Answered step by step

Verified Expert Solution

Question

1 Approved Answer

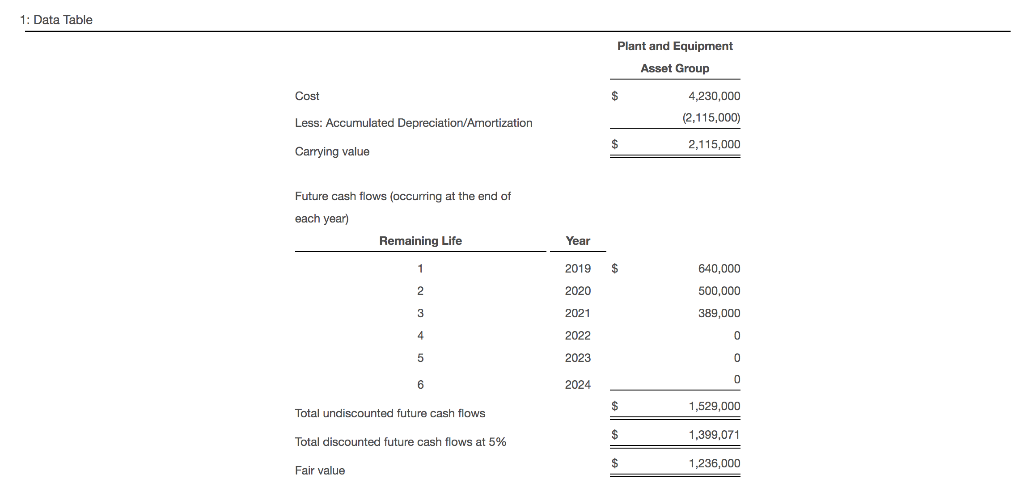

Please help!! Thank you! 1: Data Table Plant and Equipment Asset Group Cost 4,230,000 (2,115,000) Less: Accumulated Depreciation/Amortization 2,115,000 Carrying value Future cash flows (occurring

Please help!! Thank you!

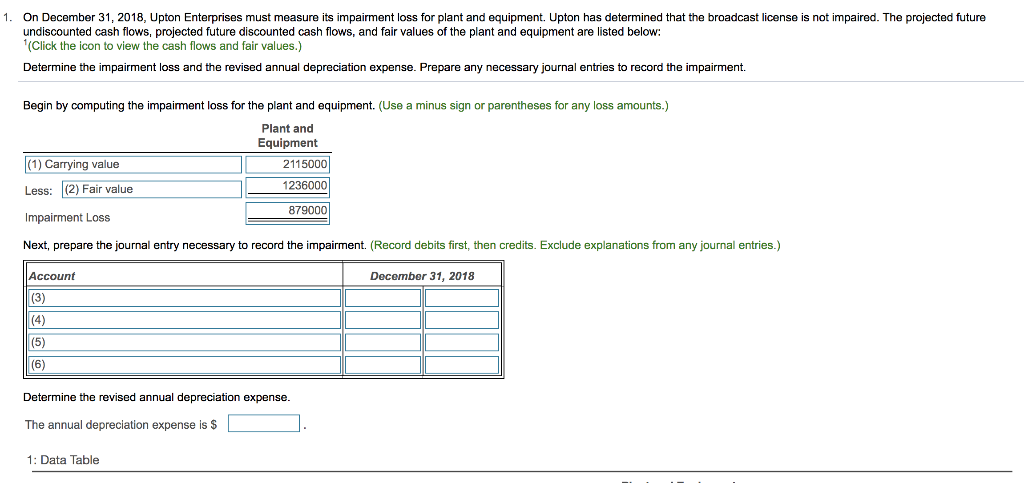

1: Data Table Plant and Equipment Asset Group Cost 4,230,000 (2,115,000) Less: Accumulated Depreciation/Amortization 2,115,000 Carrying value Future cash flows (occurring at the end of each year) Remaining Life Year $ 2019 2020 2021 2022 2023 640,000 500,000 389,000 2024 1,529,000 Total undiscounted future cash flows || on 1,399,071 Total discounted future cash flows at 5% llel 1,236,000 Fair value 1. On December 31, 2018, Upton Enterprises must measure its impairment loss for plant and equipment. Upton has determined that the broadcast license is not impaired. The projected future undiscounted cash flows, projected future discounted cash flows, and fair values of the plant and equipment are listed below: (Click the icon to view the cash flows and fair values.) Determine the impairment loss and the revised annual depreciation expense. Prepare any necessary journal entries to record the impairment. Begin by computing the impaiment loss for the plant and equipment. (Use a minus sign or parentheses for any loss amounts.) Plant and Equipment (1) Carrying value 2115000 Less: (2) Fair value 1236000 Impairment Loss 879000 Next, prepare the journal entry necessary to record the impairment. (Record debits first, then credits. Exclude explanations from any journal entries.) Account December 31, 2018 Determine the revised annual depreciation expense. The annual depreciation expense is $ L 1: Data Table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started