Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following the case of Polynovo Limited company, Polynovo now has successfully listed on NYSE in the US and the company is issuing a prospectus

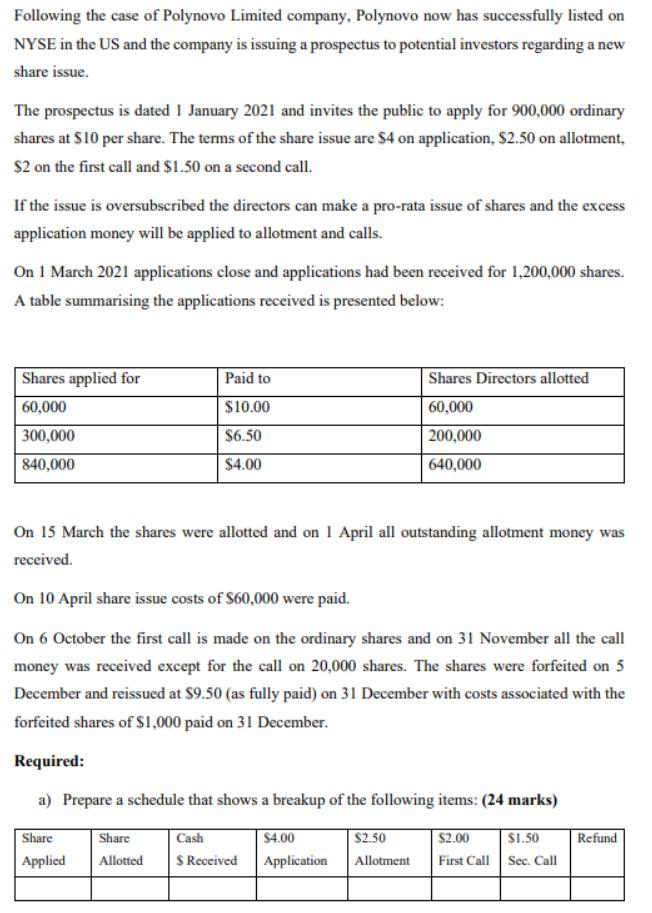

Following the case of Polynovo Limited company, Polynovo now has successfully listed on NYSE in the US and the company is issuing a prospectus to potential investors regarding a new share issue. The prospectus is dated 1 January 2021 and invites the public to apply for 900,000 ordinary shares at $10 per share. The tems of the share issue are $4 on application, $2.50 on allotment, S2 on the first call and $1.50 on a second call. If the issue is oversubscribed the directors can make a pro-rata issue of shares and the excess application money will be applied to allotment and calls. On 1 March 2021 applications close and applications had been received for 1,200,000 shares. A table summarising the applications received is presented below: Shares applied for Paid to Shares Directors allotted 60,000 $10.00 60,000 300,000 $6.50 200,000 840,000 $4.00 640,000 On 15 March the shares were allotted and on 1 April all outstanding allotment money was received. On 10 April share issue costs of S60,000 were paid. On 6 October the first call is made on the ordinary shares and on 31 November all the call money was received except for the call on 20,000 shares. The shares were forfeited on 5 December and reissued at $9.50 (as fully paid) on 31 December with costs associated with the forfeited shares of S1,000 paid on 31 December. Required: a) Prepare a schedule that shows a breakup of the following items: (24 marks) Share Share Cash $4.00 | $2.50 $2.00 $1.50 Sec. Call Refund Applied Allotted S Received Application Allotment First Call

Step by Step Solution

★★★★★

3.51 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started