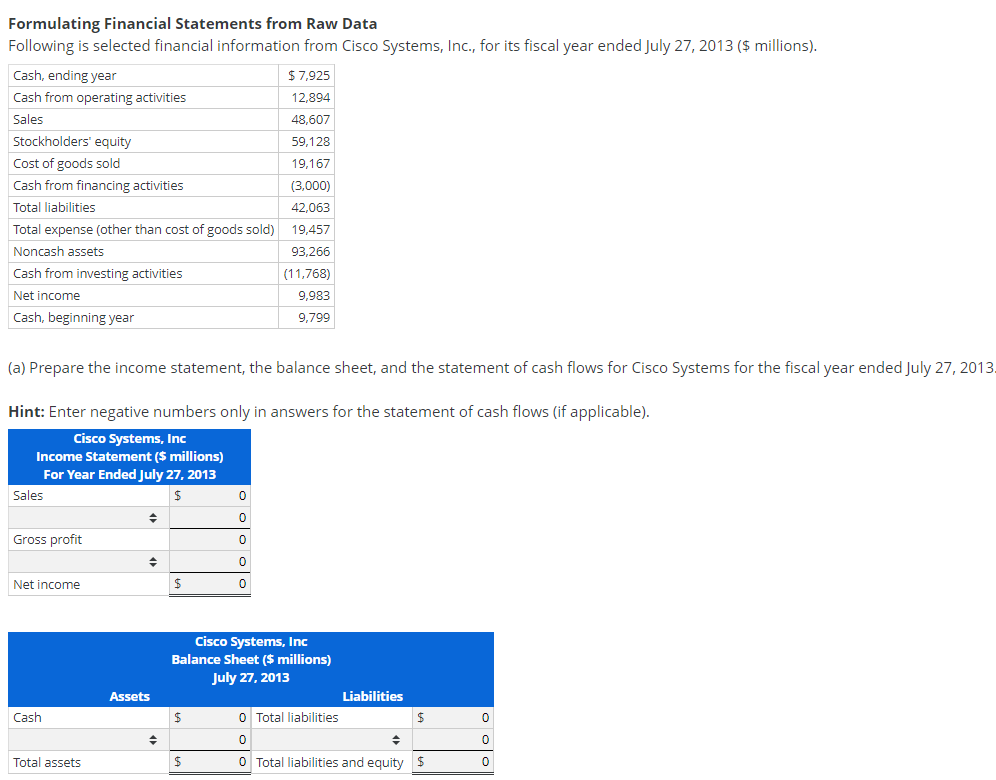

Following is selected financial information from Cisco Systems, Inc., for its fiscal year ended July 27, 2013 ($ millions).

Following is selected financial information from Cisco Systems, Inc., for its fiscal year ended July 27, 2013 ($ millions).

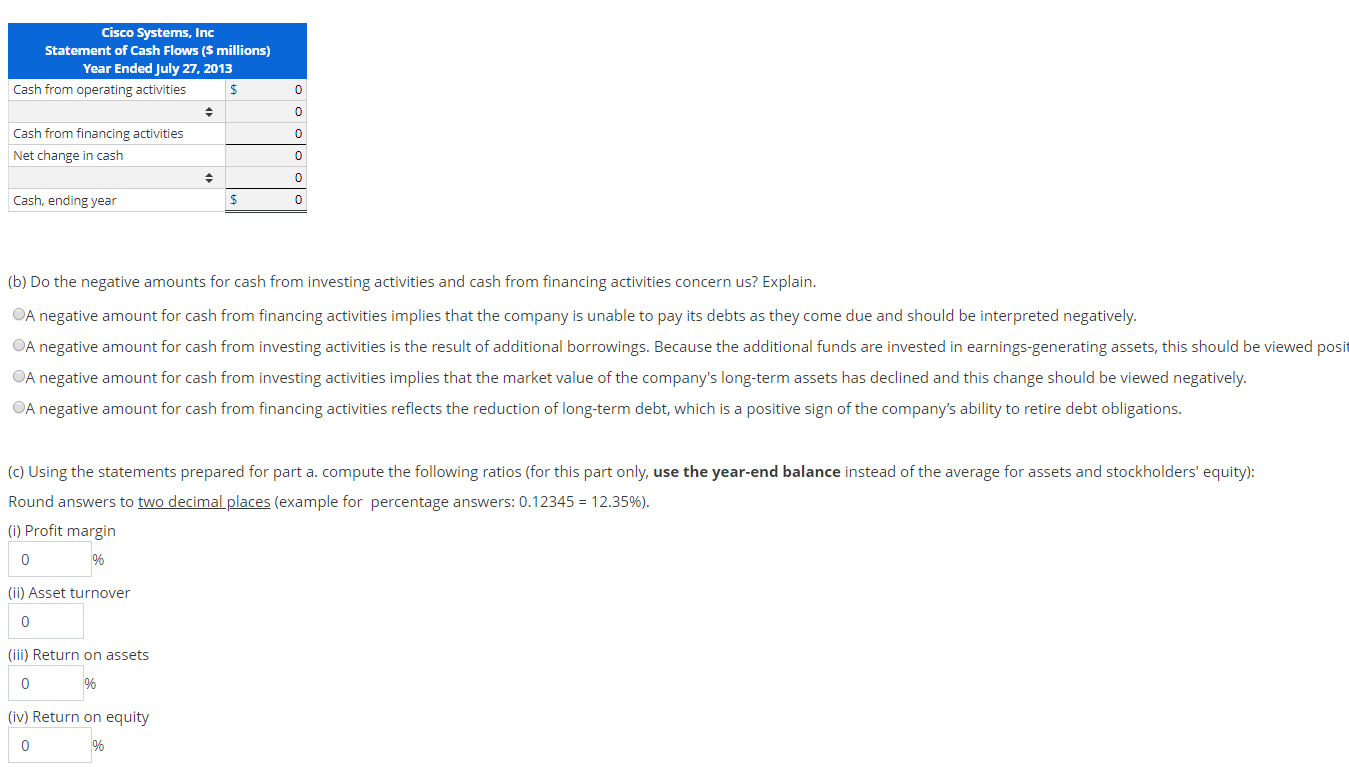

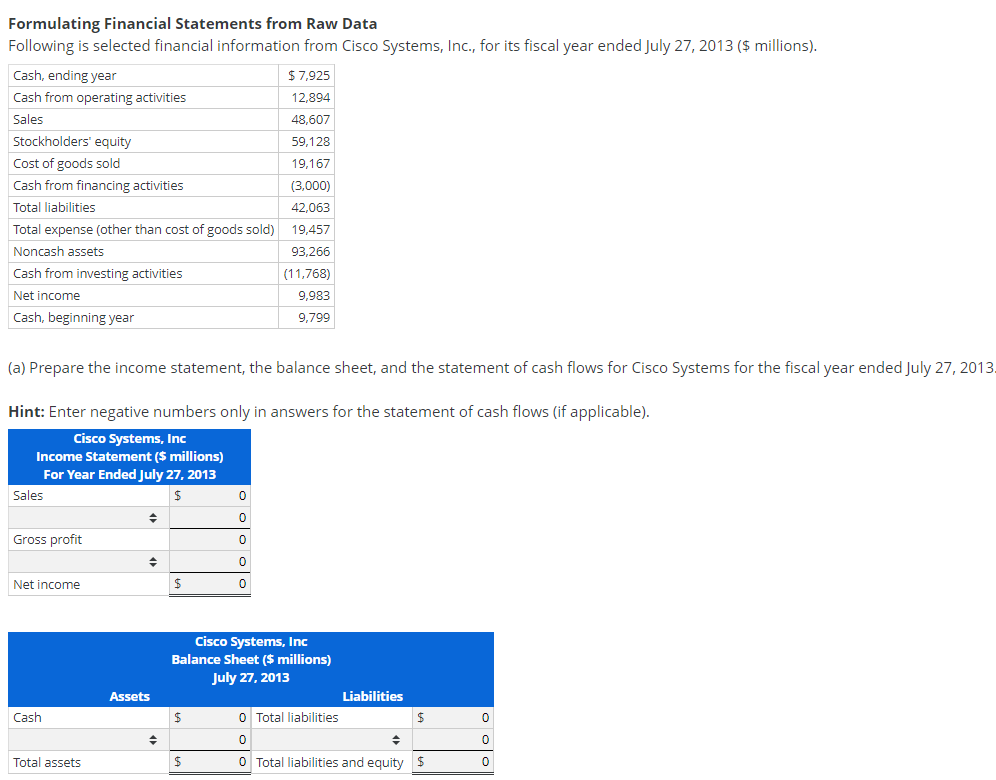

Formulating Financial Statements from Raw Data Following is selected financial information from Cisco Systems, Inc., for its fiscal year ended July 27, 2013 ($ millions). Cash, ending year $ 7,925 Cash from operating activities 12,894 Sales 48,607 Stockholders' equity 59,128 Cost of goods sold 19,167 Cash from financing activities (3,000) Total liabilities 42,063 Total expense (other than cost of goods sold) 19,457 Noncash assets 93,266 Cash from investing activities (11,768) Net income 9,983 Cash, beginning year 9,799 (a) Prepare the income statement, the balance sheet, and the statement of cash flows for Cisco Systems for the fiscal year ended July 27, 2013. Hint: Enter negative numbers only in answers for the statement of cash flows (if applicable). Cisco Systems, Inc Income Statement ($ millions) For Year Ended July 27, 2013 Sales Gross profit Net income Cisco Systems, Inc Balance Sheet ($ millions) July 27, 2013 Liabilities $ 0 Total liabilities Assets Cash Total assets $ 0 Total liabilities and equity $ Cisco Systems, Inc Statement of Cash Flows ($ millions) Year Ended July 27, 2013 Cash from operating activities $ Cash from financing activities Net change in cash Cash, ending year (b) Do the negative amounts for cash from investing activities and cash from financing activities concern us? Explain. OA negative amount for cash from financing activities implies that the company is unable to pay its debts as they come due and should be interpreted negatively. A negative amount for cash from investing activities is the result of additional borrowings. Because the additional funds are invested in earnings-generating assets, this should be viewed posit A negative amount for cash from investing activities implies that the market value of the company's long-term assets has declined and this change should be viewed negatively. OA negative amount for cash from financing activities reflects the reduction of long-term debt, which is a positive sign of the company's ability to retire debt obligations. (c) Using the statements prepared for part a. compute the following ratios (for this part only, use the year-end balance instead of the average for assets and stockholders' equity): Round answers to two decimal places (example for percentage answers: 0.12345 = 12.35%). (1) Profit margin 0 % (ii) Asset turnover (iii) Return on assets (iv) Return on equity 0 %

Following is selected financial information from Cisco Systems, Inc., for its fiscal year ended July 27, 2013 ($ millions).

Following is selected financial information from Cisco Systems, Inc., for its fiscal year ended July 27, 2013 ($ millions).