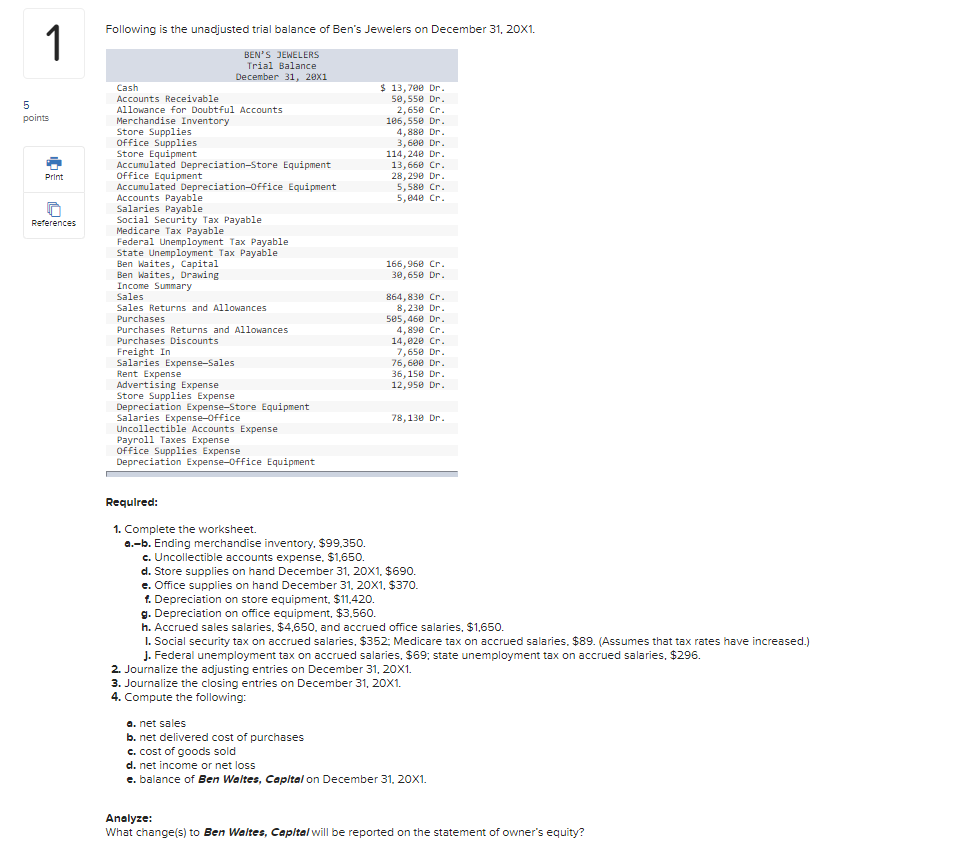

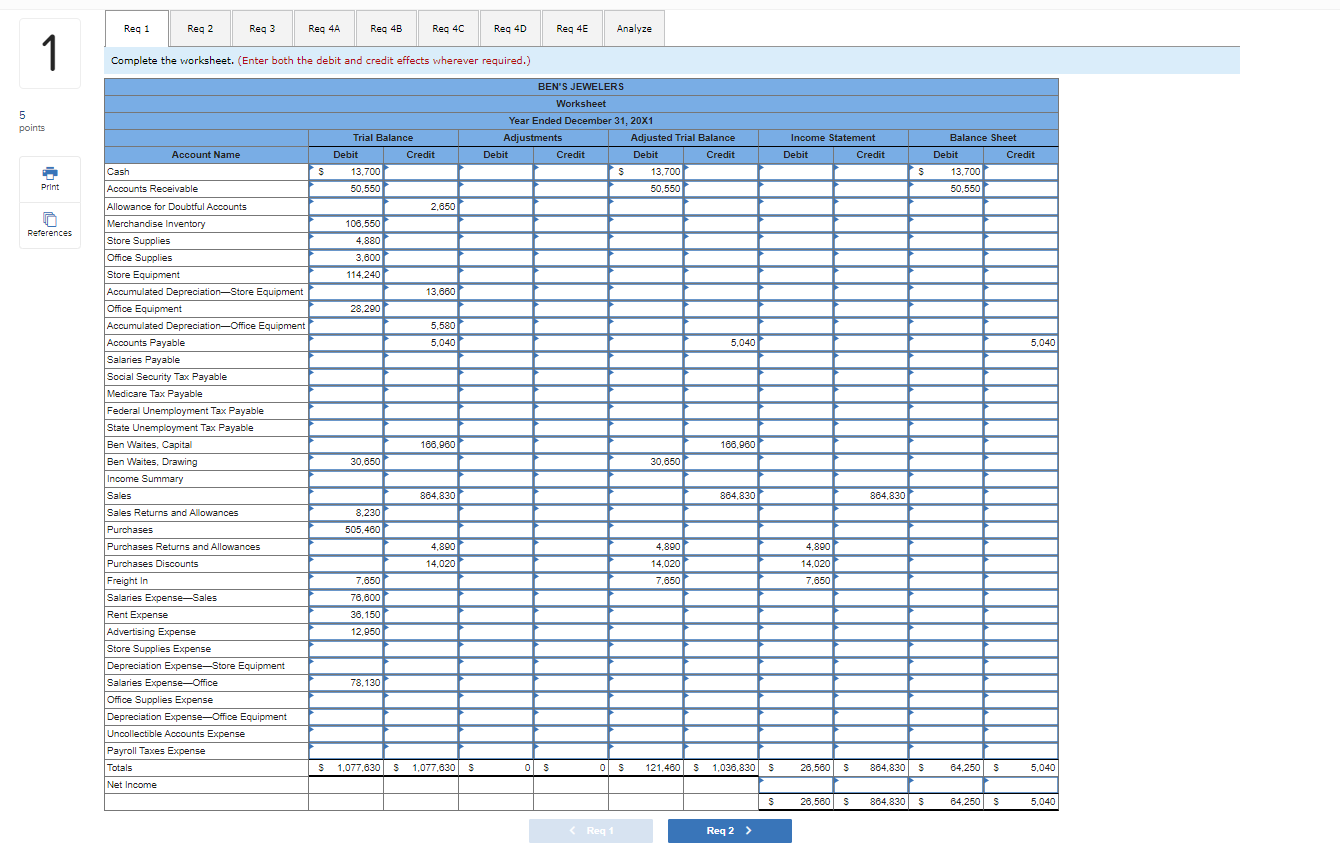

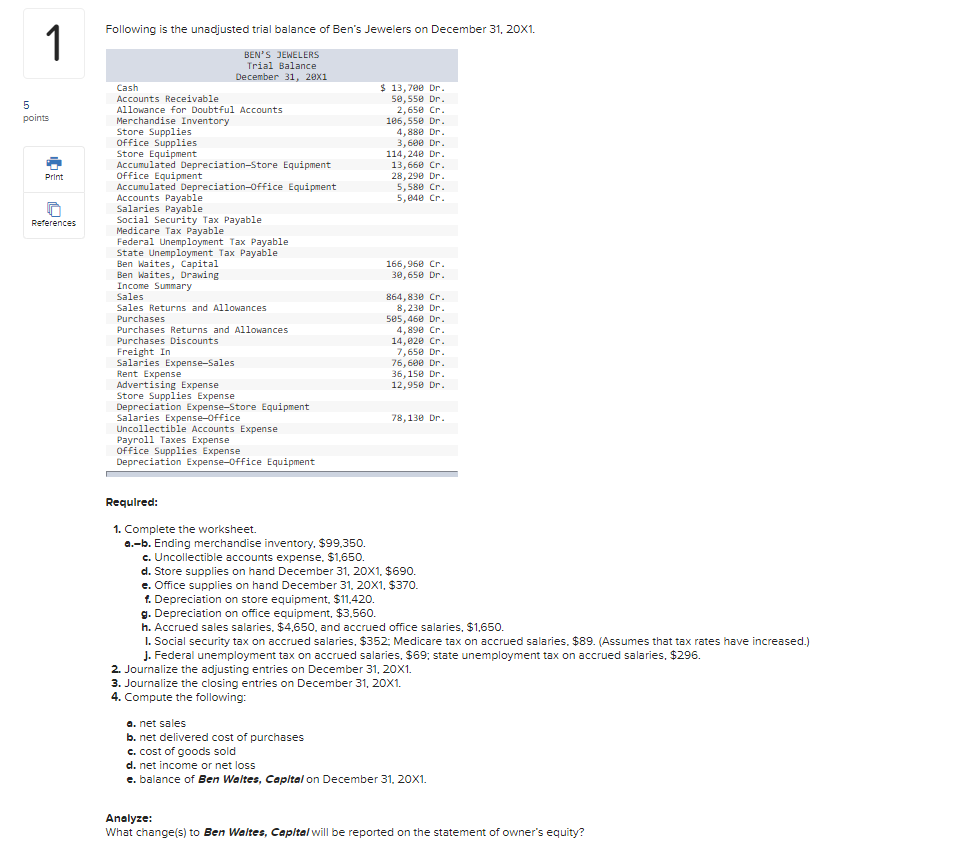

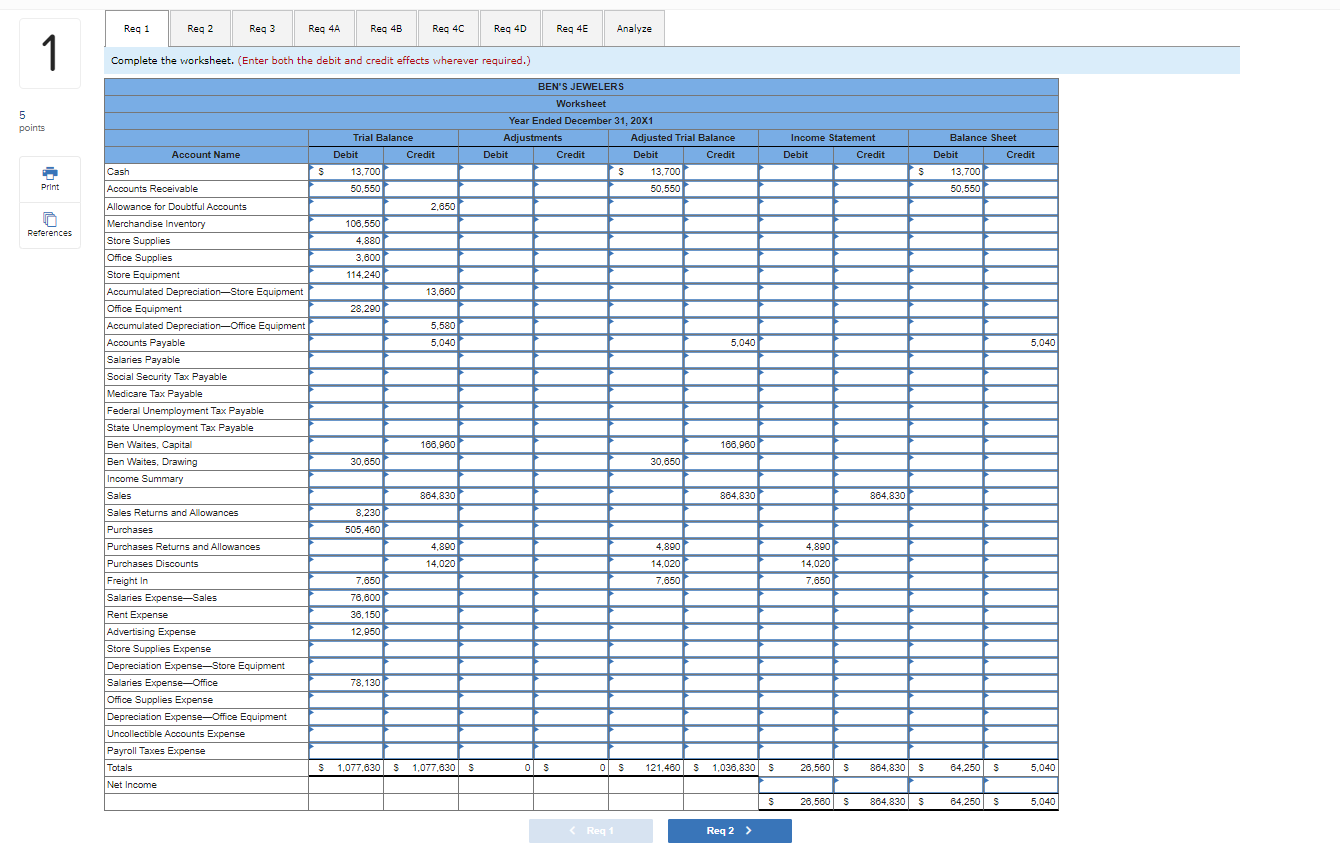

Following is the unadjusted trial balance of Ben's Jewelers on December 31, 20X1. 1 5 points $ 13,700 Dr. 50,550 Dr. 2,650 Cr. 106,550 Dr. 4,889 Dr. 3,600 Dr. 114,240 Dr. 13,662 Cr. 28, 290 Dr. 5,580 Cr. 5,640 Cr. Print References BEN'S JEWELERS Trial Balance December 31, 20x1 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Store Supplies Office Supplies Store Equipment Accumulated Depreciation Store Equipment Office Equipment Accumulated Depreciation-office Equipment Accounts Payable Salaries Payable Social Security Tax Payable Federal Unemployment Tax Payable Medicare Tax Payable State Unemployment Tax Payable Ben Waites, Capital Ben Waites, Drawing Income Summary Sales Sales Returns and Allowances Purchases Purchases Returns and Allowances Purchases Discounts Freight In Salaries Expense-Sales Rent Expense Advertising Expense Store Supplies Expense Depreciation Expense-Store Equipment Salaries Expense-Office Uncollectible Accounts Expense Payroll Taxes Expense Office Supplies Expense Depreciation Expense-Office Equipment 166,960 Cr. 30.650 Dr. 864,830 Cr. 8,230 Dr 505,460 Dr. 4,890 Cr. 14, e2e Cr. 7,650 Dr. 76,600 Dr. 36,150 Dr 12,950 Dr. 78,130 Dr. Required: 1. Complete the worksheet. a.-b. Ending merchandise inventory. $99.350. c. Uncollectible accounts expense. $1.650. d. Store supplies on hand December 31, 20X1. $690. e. Office supplies on hand December 31, 20X1. $370. f. Depreciation on store equipment. $11.420. g. Depreciation on office equipment, $3,560. h. Accrued sales salaries, $4,650, and accrued office salaries, $1.650. 1. Social security tax on accrued salaries, $352: Medicare tax on accrued salaries. $89. (Assumes that tax rates have increased.) J. Federal unemployment tax on accrued salaries, $69; state unemployment tax on accrued salaries, $296. 2. Journalize the adjusting entries on December 31, 20X1. 3. Journalize the closing entries on December 31, 20X1. 4. Compute the following: a. net sales b. net delivered cost of purchases C. cost of goods sold d. net income or net loss e. balance of Ben Waltes, Capital on December 31, 20X1. Analyze: What change(s) to Ben Waltes, Capital will be reported on the statement of owner's equity? Reg 1 Reg 2 Reg 3 Reg 4A Reg 4B Rea 40 Reg 4D Reg 4E Analyze 1 Complete the worksheet. (Enter both the debit and credit effects wherever required.) 5 points BEN'S JEWELERS Worksheet Year Ended December 31, 20X1 Adjustments Adjusted Trial Balance Debit Credit Debit Credit S 13,700 50,550 Income Statement Debit Credit Trial Balance Debit Credit 13,700 50,550 Balance Sheet Debit Credit S S 13,700 50,550 Print 2,650 References 106.550 4,880 3,600 114,240 13,660 28,290 5,580 5,040 5,040 5,040 166,960 188,960 30,650 30,650 Account Name Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Store Supplies Office Supplies Store Equipment Accumulated Depreciation Store Equipment Office Equipment Accumulated Depreciation Office Equipment Accounts Payable Salaries Payable Social Security Tac Payable Medicare Tax Payable Federal Unemployment Tax Payable State Unemployment Tax Payable Ben Waites, Capital Ben Waites, Drawing Income Summary Sales Sales Returns and Allowances Purchases Purchases Returns and Allowances Purchases Discounts Freight in Salaries Expense-Sales Rent Expense Advertising Expense Store Supplies Expense Depreciation ExpenseStore Equipment Salaries Expense-Office Office Supplies Expense Depreciation Expense-Office Equipment Uncollectible Accounts Expense Payroll Taxes Expense Totals Net Income 864,830 864,830 864,830 8,230 505,460 4.890 14,020 4,890 14,020 7,650 4,890 14,020 7,650 7,650 78,600 36,150 12,950 78,130 S 1,077,630 S 1,077,630 S 0 S 0 s 121,460 s 1,036,830 s 28,560 s 864,830 S 64,250 $ 5.040 S 26,560 S 864,830 S 84,250 $ 5,040 Req 1 Reg 2 >