footnote this is australian accounting policy

footnote this is australian accounting policy

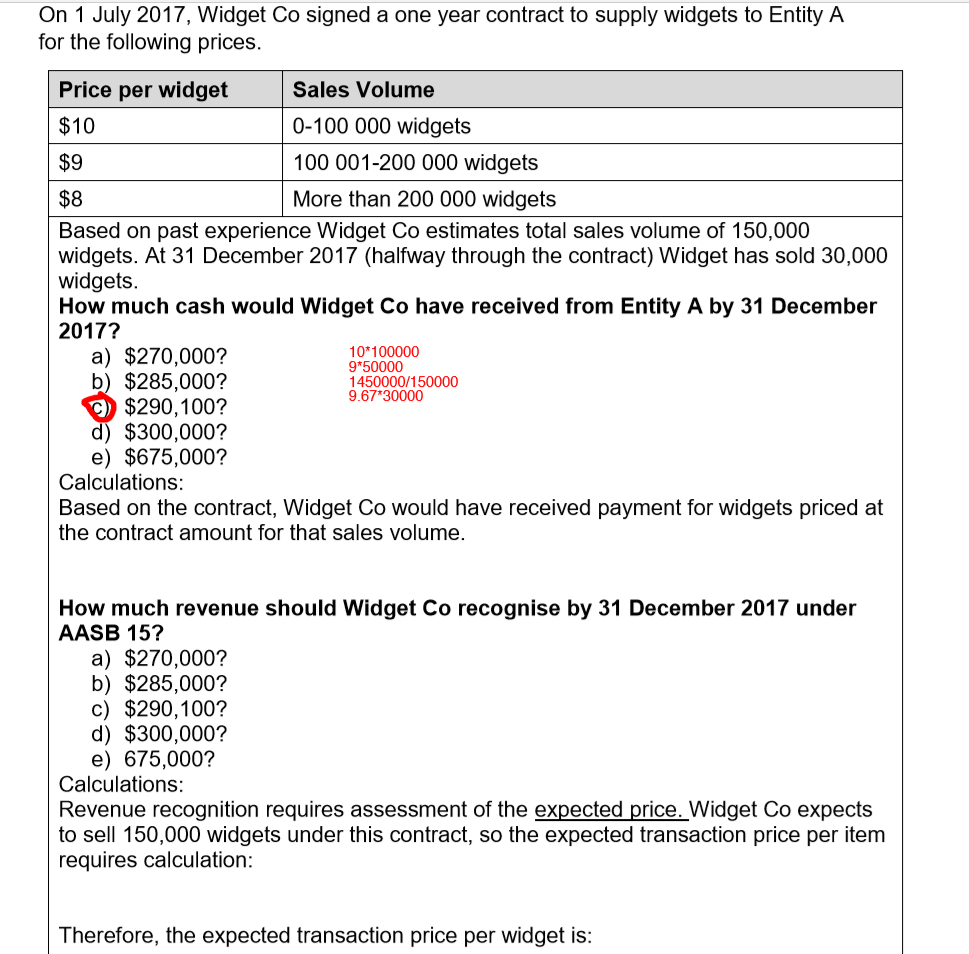

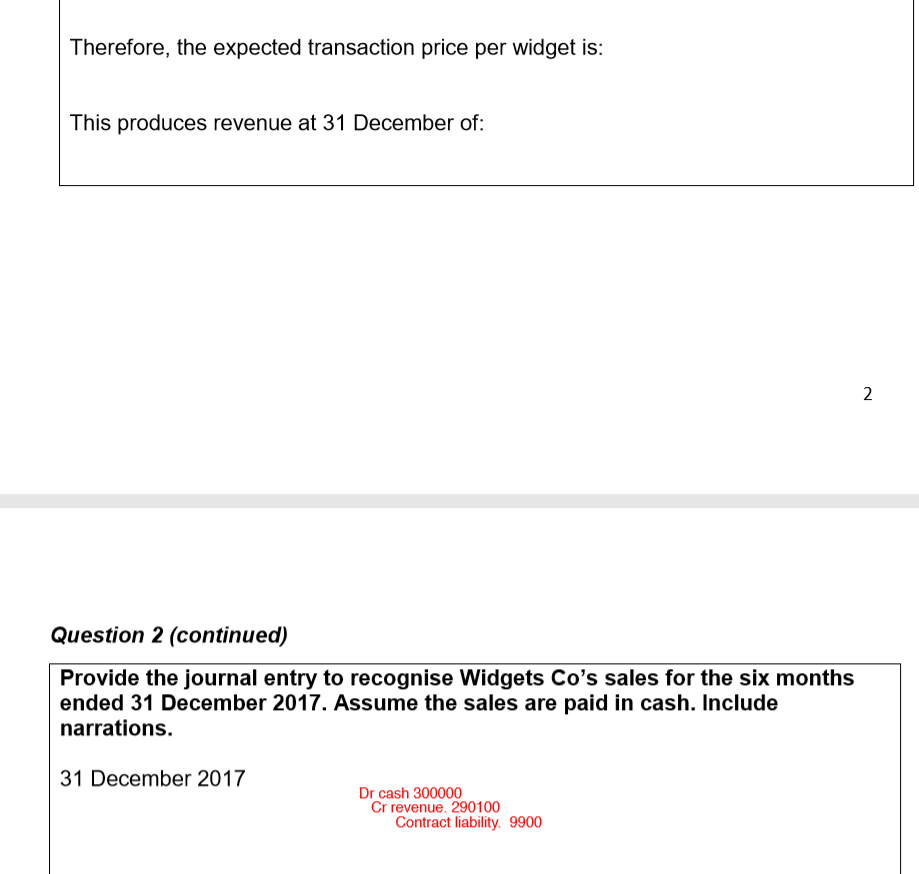

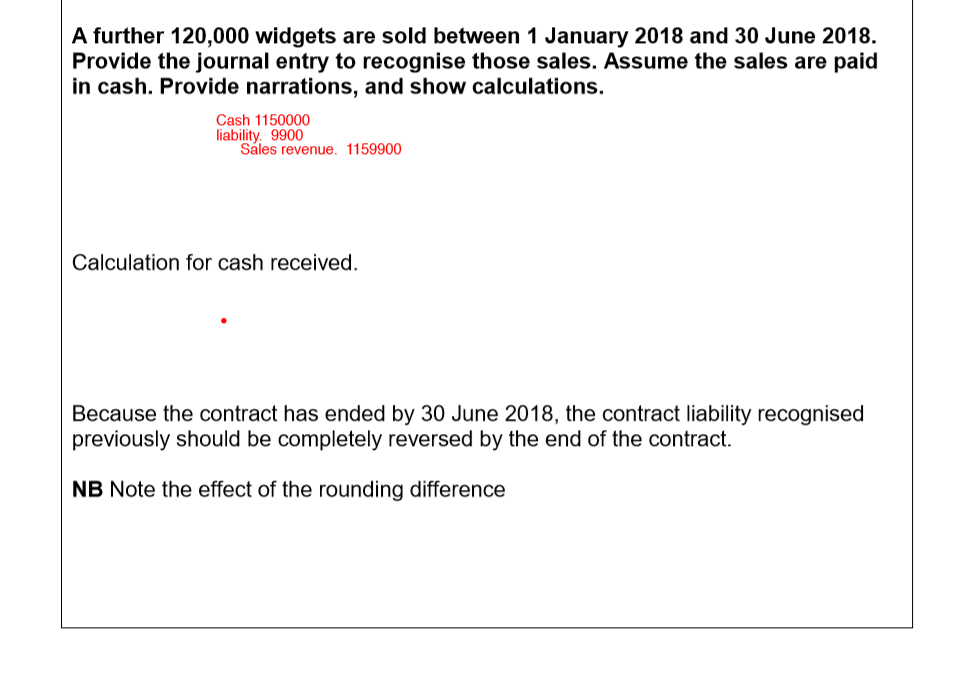

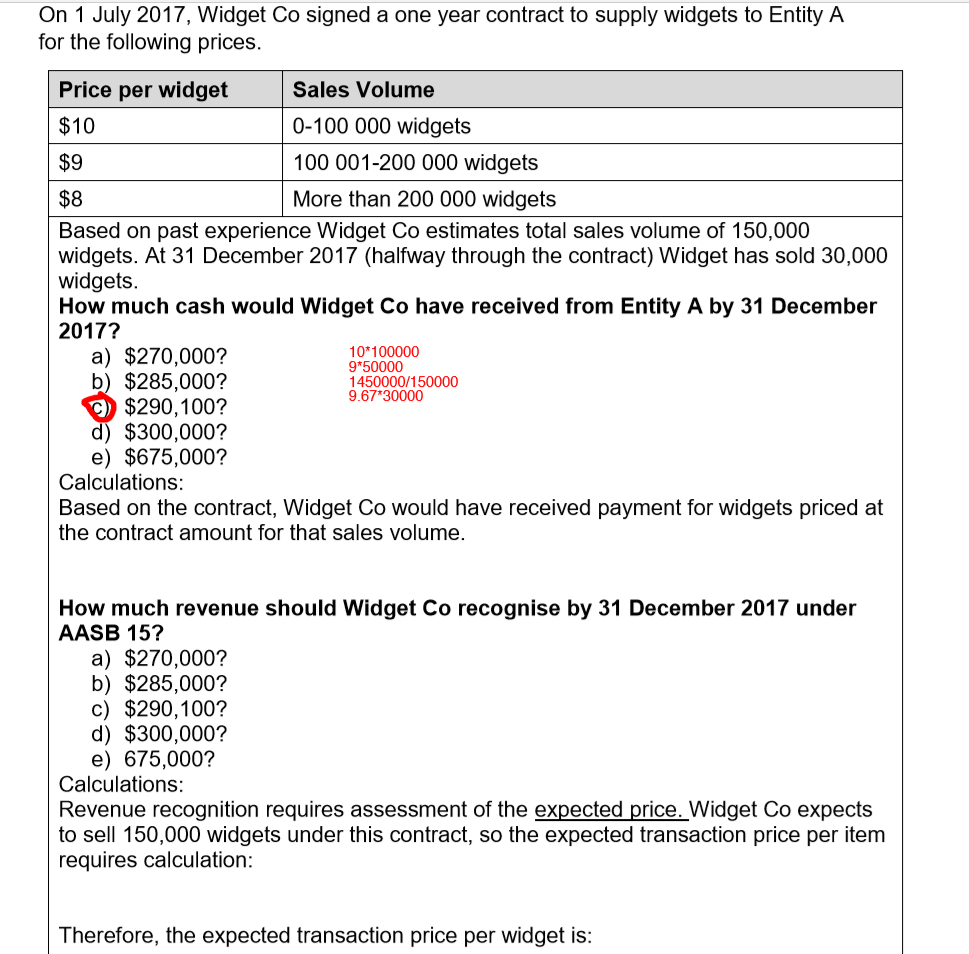

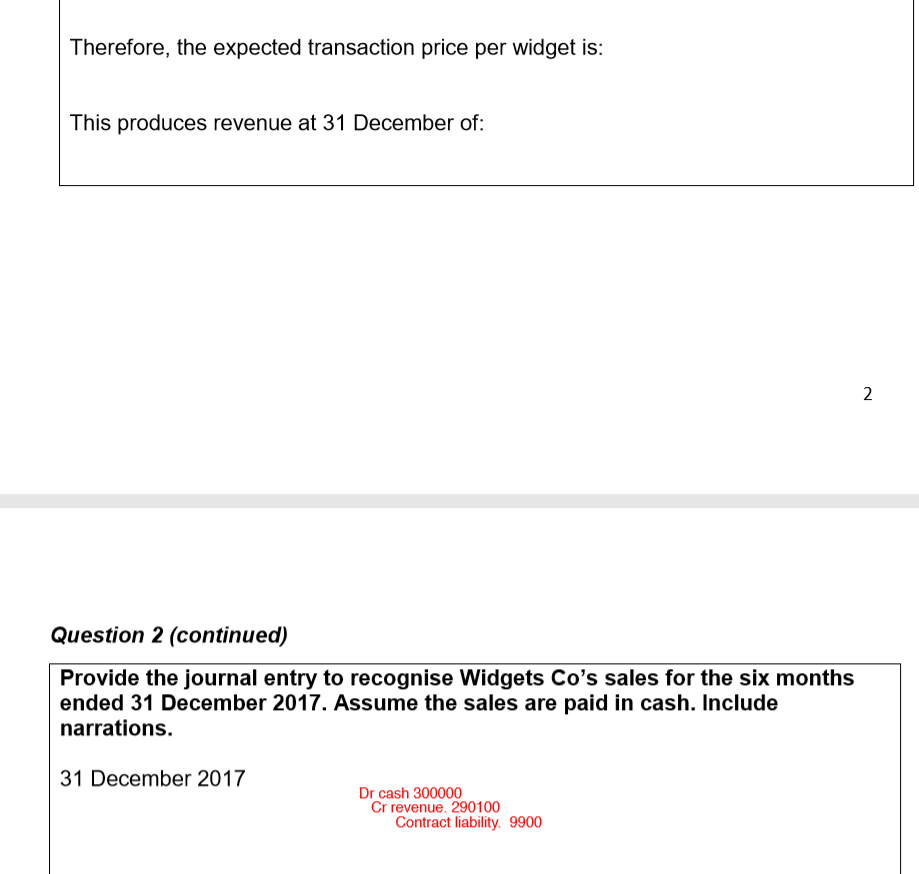

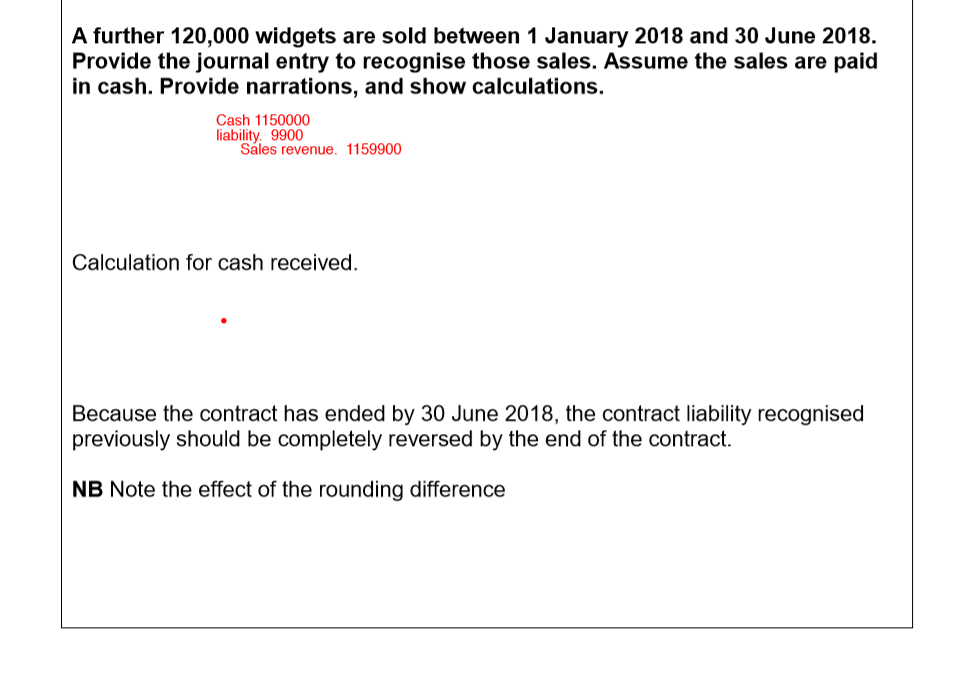

On 1 July 2017, Widget Co signed a one year contract to supply widgets to Entity A for the following prices Sales Volume 0-100 000 widgets 100 001-200 000 widgets More than 200 000 widgets Price per widget $10 $9 $8 Based on past experience Widget Co estimates total sales volume of 150,000 widgets. At 31 December 2017 (halfway through the contract) Widget has sold 30,000 widgets. How much cash would Widget Co have received from Entity A by 31 December 2017? 10 100000 9*50000 1450000/150000 9.67 30000 a) $270,000? b) $285,000? $290,100? d) $300,000? e) $675,000? Calculations Based on the contract, Widget Co would have received payment for widgets priced at the contract amount for that sales volume. How much revenue should Widget Co recognise by 31 December 2017 under AASB 15? a) $270,000? b) $285,000? c) $290,100? d) $300,000? e) 675,000? Calculations Revenue recognition requires assessment of the expected price.Widget Co expects to sell 150,000 widgets under this contract, so the expected transaction price per item requires calculation Therefore, the expected transaction price per widget is: Therefore, the expected transaction price per widget is: This produces revenue at 31 December of: Question 2 (continued) Provide the journal entry to recognise Widgets Co's sales for the six month:s ended 31 December 2017. Assume the sales are paid in cash. Include narrations. 31 December 2017 Dr cash 300000 Cr revenue. 290100 Contract liability. 9900 A further 120,000 widgets are sold between 1 January 2018 and 30 June 2018 Provide the journal entry to recognise those sales. Assume the sales are paid in cash. Provide narrations, and show calculations. Cash 1150000 liability. 9900 Sales revenue. 1159900 Calculation for cash received. Because the contract has ended by 30 June 2018, the contract liability recognised previously should be completely reversed by the end of the contract. NB Note the effect of the rounding difference On 1 July 2017, Widget Co signed a one year contract to supply widgets to Entity A for the following prices Sales Volume 0-100 000 widgets 100 001-200 000 widgets More than 200 000 widgets Price per widget $10 $9 $8 Based on past experience Widget Co estimates total sales volume of 150,000 widgets. At 31 December 2017 (halfway through the contract) Widget has sold 30,000 widgets. How much cash would Widget Co have received from Entity A by 31 December 2017? 10 100000 9*50000 1450000/150000 9.67 30000 a) $270,000? b) $285,000? $290,100? d) $300,000? e) $675,000? Calculations Based on the contract, Widget Co would have received payment for widgets priced at the contract amount for that sales volume. How much revenue should Widget Co recognise by 31 December 2017 under AASB 15? a) $270,000? b) $285,000? c) $290,100? d) $300,000? e) 675,000? Calculations Revenue recognition requires assessment of the expected price.Widget Co expects to sell 150,000 widgets under this contract, so the expected transaction price per item requires calculation Therefore, the expected transaction price per widget is: Therefore, the expected transaction price per widget is: This produces revenue at 31 December of: Question 2 (continued) Provide the journal entry to recognise Widgets Co's sales for the six month:s ended 31 December 2017. Assume the sales are paid in cash. Include narrations. 31 December 2017 Dr cash 300000 Cr revenue. 290100 Contract liability. 9900 A further 120,000 widgets are sold between 1 January 2018 and 30 June 2018 Provide the journal entry to recognise those sales. Assume the sales are paid in cash. Provide narrations, and show calculations. Cash 1150000 liability. 9900 Sales revenue. 1159900 Calculation for cash received. Because the contract has ended by 30 June 2018, the contract liability recognised previously should be completely reversed by the end of the contract. NB Note the effect of the rounding difference

footnote this is australian accounting policy

footnote this is australian accounting policy