Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fOn December 31, 2023, Jen & Mink Clothing (J&M) performed the inventory count and determined the year-end ending inventory value to be $77500. It is

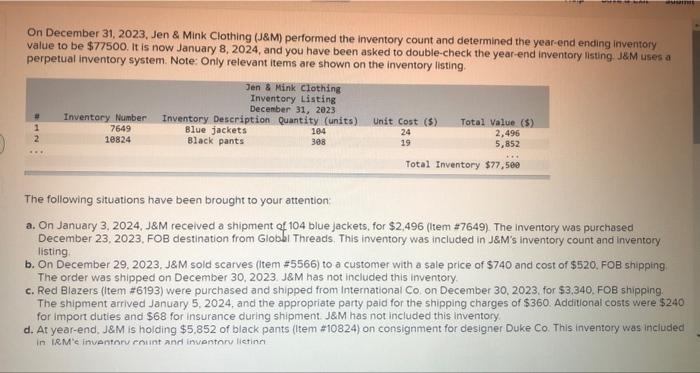

fOn December 31, 2023, Jen & Mink Clothing (J&M) performed the inventory count and determined the year-end ending inventory value to be $77500. It is now January 8, 2024, and you have been asked to double-check the year-end inventory listing. J&M uses a perpetual inventory system. Note: Only relevant items are shown on the inventory listing. #N 1 2 Jen & Mink Clothing Inventory Listing December 31, 2023 Inventory Number Inventory Description Quantity (units) 7649 10824 Blue jackets Black pants 104 308 Unit Cost ($) Total Value ($) 24 19 2,496 5,852 ... Total Inventory $77,500 The following situations have been brought to your attention: a. On January 3, 2024, J&M received a shipment of 104 blue jackets, for $2,496 (Item #7649). The inventory was purchased December 23, 2023, FOB destination from Global Threads. This inventory was included in J&M's inventory count and inventory listing. b. On December 29, 2023, J&M sold scarves (Item #5566) to a customer with a sale price of $740 and cost of $520, FOB shipping. The order was shipped on December 30, 2023. J&M has not included this inventory. c. Red Blazers (Item #6193) were purchased and shipped from International Co. on December 30, 2023, for $3,340, FOB shipping. The shipment arrived January 5, 2024, and the appropriate party paid for the shipping charges of $360. Additional costs were $240 for import duties and $68 for insurance during shipment. J&M has not included this inventory. d. At year-end, J&M is holding $5,852 of black pants (Item # 10824) on consignment for designer Duke Co. This inventory was included in I&M's inventory count and inventory listing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started