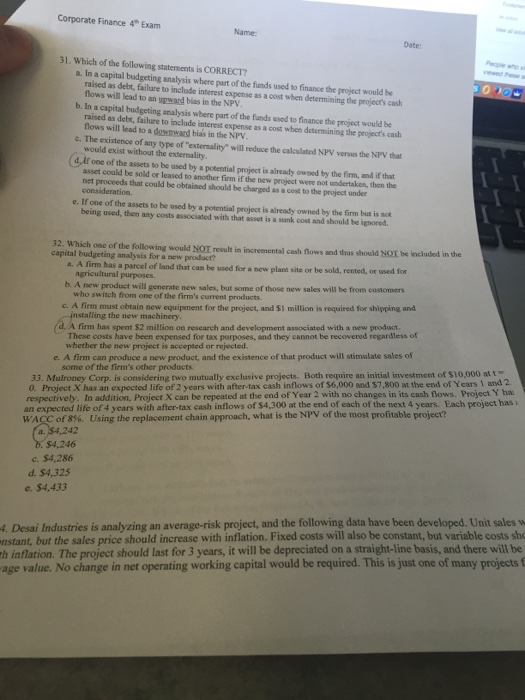

Which of the following statement is CORRECT? In a capital budgeting analysis where part of the funds used to finance the project be raised as debt, failure to include interest expense as a cost when determining the project cash flows will lead to an upward bias in the NPV. In a capital budgeting analysis where part of the fund used to finance the project would be raised as debs, failure to include interest expense as a cost when determining the project's cash flows will lead to a downward bias in the NPV. The existence of any type of "externality" will reduce the calculate NPV various the NPV that would exist without the externality. If one of the assess to be used by a potential project is already owned by the firm and if that asset could be sold or leased to another firm if the new project were not then the net proceeds that could be obtained should be charged as a cost to the project under consideration. If one of the assets to be used by potential project is already owned by the firm bus is not being used, then any costs associated with that asset is a sunk cost and should be ignored. Which one of the following would NOT result in incremental each flows and thus should NOT be included in the capital budgeting analysis for a new product? A firm has a parcel of land that can be used for a new plant site or be sold, rented, or used for agricultural purposes. A new product will generate new sales, but some of those new sales will be from customers who switch from one of the firm's current products. A firm must obtain new equipment for the project, and $1 million is required for shipping and installing the new machinery. A firm has spent $2 million on research and development associated with a new product. These costs have been expensed for tax purposes, and they cannot be recovered regardless of whether the new project is accepted or rejected. A firm can produce a new product, and the existence of that product will stimulate sales of some of the firm's other products. Mulroney Corp. is considering two mutually exclusive projects. Both require an initial investment of $10,000 at l=0 Project X has an expected life of 2 years with after-tax each inflows of 56,000 and 57,800 at the end of years 1 and 2 respectively. In addition, Project X can be repeated at the end of Year 2 with no changes in its each flows. Project Y has an expected life of 4 years with after-tax each inflows of $4,3000 at the end of the next 4 years. Each project has WACC of 8%. Using the replacement chain approach, What is the NPV of the most profitable project? $4,242 $4,246 $4,286 $4,325 $4,433 Desai industries is analyzing an average-risk project, and the following data have been developed. Unit sales,but the sales price should increase inflation. Fixed cost will also be constant, but variable costs inflation. The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be average value. No change in net operating working capital would be required. This is just one of many projects Which of the following statement is CORRECT? In a capital budgeting analysis where part of the funds used to finance the project be raised as debt, failure to include interest expense as a cost when determining the project cash flows will lead to an upward bias in the NPV. In a capital budgeting analysis where part of the fund used to finance the project would be raised as debs, failure to include interest expense as a cost when determining the project's cash flows will lead to a downward bias in the NPV. The existence of any type of "externality" will reduce the calculate NPV various the NPV that would exist without the externality. If one of the assess to be used by a potential project is already owned by the firm and if that asset could be sold or leased to another firm if the new project were not then the net proceeds that could be obtained should be charged as a cost to the project under consideration. If one of the assets to be used by potential project is already owned by the firm bus is not being used, then any costs associated with that asset is a sunk cost and should be ignored. Which one of the following would NOT result in incremental each flows and thus should NOT be included in the capital budgeting analysis for a new product? A firm has a parcel of land that can be used for a new plant site or be sold, rented, or used for agricultural purposes. A new product will generate new sales, but some of those new sales will be from customers who switch from one of the firm's current products. A firm must obtain new equipment for the project, and $1 million is required for shipping and installing the new machinery. A firm has spent $2 million on research and development associated with a new product. These costs have been expensed for tax purposes, and they cannot be recovered regardless of whether the new project is accepted or rejected. A firm can produce a new product, and the existence of that product will stimulate sales of some of the firm's other products. Mulroney Corp. is considering two mutually exclusive projects. Both require an initial investment of $10,000 at l=0 Project X has an expected life of 2 years with after-tax each inflows of 56,000 and 57,800 at the end of years 1 and 2 respectively. In addition, Project X can be repeated at the end of Year 2 with no changes in its each flows. Project Y has an expected life of 4 years with after-tax each inflows of $4,3000 at the end of the next 4 years. Each project has WACC of 8%. Using the replacement chain approach, What is the NPV of the most profitable project? $4,242 $4,246 $4,286 $4,325 $4,433 Desai industries is analyzing an average-risk project, and the following data have been developed. Unit sales,but the sales price should increase inflation. Fixed cost will also be constant, but variable costs inflation. The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be average value. No change in net operating working capital would be required. This is just one of many projects