Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for 20167 Task 2: A firm plans to borrow 50,000 for five years. The local bank will lend the money at a rate of 9%

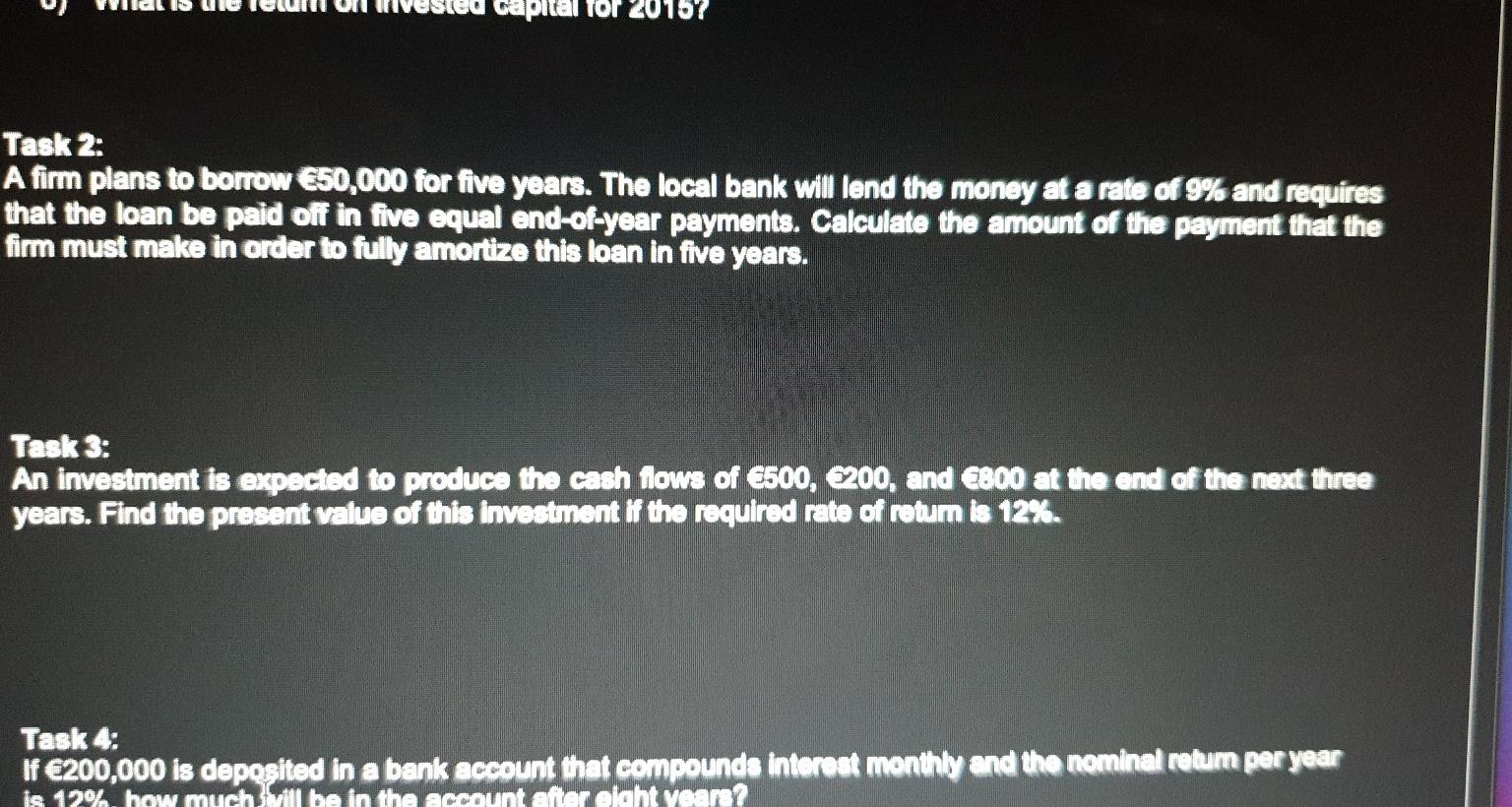

for 20167 Task 2: A firm plans to borrow 50,000 for five years. The local bank will lend the money at a rate of 9% and requires that the loan be paid off in five equal end-of-year payments. Calculate the amount of the payment that the firm must make in order to fully amortize this loan in five years. Task 3: An investment is expected to produce the cash flows of 500, 200, and 800 at the end of the next three years. Find the present value of this investment if the required rate of return is 12%. Task 4: If 200,000 is deposited in a bank account that compounds interest monthly and the nominal relum per year Is 12% how much vill be in the account after alght years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started