Answered step by step

Verified Expert Solution

Question

1 Approved Answer

following questions: a. How much income, in today's dollars, will Anne-Marie and Yancy need in retirement assuming 70 percent replacement and an additional $5,000 for

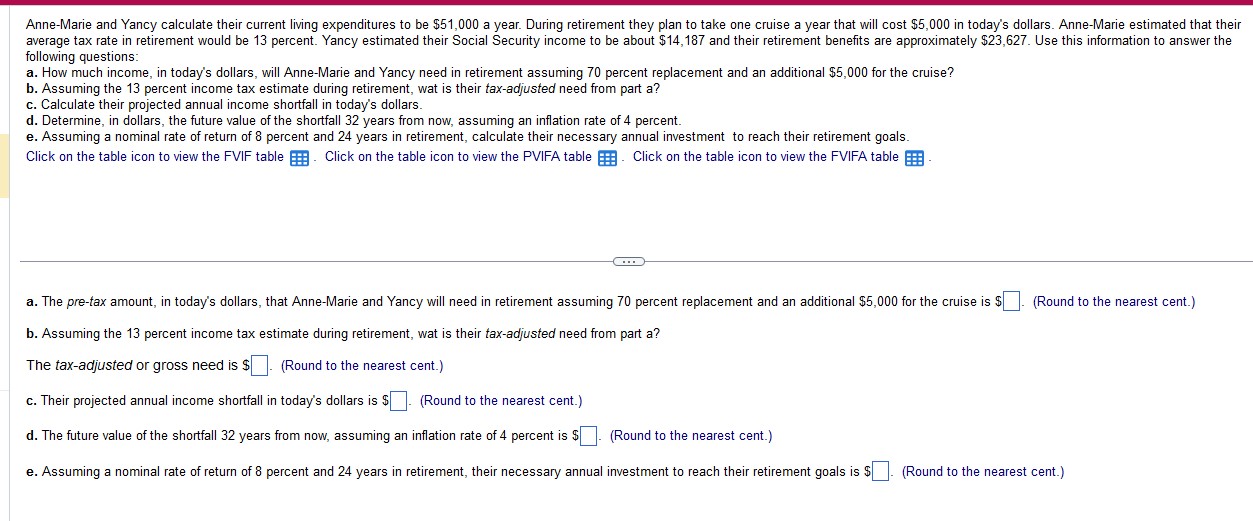

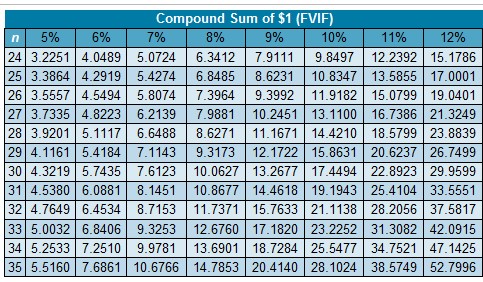

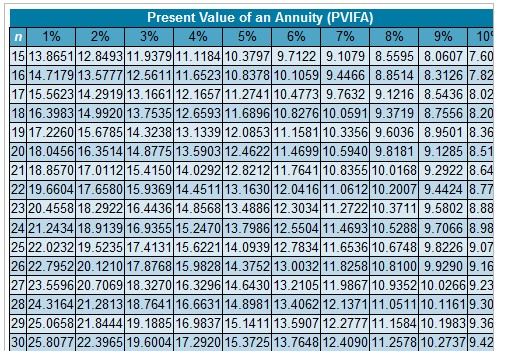

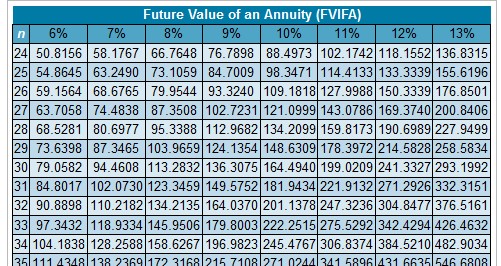

following questions: a. How much income, in today's dollars, will Anne-Marie and Yancy need in retirement assuming 70 percent replacement and an additional $5,000 for the cruise? b. Assuming the 13 percent income tax estimate during retirement, wat is their tax-adjusted need from part a? c. Calculate their projected annual income shortfall in today's dollars. d. Determine, in dollars, the future value of the shortfall 32 years from now, assuming an inflation rate of 4 percent. e. Assuming a nominal rate of return of 8 percent and 24 years in retirement, calculate their necessary annual investment to reach their retirement goals. Click on the table icon to view the FVIF table. Click on the table icon to view the PVIFA table. Click on the table icon to view the FVIFA table . a. The pre-tax amount, in today's dollars, that Anne-Marie and Yancy will need in retirement assuming 70 percent replacement and an additional $5,000 for the cruise is $ (Round to the nearest cent.) b. Assuming the 13 percent income tax estimate during retirement, wat is their tax-adjusted need from part a? The tax-adjusted or gross need is $ (Round to the nearest cent.) c. Their projected annual income shortfall in today's dollars is $ (Round to the nearest cent.) d. The future value of the shortfall 32 years from now, assuming an inflation rate of 4 percent is $ (Round to the nearest cent.) e. Assuming a nominal rate of return of 8 percent and 24 years in retirement, their necessary annual investment to reach their retirement goals is $ (Round to the nearest cent.) \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Compound Sum of \$1 (FVIF) } \\ \hlinen & 5% & 6% & 7% & 8% & 9% & 10% & 11% & 12% \\ \hline 24 & 3.2251 & 4.0489 & 5.0724 & 6.3412 & 7.9111 & 9.8497 & 12.2392 & 15.1786 \\ \hline 25 & 3.3864 & 4.2919 & 5.4274 & 6.8485 & 8.6231 & 10.8347 & 13.5855 & 17.0001 \\ \hline 26 & 3.5557 & 4.5494 & 5.8074 & 7.3964 & 9.3992 & 11.9182 & 15.0799 & 19.0401 \\ \hline 27 & 3.7335 & 4.8223 & 6.2139 & 7.9881 & 10.2451 & 13.1100 & 16.7386 & 21.3249 \\ \hline 28 & 3.9201 & 5.1117 & 6.6488 & 8.6271 & 11.1671 & 14.4210 & 18.5799 & 23.8839 \\ \hline 29 & 4.1161 & 5.4184 & 7.1143 & 9.3173 & 12.1722 & 15.8631 & 20.6237 & 26.7499 \\ \hline 30 & 4.3219 & 5.7435 & 7.6123 & 10.0627 & 13.2677 & 17.4494 & 22.8923 & 29.9599 \\ \hline 31 & 4.5380 & 6.0881 & 8.1451 & 10.8677 & 14.4618 & 19.1943 & 25.4104 & 33.5551 \\ \hline 32 & 4.7649 & 6.4534 & 8.7153 & 11.7371 & 15.7633 & 21.1138 & 28.2056 & 37.5817 \\ \hline 33 & 5.0032 & 6.8406 & 9.3253 & 12.6760 & 17.1820 & 23.2252 & 31.3082 & 42.0915 \\ \hline 34 & 5.2533 & 7.2510 & 9.9781 & 13.6901 & 18.7284 & 25.5477 & 34.7521 & 47.1425 \\ \hline 35 & 5.5160 & 7.6861 & 10.6766 & 14.7853 & 20.4140 & 28.1024 & 38.5749 & 52.7996 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Present Value of an Annuity (PVIFA) } \\ \hlinen & 1% & 2% & 3% & 4% & 5% & 6% & 7% & 8% & 9% & 10 \\ \hline 15 & 13.8651 & 12.8493 & 11.9379 & 11.1184 & 10.3797 & 9.7122 & 9.1079 & 8.5595 & 8.0607 & 7.60 \\ \hline 16 & 14.7179 & 13.5777 & 12.5611 & 11.6523 & 10.8378 & 10.1059 & 9.4466 & 8.8514 & 8.3126 & 7.82 \\ \hline 17 & 15.5623 & 14.2919 & 13.1661 & 12.1657 & 11.2741 & 10.4773 & 9.7632 & 9.1216 & 8.5436 & 8.02 \\ \hline 18 & 16.3983 & 14.9920 & 13.7535 & 12.6593 & 11.6896 & 10.8276 & 10.0591 & 9.3719 & 8.7556 & 8.20 \\ \hline 19 & 17.2260 & 15.6785 & 14.3238 & 13.1339 & 12.0853 & 11.1581 & 10.3356 & 9.6036 & 8.9501 & 8.36 \\ \hline 20 & 18.0456 & 16.3514 & 14.8775 & 13.5903 & 12.4622 & 11.4699 & 10.5940 & 9.8181 & 9.1285 & 8.51 \\ \hline 21 & 18.8570 & 17.0112 & 15.4150 & 14.0292 & 12.8212 & 11.7641 & 10.8355 & 10.0168 & 9.2922 & 8.64 \\ \hline 22 & 19.6604 & 17.6580 & 15.9369 & 14.4511 & 13.1630 & 12.0416 & 11.0612 & 10.2007 & 9.4424 & 8.77 \\ \hline 23 & 20.4558 & 18.2922 & 16.4436 & 14.8568 & 13.4886 & 12.3034 & 11.2722 & 10.3711 & 9.5802 & 8.88 \\ \hline 24 & 21.2434 & 18.9139 & 16.9355 & 15.2470 & 13.7986 & 12.5504 & 11.4693 & 10.5288 & 9.7066 & 8.98 \\ \hline 25 & 22.0232 & 19.5235 & 17.4131 & 15.6221 & 14.0939 & 12.7834 & 11.6536 & 10.6748 & 9.8226 & 9.07 \\ \hline 26 & 22.7952 & 20.1210 & 17.8768 & 15.9828 & 14.3752 & 13.0032 & 11.8258 & 10.8100 & 9.9290 & 9.16 \\ \hline 27 & 23.5596 & 20.7069 & 18.3270 & 16.3296 & 14.6430 & 13.2105 & 11.9867 & 10.9352 & 10.0266 & 9.23 \\ \hline 28 & 24.3164 & 21.2813 & 18.7641 & 16.6631 & 14.8981 & 13.4062 & 12.1371 & 11.0511 & 10.1161 & 9.30 \\ \hline 29 & 25.0658 & 21.8444 & 19.1885 & 16.9837 & 15.1411 & 13.5907 & 12.2777 & 11.1584 & 10.1983 & 9.36 \\ \hline 30 & 25.8077 & 22.3965 & 19.6004 & 17.2920 & 15.3725 & 13.7648 & 12.4090 & 11.2578 & 10.2737 & 9.42 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Future Value of an Annuity (FVIFA) } \\ \hlinen & 6% & 7% & 8% & 9% & 10% & 11% & 12% & 13% \\ \hline 24 & 50.8156 & 58.1767 & 66.7648 & 76.7898 & 88.4973 & 102.1742 & 118.1552 & 136.8315 \\ \hline 25 & 54.8645 & 63.2490 & 73.1059 & 84.7009 & 98.3471 & 114.4133 & 133.3339 & 155.6196 \\ \hline 26 & 59.1564 & 68.6765 & 79.9544 & 93.3240 & 109.1818 & 127.9988 & 150.3339 & 176.8501 \\ \hline 27 & 63.7058 & 74.4838 & 87.3508 & 102.7231 & 121.0999 & 143.0786 & 169.3740 & 200.8406 \\ \hline 28 & 68.5281 & 80.6977 & 95.3388 & 112.9682 & 134.2099 & 159.8173 & 190.6989 & 227.9499 \\ \hline 29 & 73.6398 & 87.3465 & 103.9659 & 124.1354 & 148.6309 & 178.3972 & 214.5828 & 258.5834 \\ \hline 30 & 79.0582 & 94.4608 & 113.2832 & 136.3075 & 164.4940 & 199.0209 & 241.3327 & 293.1992 \\ \hline 31 & 84.8017 & 102.0730 & 123.3459 & 149.5752 & 181.9434 & 221.9132 & 271.2926 & 332.3151 \\ \hline 32 & 90.8898 & 110.2182 & 134.2135 & 164.0370 & 201.1378 & 247.3236 & 304.8477 & 376.5161 \\ \hline 33 & 97.3432 & 118.9334 & 145.9506 & 179.8003 & 222.2515 & 275.5292 & 342.4294 & 426.4632 \\ \hline 34 & 104.1838 & 128.2588 & 158.6267 & 196.9823 & 245.4767 & 306.8374 & 384.5210 & 482.9034 \\ \hline \end{tabular}

following questions: a. How much income, in today's dollars, will Anne-Marie and Yancy need in retirement assuming 70 percent replacement and an additional $5,000 for the cruise? b. Assuming the 13 percent income tax estimate during retirement, wat is their tax-adjusted need from part a? c. Calculate their projected annual income shortfall in today's dollars. d. Determine, in dollars, the future value of the shortfall 32 years from now, assuming an inflation rate of 4 percent. e. Assuming a nominal rate of return of 8 percent and 24 years in retirement, calculate their necessary annual investment to reach their retirement goals. Click on the table icon to view the FVIF table. Click on the table icon to view the PVIFA table. Click on the table icon to view the FVIFA table . a. The pre-tax amount, in today's dollars, that Anne-Marie and Yancy will need in retirement assuming 70 percent replacement and an additional $5,000 for the cruise is $ (Round to the nearest cent.) b. Assuming the 13 percent income tax estimate during retirement, wat is their tax-adjusted need from part a? The tax-adjusted or gross need is $ (Round to the nearest cent.) c. Their projected annual income shortfall in today's dollars is $ (Round to the nearest cent.) d. The future value of the shortfall 32 years from now, assuming an inflation rate of 4 percent is $ (Round to the nearest cent.) e. Assuming a nominal rate of return of 8 percent and 24 years in retirement, their necessary annual investment to reach their retirement goals is $ (Round to the nearest cent.) \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Compound Sum of \$1 (FVIF) } \\ \hlinen & 5% & 6% & 7% & 8% & 9% & 10% & 11% & 12% \\ \hline 24 & 3.2251 & 4.0489 & 5.0724 & 6.3412 & 7.9111 & 9.8497 & 12.2392 & 15.1786 \\ \hline 25 & 3.3864 & 4.2919 & 5.4274 & 6.8485 & 8.6231 & 10.8347 & 13.5855 & 17.0001 \\ \hline 26 & 3.5557 & 4.5494 & 5.8074 & 7.3964 & 9.3992 & 11.9182 & 15.0799 & 19.0401 \\ \hline 27 & 3.7335 & 4.8223 & 6.2139 & 7.9881 & 10.2451 & 13.1100 & 16.7386 & 21.3249 \\ \hline 28 & 3.9201 & 5.1117 & 6.6488 & 8.6271 & 11.1671 & 14.4210 & 18.5799 & 23.8839 \\ \hline 29 & 4.1161 & 5.4184 & 7.1143 & 9.3173 & 12.1722 & 15.8631 & 20.6237 & 26.7499 \\ \hline 30 & 4.3219 & 5.7435 & 7.6123 & 10.0627 & 13.2677 & 17.4494 & 22.8923 & 29.9599 \\ \hline 31 & 4.5380 & 6.0881 & 8.1451 & 10.8677 & 14.4618 & 19.1943 & 25.4104 & 33.5551 \\ \hline 32 & 4.7649 & 6.4534 & 8.7153 & 11.7371 & 15.7633 & 21.1138 & 28.2056 & 37.5817 \\ \hline 33 & 5.0032 & 6.8406 & 9.3253 & 12.6760 & 17.1820 & 23.2252 & 31.3082 & 42.0915 \\ \hline 34 & 5.2533 & 7.2510 & 9.9781 & 13.6901 & 18.7284 & 25.5477 & 34.7521 & 47.1425 \\ \hline 35 & 5.5160 & 7.6861 & 10.6766 & 14.7853 & 20.4140 & 28.1024 & 38.5749 & 52.7996 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Present Value of an Annuity (PVIFA) } \\ \hlinen & 1% & 2% & 3% & 4% & 5% & 6% & 7% & 8% & 9% & 10 \\ \hline 15 & 13.8651 & 12.8493 & 11.9379 & 11.1184 & 10.3797 & 9.7122 & 9.1079 & 8.5595 & 8.0607 & 7.60 \\ \hline 16 & 14.7179 & 13.5777 & 12.5611 & 11.6523 & 10.8378 & 10.1059 & 9.4466 & 8.8514 & 8.3126 & 7.82 \\ \hline 17 & 15.5623 & 14.2919 & 13.1661 & 12.1657 & 11.2741 & 10.4773 & 9.7632 & 9.1216 & 8.5436 & 8.02 \\ \hline 18 & 16.3983 & 14.9920 & 13.7535 & 12.6593 & 11.6896 & 10.8276 & 10.0591 & 9.3719 & 8.7556 & 8.20 \\ \hline 19 & 17.2260 & 15.6785 & 14.3238 & 13.1339 & 12.0853 & 11.1581 & 10.3356 & 9.6036 & 8.9501 & 8.36 \\ \hline 20 & 18.0456 & 16.3514 & 14.8775 & 13.5903 & 12.4622 & 11.4699 & 10.5940 & 9.8181 & 9.1285 & 8.51 \\ \hline 21 & 18.8570 & 17.0112 & 15.4150 & 14.0292 & 12.8212 & 11.7641 & 10.8355 & 10.0168 & 9.2922 & 8.64 \\ \hline 22 & 19.6604 & 17.6580 & 15.9369 & 14.4511 & 13.1630 & 12.0416 & 11.0612 & 10.2007 & 9.4424 & 8.77 \\ \hline 23 & 20.4558 & 18.2922 & 16.4436 & 14.8568 & 13.4886 & 12.3034 & 11.2722 & 10.3711 & 9.5802 & 8.88 \\ \hline 24 & 21.2434 & 18.9139 & 16.9355 & 15.2470 & 13.7986 & 12.5504 & 11.4693 & 10.5288 & 9.7066 & 8.98 \\ \hline 25 & 22.0232 & 19.5235 & 17.4131 & 15.6221 & 14.0939 & 12.7834 & 11.6536 & 10.6748 & 9.8226 & 9.07 \\ \hline 26 & 22.7952 & 20.1210 & 17.8768 & 15.9828 & 14.3752 & 13.0032 & 11.8258 & 10.8100 & 9.9290 & 9.16 \\ \hline 27 & 23.5596 & 20.7069 & 18.3270 & 16.3296 & 14.6430 & 13.2105 & 11.9867 & 10.9352 & 10.0266 & 9.23 \\ \hline 28 & 24.3164 & 21.2813 & 18.7641 & 16.6631 & 14.8981 & 13.4062 & 12.1371 & 11.0511 & 10.1161 & 9.30 \\ \hline 29 & 25.0658 & 21.8444 & 19.1885 & 16.9837 & 15.1411 & 13.5907 & 12.2777 & 11.1584 & 10.1983 & 9.36 \\ \hline 30 & 25.8077 & 22.3965 & 19.6004 & 17.2920 & 15.3725 & 13.7648 & 12.4090 & 11.2578 & 10.2737 & 9.42 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Future Value of an Annuity (FVIFA) } \\ \hlinen & 6% & 7% & 8% & 9% & 10% & 11% & 12% & 13% \\ \hline 24 & 50.8156 & 58.1767 & 66.7648 & 76.7898 & 88.4973 & 102.1742 & 118.1552 & 136.8315 \\ \hline 25 & 54.8645 & 63.2490 & 73.1059 & 84.7009 & 98.3471 & 114.4133 & 133.3339 & 155.6196 \\ \hline 26 & 59.1564 & 68.6765 & 79.9544 & 93.3240 & 109.1818 & 127.9988 & 150.3339 & 176.8501 \\ \hline 27 & 63.7058 & 74.4838 & 87.3508 & 102.7231 & 121.0999 & 143.0786 & 169.3740 & 200.8406 \\ \hline 28 & 68.5281 & 80.6977 & 95.3388 & 112.9682 & 134.2099 & 159.8173 & 190.6989 & 227.9499 \\ \hline 29 & 73.6398 & 87.3465 & 103.9659 & 124.1354 & 148.6309 & 178.3972 & 214.5828 & 258.5834 \\ \hline 30 & 79.0582 & 94.4608 & 113.2832 & 136.3075 & 164.4940 & 199.0209 & 241.3327 & 293.1992 \\ \hline 31 & 84.8017 & 102.0730 & 123.3459 & 149.5752 & 181.9434 & 221.9132 & 271.2926 & 332.3151 \\ \hline 32 & 90.8898 & 110.2182 & 134.2135 & 164.0370 & 201.1378 & 247.3236 & 304.8477 & 376.5161 \\ \hline 33 & 97.3432 & 118.9334 & 145.9506 & 179.8003 & 222.2515 & 275.5292 & 342.4294 & 426.4632 \\ \hline 34 & 104.1838 & 128.2588 & 158.6267 & 196.9823 & 245.4767 & 306.8374 & 384.5210 & 482.9034 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started