Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following your analysis of the information in Schedules A-D, assume that you met with RedPack's Credit Manager, Katie Henson, to ask her a number of

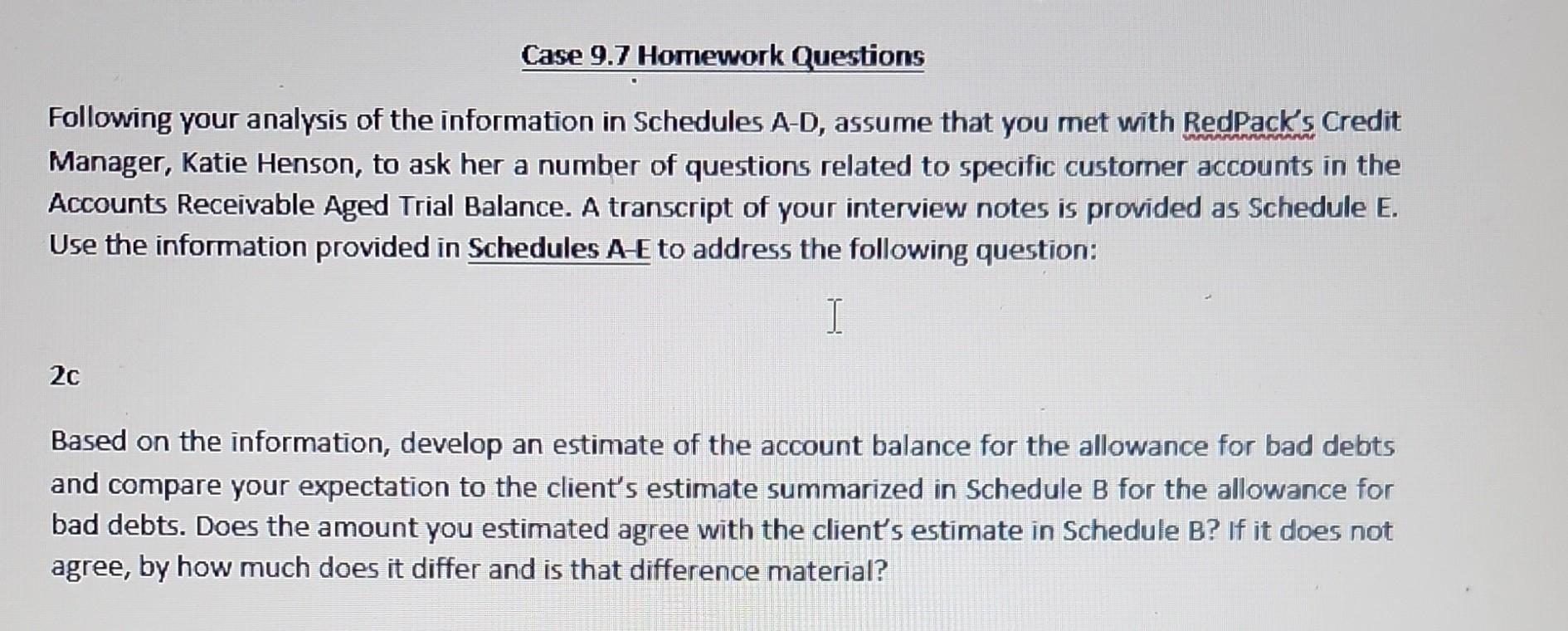

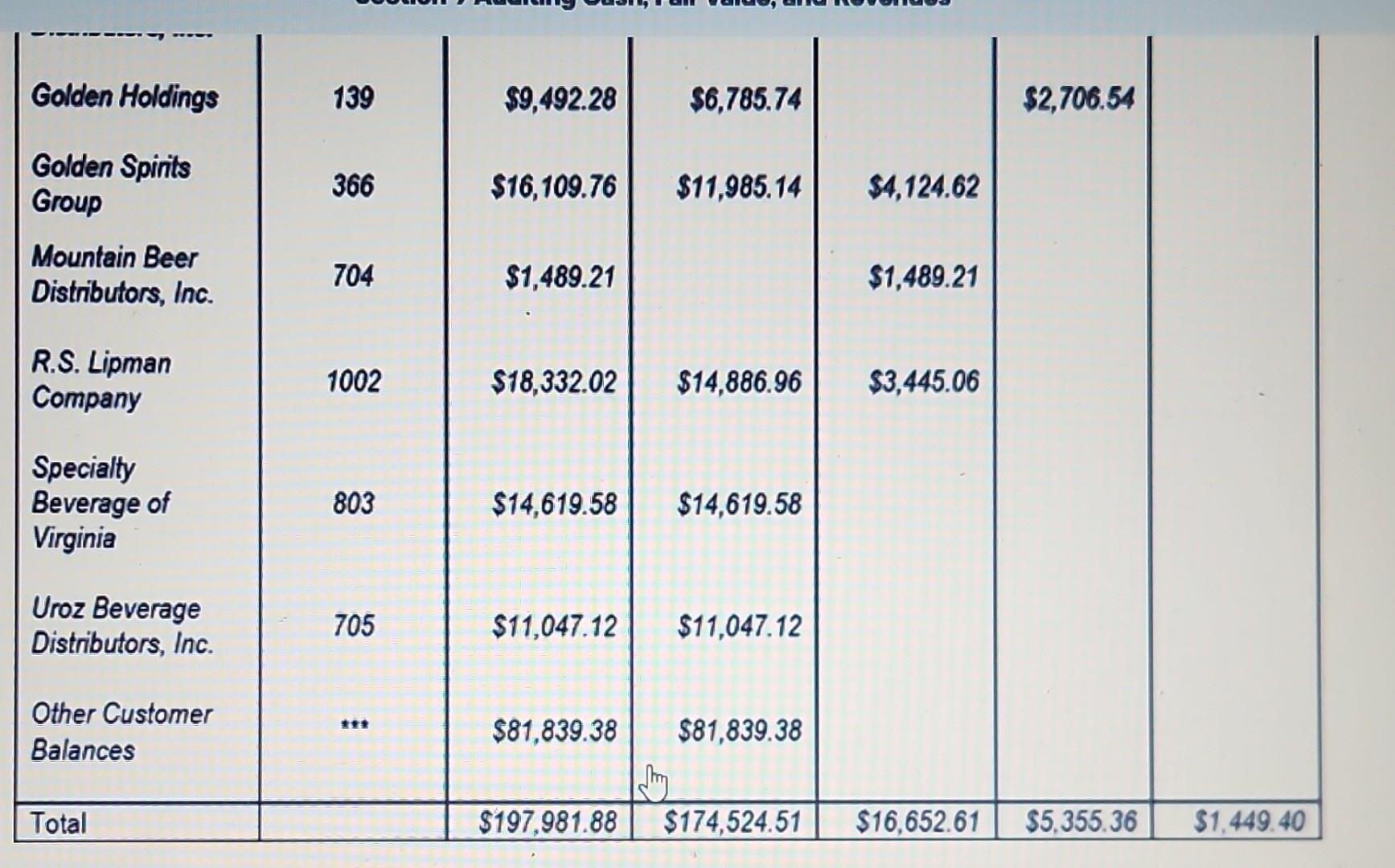

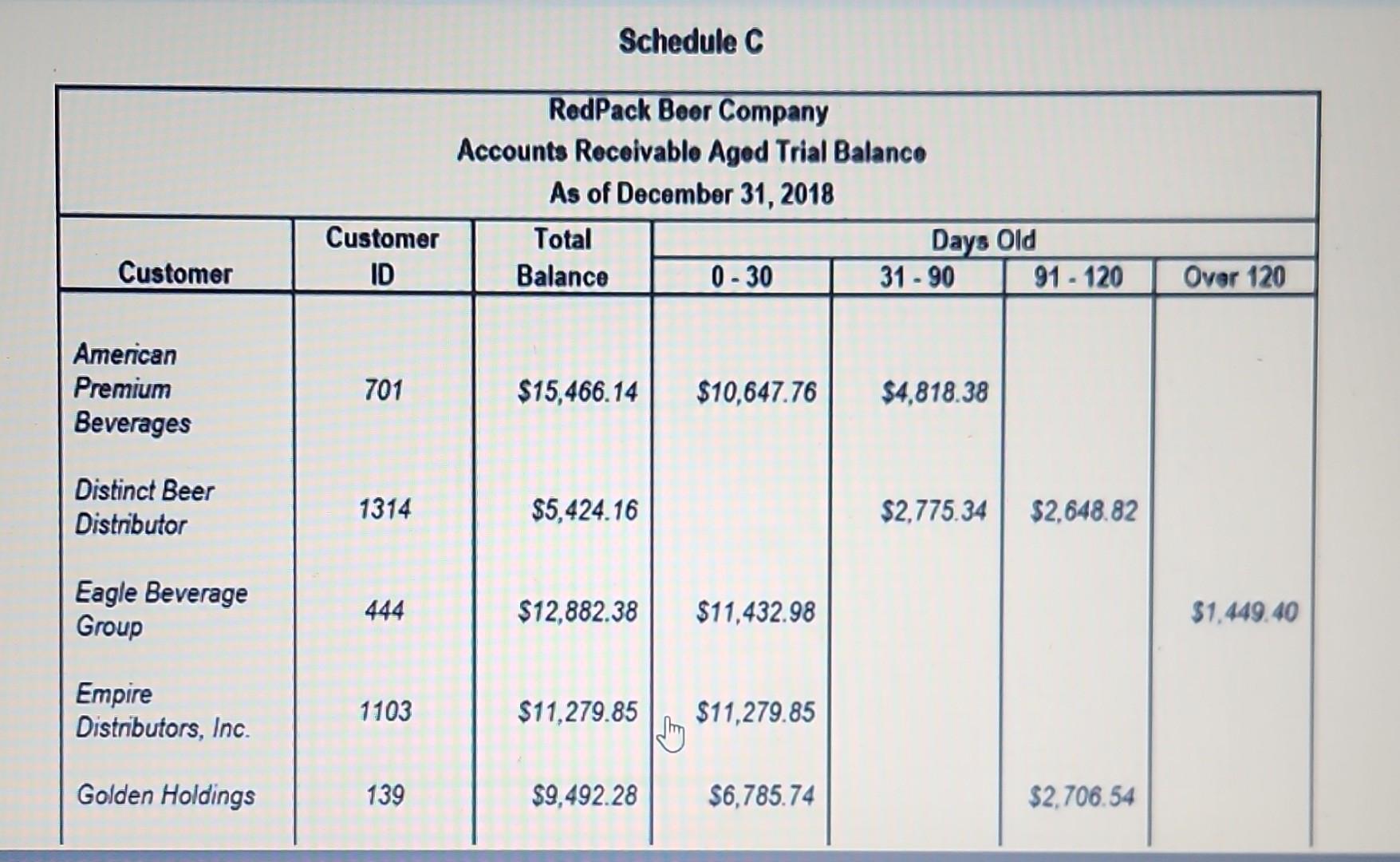

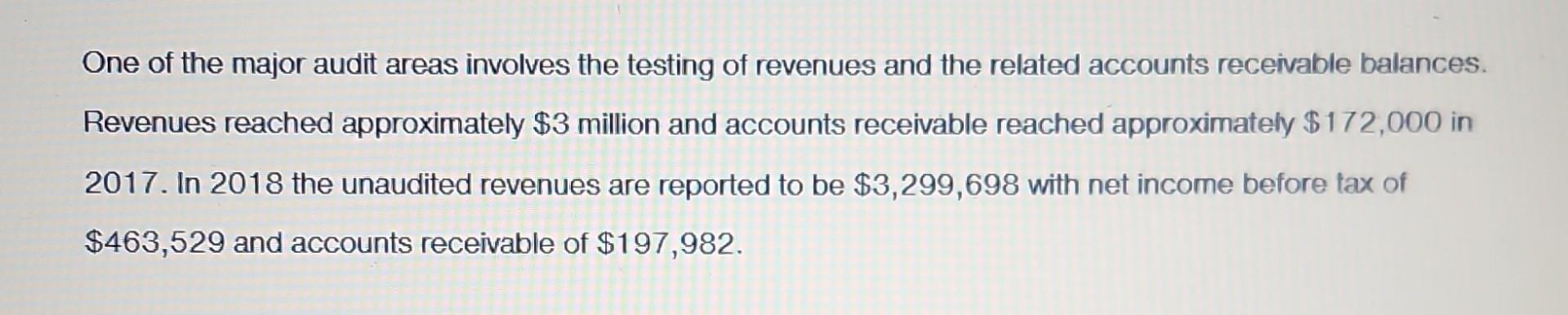

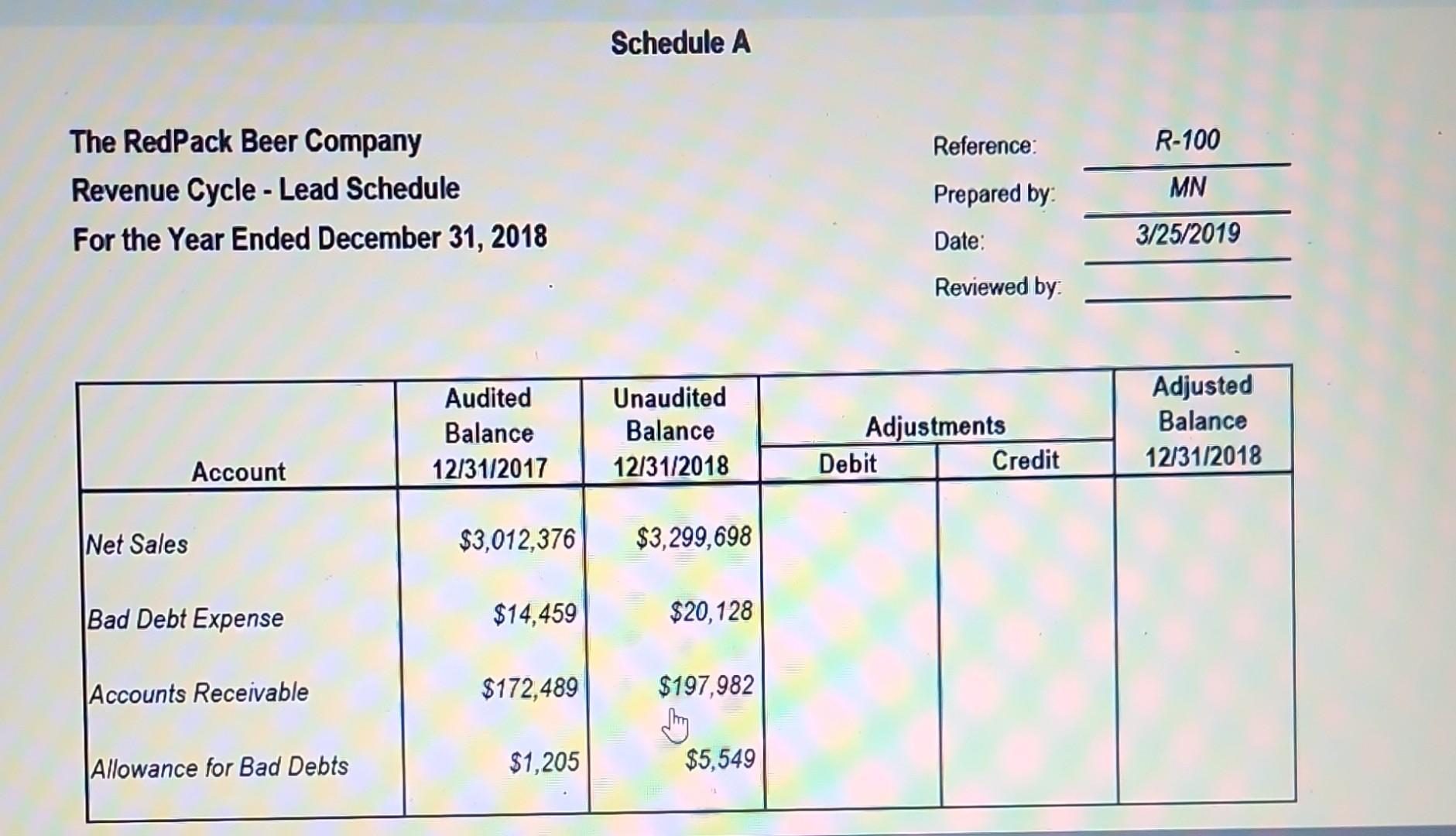

Following your analysis of the information in Schedules A-D, assume that you met with RedPack's Credit Manager, Katie Henson, to ask her a number of questions related to specific customer accounts in the Accounts Receivable Aged Trial Balance. A transcript of your interview notes is provided as Schedule E. Use the information provided in Schedules A-E to address the following question: 2c Based on the information, develop an estimate of the account balance for the allowance for bad debts and compare your expectation to the client's estimate summarized in Schedule B for the allowance for bad debts. Does the amount you estimated agree with the client's estimate in Schedule B? If it does not agree, by how much does it differ and is that difference material? \begin{tabular}{|c|c|c|c|c|c|c|} \hline Golden Holdings & 139 & $9,492.28 & $6,785.74 & & $2,706.54 & \\ \hline \begin{tabular}{l} Golden Spinits \\ Group \end{tabular} & 366 & $16,109.76 & $11,985.14 & $4,124.62 & & \\ \hline \begin{tabular}{l} Mountain Beer \\ Distributors, Inc. \end{tabular} & 704 & $1,489.21 & & $1,489.21 & & \\ \hline \begin{tabular}{l} R.S. Lipman \\ Company \end{tabular} & 1002 & $18,332.02 & $14,886.96 & $3,445.06 & & \\ \hline \begin{tabular}{l} Specialty \\ Beverage of \\ Virginia \end{tabular} & 803 & $14,619.58 & $14,619.58 & & & \\ \hline \begin{tabular}{l} Uroz Beverage \\ Distributors, Inc. \end{tabular} & 705 & $11,047.12 & $11,047.12 & & & \\ \hline \begin{tabular}{l} Other Customer \\ Balances \end{tabular} & *** & $81,839.38 & $81,839.38 & & & \\ \hline Total & & $197,981.88 & $174,524.51 & $16,652.61 & $5,355.36 & $1,449.40 \\ \hline \end{tabular} Schedule A Schedule C Schedule B One of the major audit areas involves the testing of revenues and the related accounts receivable balances. Revenues reached approximately $3 million and accounts receivable reached approximately $172,000 in 2017. In 2018 the unaudited revenues are reported to be $3,299,698 with net income before tax of $463,529 and accounts receivable of $197,982. The review of the adequacy of the allowance for bad debts is conducted quarterly by the Credit Manager and reviewed by the CFO. The company provides allowance for bad debts for accounts receivables that are over 30 days past due. The amount reserved is based on historical experience and is as follows: - Balances 31 to 90 days past due, reserve 10% - Balances 91 to 120 days past due, reserve 25% Individual accounts receivable balances that are over 120 past due, or are over $2,500 and 91 days past due, or are over $5,000 and 31 days past due are excluded from the base allowance and provided for separately on an individual basis. Following your analysis of the information in Schedules A-D, assume that you met with RedPack's Credit Manager, Katie Henson, to ask her a number of questions related to specific customer accounts in the Accounts Receivable Aged Trial Balance. A transcript of your interview notes is provided as Schedule E. Use the information provided in Schedules A-E to address the following question: 2c Based on the information, develop an estimate of the account balance for the allowance for bad debts and compare your expectation to the client's estimate summarized in Schedule B for the allowance for bad debts. Does the amount you estimated agree with the client's estimate in Schedule B? If it does not agree, by how much does it differ and is that difference material? \begin{tabular}{|c|c|c|c|c|c|c|} \hline Golden Holdings & 139 & $9,492.28 & $6,785.74 & & $2,706.54 & \\ \hline \begin{tabular}{l} Golden Spinits \\ Group \end{tabular} & 366 & $16,109.76 & $11,985.14 & $4,124.62 & & \\ \hline \begin{tabular}{l} Mountain Beer \\ Distributors, Inc. \end{tabular} & 704 & $1,489.21 & & $1,489.21 & & \\ \hline \begin{tabular}{l} R.S. Lipman \\ Company \end{tabular} & 1002 & $18,332.02 & $14,886.96 & $3,445.06 & & \\ \hline \begin{tabular}{l} Specialty \\ Beverage of \\ Virginia \end{tabular} & 803 & $14,619.58 & $14,619.58 & & & \\ \hline \begin{tabular}{l} Uroz Beverage \\ Distributors, Inc. \end{tabular} & 705 & $11,047.12 & $11,047.12 & & & \\ \hline \begin{tabular}{l} Other Customer \\ Balances \end{tabular} & *** & $81,839.38 & $81,839.38 & & & \\ \hline Total & & $197,981.88 & $174,524.51 & $16,652.61 & $5,355.36 & $1,449.40 \\ \hline \end{tabular} Schedule A Schedule C Schedule B One of the major audit areas involves the testing of revenues and the related accounts receivable balances. Revenues reached approximately $3 million and accounts receivable reached approximately $172,000 in 2017. In 2018 the unaudited revenues are reported to be $3,299,698 with net income before tax of $463,529 and accounts receivable of $197,982. The review of the adequacy of the allowance for bad debts is conducted quarterly by the Credit Manager and reviewed by the CFO. The company provides allowance for bad debts for accounts receivables that are over 30 days past due. The amount reserved is based on historical experience and is as follows: - Balances 31 to 90 days past due, reserve 10% - Balances 91 to 120 days past due, reserve 25% Individual accounts receivable balances that are over 120 past due, or are over $2,500 and 91 days past due, or are over $5,000 and 31 days past due are excluded from the base allowance and provided for separately on an individual basis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started