Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following up Question 9 above, you also have benchmark weight, which is 35% in Asset 1, 40% in Asset 2, 25% in Asset 3. Calculate

Following up Question 9 above, you also have benchmark weight, which is 35% in Asset 1, 40% in Asset 2, 25% in Asset 3. Calculate marginal contribution to tracking error (MCTE) and absolute contribution to tracking error (ACTE). Specify which method do you use and the pros and cons of that method in the context of this question.

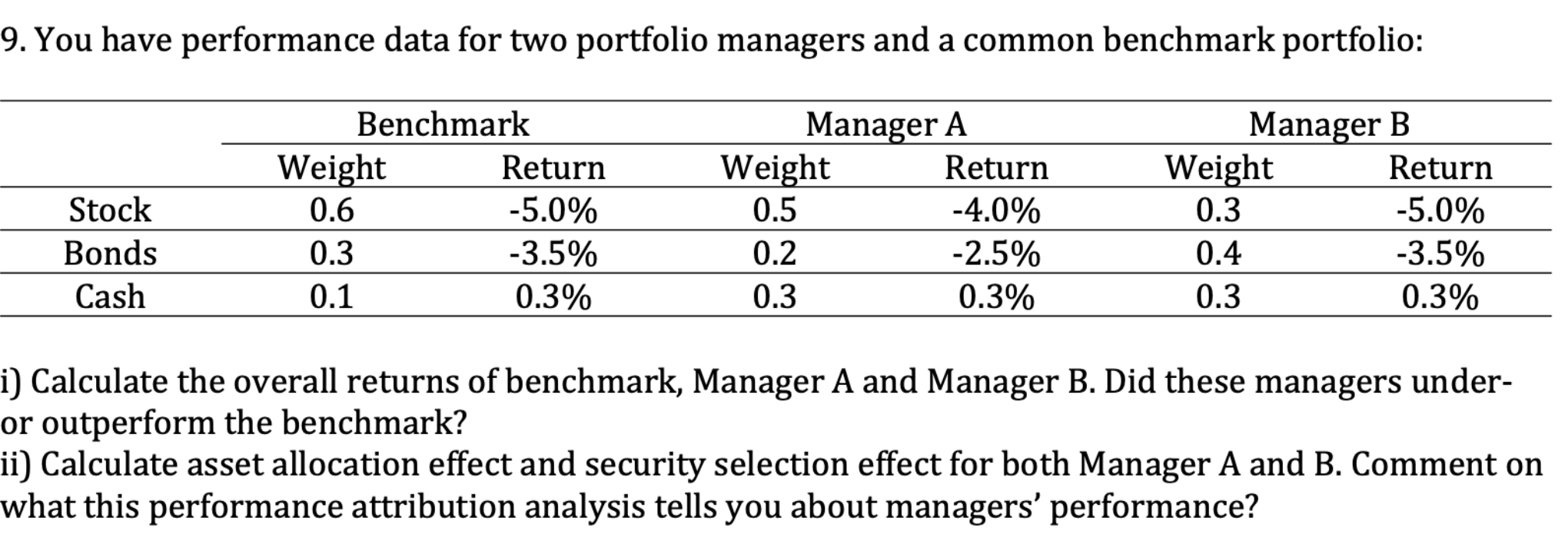

9. You have performance data for two portfolio managers and a common benchmark portfolio: Stock Bonds Cash Benchmark Weight Return 0.6 -5.0% 0.3 -3.5% 0.1 0.3% Manager A Weight Return 0.5 -4.0% 0.2 -2.5% 0.3 0.3% Manager B Weight Return 0.3 -5.0% 0.4 -3.5% 0.3 0.3% i) Calculate the overall returns of benchmark, Manager A and Manager B. Did these managers under- or outperform the benchmark? ii) Calculate asset allocation effect and security selection effect for both Manager A and B. Comment on what this performance attribution analysis tells you about managers' performance? 9. You have performance data for two portfolio managers and a common benchmark portfolio: Stock Bonds Cash Benchmark Weight Return 0.6 -5.0% 0.3 -3.5% 0.1 0.3% Manager A Weight Return 0.5 -4.0% 0.2 -2.5% 0.3 0.3% Manager B Weight Return 0.3 -5.0% 0.4 -3.5% 0.3 0.3% i) Calculate the overall returns of benchmark, Manager A and Manager B. Did these managers under- or outperform the benchmark? ii) Calculate asset allocation effect and security selection effect for both Manager A and B. Comment on what this performance attribution analysis tells you about managers' performanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started