Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For a comparison of the six capital budgeting methods, two capital investments projects are for analysis. The first is a $450,000 investment that returns $80,000

For a comparison of the six capital budgeting methods, two capital investments projects are for analysis. The first is a $450,000 investment that returns $80,000 per year for five years. The other is a $3 million investment that returns $600,000 per year for five years.

Both projects have Payback Periods well within the five year time period.

Project A has the shortest Payback Period of three years and Project B is only slightly longer. When the cash flows are discounted (10 percent) to compute a Discounted Payback Period, the time period needed to repay the investment is longer.

Project B now has a repayment period over four years in length and comes close to consuming the entire cash flows from the five year time period.

If only one investment project will be chosen and funds are unlimited which project will be chosen after you have carried out the following assessments on either project

Using discounted cash flow analysis, analyse the economic merit of this investment and advise the potential investor about the returns on either project

Explain how you would conduct the financial analysis to make a case to present to a financier (but do not do the financial analysis).

In reaching your explanation you must calculate using the formulas provided

a) Payback period for both projects

b) NPV @ 10% for each year

c) Profitability Index @ 10%

d) Internal rate of return

e) Which capital budgeting method should you use? List some advantages and disadvantages of each.

Both projects have Payback Periods well within the five year time period.

Project A has the shortest Payback Period of three years and Project B is only slightly longer. When the cash flows are discounted (10 percent) to compute a Discounted Payback Period, the time period needed to repay the investment is longer.

Project B now has a repayment period over four years in length and comes close to consuming the entire cash flows from the five year time period.

If only one investment project will be chosen and funds are unlimited which project will be chosen after you have carried out the following assessments on either project

Using discounted cash flow analysis, analyse the economic merit of this investment and advise the potential investor about the returns on either project

Explain how you would conduct the financial analysis to make a case to present to a financier (but do not do the financial analysis).

In reaching your explanation you must calculate using the formulas provided

a) Payback period for both projects

b) NPV @ 10% for each year

c) Profitability Index @ 10%

d) Internal rate of return

e) Which capital budgeting method should you use? List some advantages and disadvantages of each.

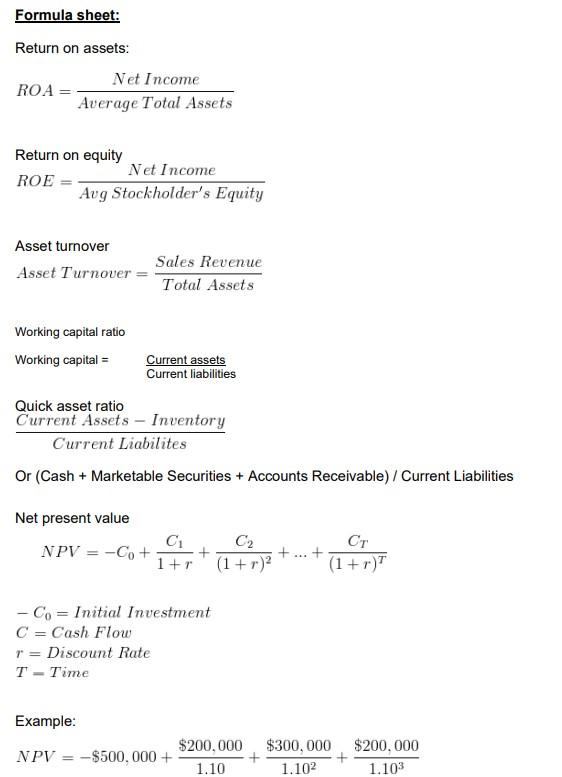

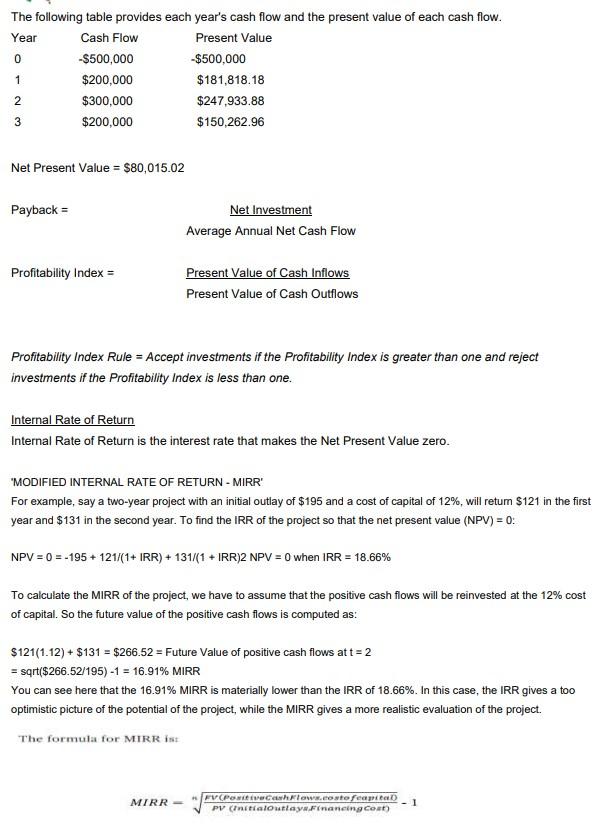

Formula sheet: Return on assets: ROA = Net Income Average Total Assets Return on equity ROE = Net Income Aug Stockholder's Equity Asset turnover Asset Turnover Working capital ratio Working capital = Net present value Quick asset ratio Current Assets Inventory Current Liabilites Or (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities Current assets Current liabilities NPV -Co + Sales Revenue Total Assets Example: r = Discount Rate T = Time C 1+r - Co Initial Investment C = Cash Flow + NPV-$500,000+ C (1+r) $200,000 1.10 + + * CT (1+r)T $300,000 $200,000 1.102 1.10

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To conduct a financial analysis and make a case for presentation to a financier you would need to calculate the following metrics for each project a P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started