return from its investments. (PV of $1. FV of $1. PVA of $1. and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project $(176,325) Project B $(152,960) Initial investment Expected net cash flows in Year 1 Year 2 Year 3 Year 4 Year 5 50,000 59,000 91, 295 95,400 60,000 38,000 54,000 67,000 78,000 32,000 a. For each alternative project compute the net present value. b. For each alternative project compute the profitability index. If the company can only select one project, which should it choose? Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B For each alternative project compute the net present value. Project A Initial Investment 176,325 For each alternative project compute the net present value. Project A Initial Investment 176,325 % Chart Values are Based on: i = 8 Year Cash Inflow 1 50,000 2 59,000 3 91,295 4 95,400 5 60,000 X x PV Factor 0.9259 1.7833 2.5771 X = 3.2397 X x Present Value 46,295 105,215 235,276 309,067 233,382 929,235 3.8897 X $ Present value of cash inflows Present value of cash outflows Net present value 929,235 176,325 (1 + )" TABLE B.3: Present Value of an Annuity of 1 Rate Periods 2% 3% 5% 6% 7% 8% 10% 12% 15% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 25 30 35 40 0.9901 1.9704 2.9410 3.9020 4.8534 5.7955 6.7282 7.6517 8.5660 9.4713 10.3676 11.2551 12.1337 13.0037 13.8651 14.7179 15.5623 16.3983 17.2260 18.0456 22.0232 25.8077 29.4086 32.8347 0.9804 1.9416 28839 3.8077 4.7135 5.6014 6.4720 7.3255 8.1622 8.9826 9.7868 10.5753 11.3484 12.1062 12.8493 13.5777 14.2919 14.9920 15.6785 16.3514 19.5235 22 3965 24.9986 27.3555 0.9709 1.9135 2.8286 3.7171 4.5797 5.4172 6.2303 7.0197 7.7861 8.5302 9.2526 9.9540 10.6350 11.2961 11.9379 125611 13.1661 13.7535 14.3238 14.8775 17.4131 19.6004 21.4872 23.1148 0.9615 1.8861 2.7751 3.6299 4.4518 5.2421 6.0021 6.7327 7.4353 8.1109 8.7605 9.3851 9.9856 10.5631 11.1184 11.6523 12.1657 12.6593 13.1339 13.5903 15.6221 17.2920 18.6646 19.7928 0.9524 1.8594 2.7232 3.5460 43295 5.0757 5.7864 6.4632 7.1078 7.7217 8.3064 8.8633 9.3936 9.8986 10.3797 10.8378 11.2741 11.6896 12.0853 12.4622 14.0939 15.3725 16.3742 17.1591 0.9434 1.8334 26730 3.4651 4.2124 4.9173 5.5824 6.2098 6.8017 7.3601 7.8869 8.3838 8.8527 9.2950 9.7122 10.1059 10.4773 10.8276 11.1581 11.4699 127834 13.7648 14.4982 15.0463 0.9346 1.8080 26243 33872 4.1002 4.7665 5.3893 59713 6.5152 7,0236 7.4987 7.9427 8.3577 8.7455 9.1079 9.4466 9.7632 10.0591 10 3356 10.5940 11,6536 124090 129477 13.3317 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 7.1390 7.5361 7.9038 82442 8.5595 8.8514 9.1216 9.3719 9.6036 9.8181 10.6748 11.2578 11.6546 11.9246 0.9174 1.7591 2.5313 3.2397 3.8897 4.4859 5.0330 5.5348 5.9952 6.4177 6.8052 7.1607 7.4869 7.7862 8.0607 8.3126 8.5436 8.7556 8.9501 9.1285 9.8226 10.2737 10.5668 10.7574 09091 0.8929 0.8696 1.7355 1.6901 1.6257 24869 2.4018 22832 3.1699 3.0373 28550 3.7908 3.6048 3.3522 43553 4.1114 3.7845 4.8684 45638 4.1604 53349 4.9676 4.4873 5.7590 5.3282 4.7716 6.1446 5.6502 5.0188 6.4951 5.9377 5.2337 6.8137 6.1944 5.4206 7.1034 6.4235 5.5831 7.3667 6.6282 5.7245 7.6061 6.8109 5.8474 7.8237 6.9740 5.9542 8.0216 7.1196 6.0472 8.2014 7.2497 6.1280 8.3649 7.3658 6.1982 8.5136 7.4694 6.2593 9.0770 7.8431 6.4641 9.4269 8.0552 6,5660 9.6442 8.1755 6.6166 9.7791 8.2438 6.6418 "Used to calculate the present value of a series of equal payments made at the end of each period. For cumple: What is the present value of 2.000 per year for 10 yean asuming annual interest rate of 957 For 10.1-98), the PV face is 64177. $2,000 per year for 10 years is the equivalent of $12.835 d (82000 x 641771