Question

Following is select information from the accounting records of Nash Inc. Additional information 1. On January 2, Nash Corp. sold equipment with an original cost

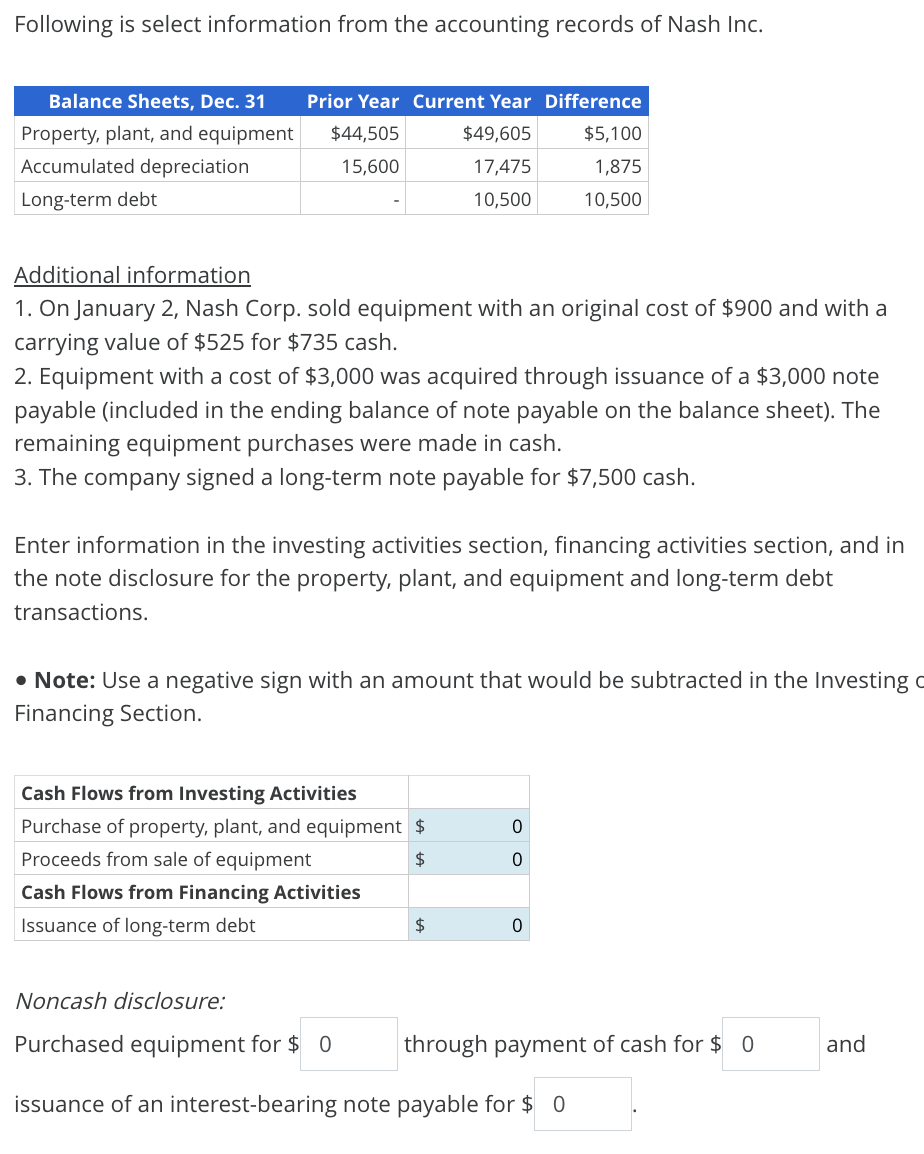

Following is select information from the accounting records of Nash Inc. Additional information 1. On January 2, Nash Corp. sold equipment with an original cost of $900 and with a carrying value of $525 for $735 cash. 2. Equipment with a cost of $3,000 was acquired through issuance of a $3,000 note payable (included in the ending balance of note payable on the balance sheet). The remaining equipment purchases were made in cash. 3. The company signed a long-term note payable for $7,500 cash. Enter information in the investing activities section, financing activities section, and in the note disclosure for the property, plant, and equipment and long-term debt transactions. Note: Use a negative sign with an amount that would be subtracted in the Investing or Financing Section.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started