Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Foods Galore is a major distributor to restaurants and other institutional food users. Foods Galore buys cereal from a manufacturer for $24 per case. Annual

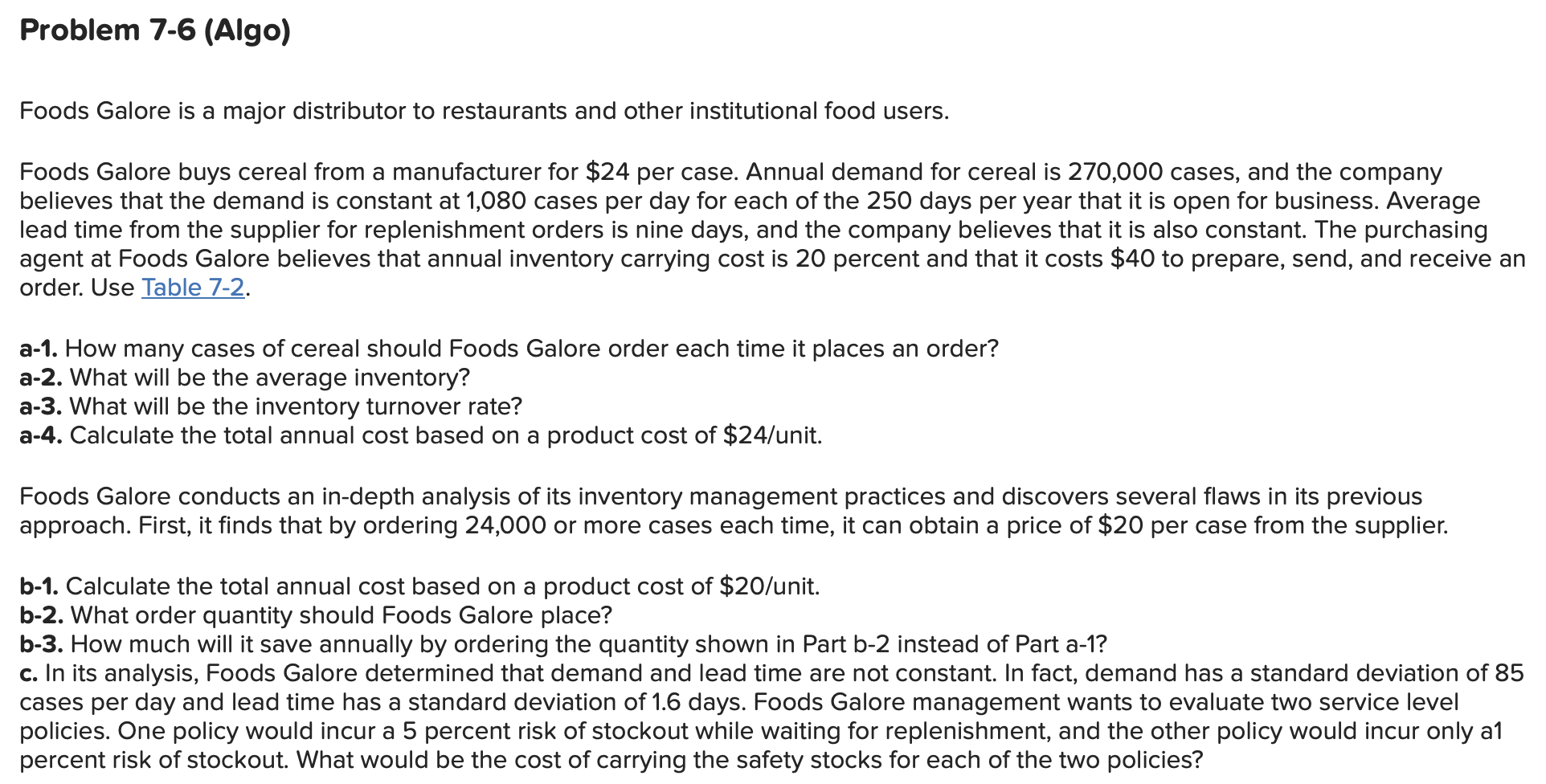

Foods Galore is a major distributor to restaurants and other institutional food users. Foods Galore buys cereal from a manufacturer for $24 per case. Annual demand for cereal is 270,000 cases, and the company believes that the demand is constant at 1,080 cases per day for each of the 250 days per year that it is open for business. Average lead time from the supplier for replenishment orders is nine days, and the company believes that it is also constant. The purchasing agent at Foods Galore believes that annual inventory carrying cost is 20 percent and that it costs $40 to prepare, send, and receive an order. Use Table 7-2. a-1. How many cases of cereal should Foods Galore order each time it places an order? a-2. What will be the average inventory? a-3. What will be the inventory turnover rate? a-4. Calculate the total annual cost based on a product cost of $24/ unit. Foods Galore conducts an in-depth analysis of its inventory management practices and discovers several flaws in its previous approach. First, it finds that by ordering 24,000 or more cases each time, it can obtain a price of $20 per case from the supplier. b-1. Calculate the total annual cost based on a product cost of $20/ unit. b-2. What order quantity should Foods Galore place? b-3. How much will it save annually by ordering the quantity shown in Part b-2 instead of Part a-1? c. In its analysis, Foods Galore determined that demand and lead time are not constant. In fact, demand has a standard deviation of 85 cases per day and lead time has a standard deviation of 1.6 days. Foods Galore management wants to evaluate two service level policies. One policy would incur a 5 percent risk of stockout while waiting for replenishment, and the other policy would incur only a1 percent risk of stockout. What would be the cost of carrying the safety stocks for each of the two policies

Foods Galore is a major distributor to restaurants and other institutional food users. Foods Galore buys cereal from a manufacturer for $24 per case. Annual demand for cereal is 270,000 cases, and the company believes that the demand is constant at 1,080 cases per day for each of the 250 days per year that it is open for business. Average lead time from the supplier for replenishment orders is nine days, and the company believes that it is also constant. The purchasing agent at Foods Galore believes that annual inventory carrying cost is 20 percent and that it costs $40 to prepare, send, and receive an order. Use Table 7-2. a-1. How many cases of cereal should Foods Galore order each time it places an order? a-2. What will be the average inventory? a-3. What will be the inventory turnover rate? a-4. Calculate the total annual cost based on a product cost of $24/ unit. Foods Galore conducts an in-depth analysis of its inventory management practices and discovers several flaws in its previous approach. First, it finds that by ordering 24,000 or more cases each time, it can obtain a price of $20 per case from the supplier. b-1. Calculate the total annual cost based on a product cost of $20/ unit. b-2. What order quantity should Foods Galore place? b-3. How much will it save annually by ordering the quantity shown in Part b-2 instead of Part a-1? c. In its analysis, Foods Galore determined that demand and lead time are not constant. In fact, demand has a standard deviation of 85 cases per day and lead time has a standard deviation of 1.6 days. Foods Galore management wants to evaluate two service level policies. One policy would incur a 5 percent risk of stockout while waiting for replenishment, and the other policy would incur only a1 percent risk of stockout. What would be the cost of carrying the safety stocks for each of the two policies Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started