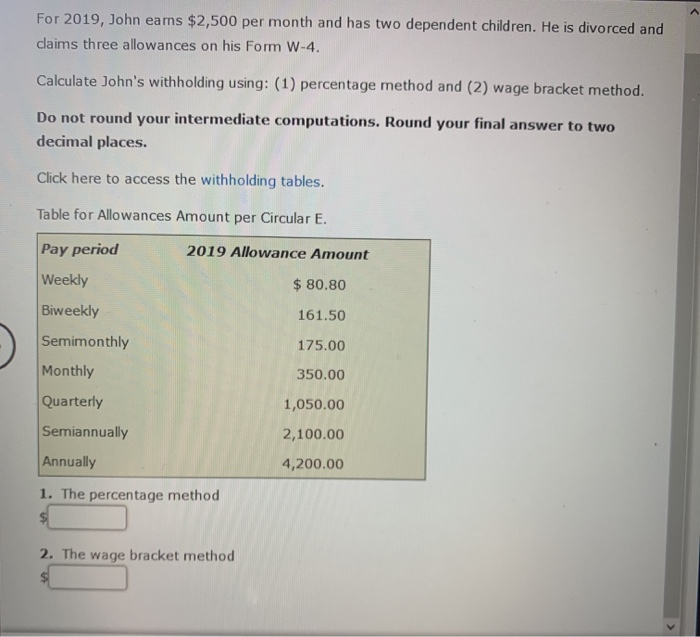

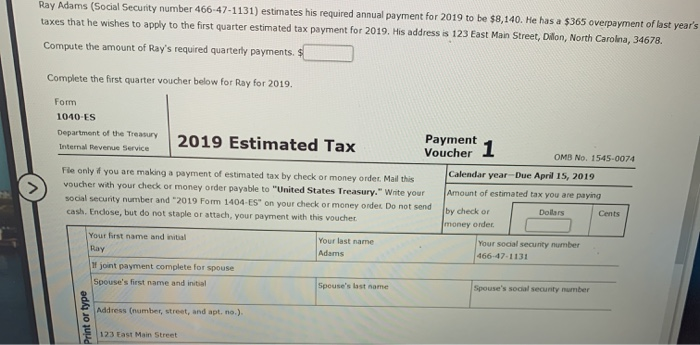

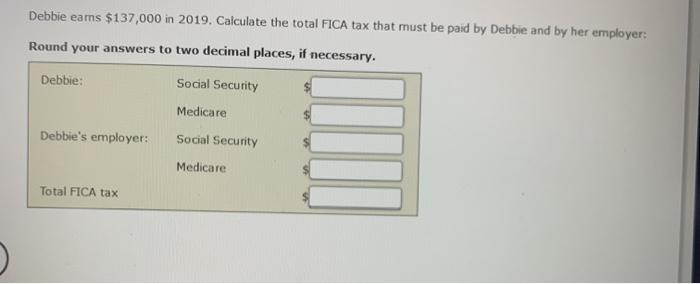

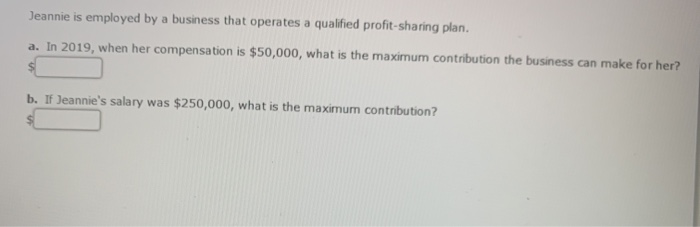

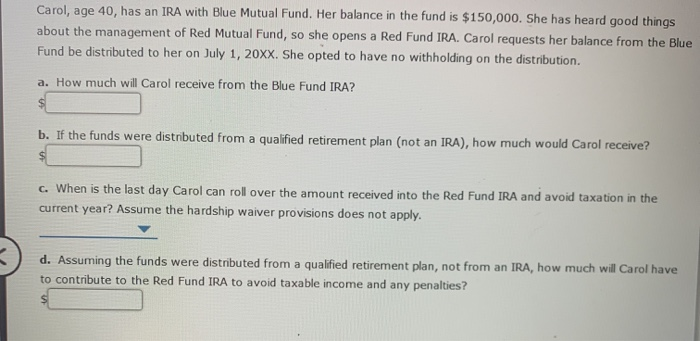

For 2019, John earns $2,500 per month and has two dependent children. He is divorced and claims three allowances on his Form W-4. Calculate John's withholding using: (1) percentage method and (2) wage bracket method. Do not round your intermediate computations. Round your final answer to two decimal places. Click here to access the withholding tables. Table for Allowances Amount per Circular E. 2019 Allowance Amount $ 80.80 161.50 Pay period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually 175.00 350.00 1,050.00 2,100.00 Annually 4,200.00 1. The percentage method $ 2. The wage bracket method Ray Adams (Social Security number 466-47-1131) estimates his required annual payment for 2019 to be $8,140. He has a $365 overpayment of last year's taxes that he wishes to apply to the first quarter estimated tax payment for 2019. His address is 123 East Main Street, Dilon, North Carolina, 34678. Compute the amount of Ray's required quarterly payments. $ Complete the first quarter voucher below for Ray for 2019. Form 1040-ES Department of the Treasury Payment 4 2019 Estimated Tax Voucher 1 Internal Revenue Service OMB No. 1545-0074 Calendar year-Due April 15, 2019 File only if you are making a payment of estimated tax by check or money order Mail this voucher with your check or money order payable to "United States Treasury." Write your Amount of estimated tax you are paying social security number and 2019 Form 1404-ES' on your check or money ordetDo not send by check or Dollars Cents cash. Endlose, but do not staple or attach, your payment with this voucher money ordet Your last name Adams Your social security number 466-47-1131 Your first name and initial Ray w joint payment complete for spouse Spouse's first name and initial Spouse's last name Spouse's social security number or type Address (numbes, street, and pt. no.). S 123 East Main Street Debbie eams $137,000 in 2019. Calculate the total FICA tax that must be paid by Debbie and by her employer: Round your answers to two decimal places, if necessary. Debbie: Social Security Medicare Debbie's employer: Social Security Medicare Total FICA tax Jeannie is employed by a business that operates a qualified profit-sharing plan. a. In 2019, when her compensation is $50,000, what is the maximum contribution the business can make for her? b. If Jeannie's salary was $250,000, what is the maximum contribution? Carol, age 40, has an IRA with Blue Mutual Fund. Her balance in the fund is $150,000. She has heard good things about the management of Red Mutual Fund, so she opens a Red Fund IRA. Carol requests her balance from the Blue Fund be distributed to her on July 1, 20XX. She opted to have no withholding on the distribution. a. How much will Carol receive from the Blue Fund IRA? b. If the funds were distributed from a qualified retirement plan (not an IRA), how much would Carol receive? c. When is the last day Carol can roll over the amount received into the Red Fund IRA and avoid taxation in the current year? Assume the hardship waiver provisions does not apply. d. Assuming the funds were distributed from a qualified retirement plan, not from an IRA, how much will Carol have to contribute to the Red Fund IRA to avoid taxable income and any penalties