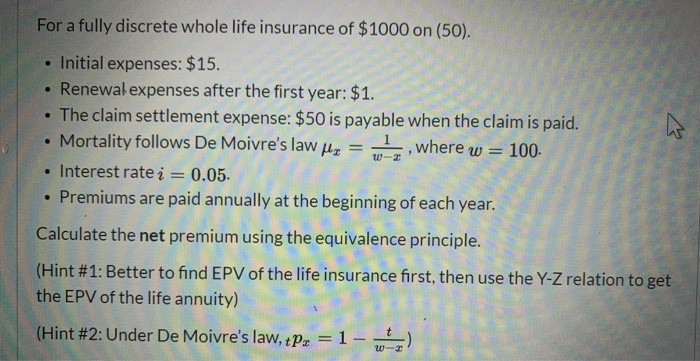

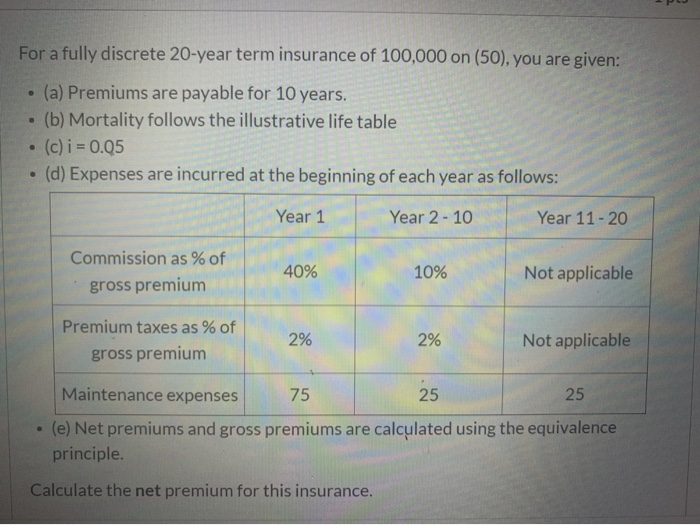

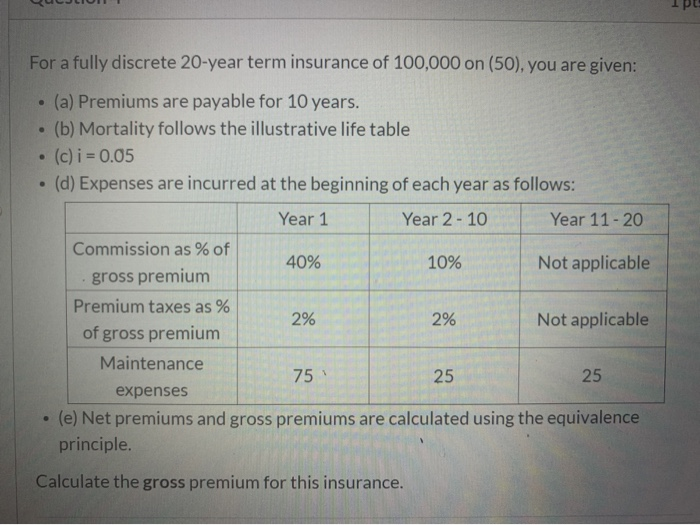

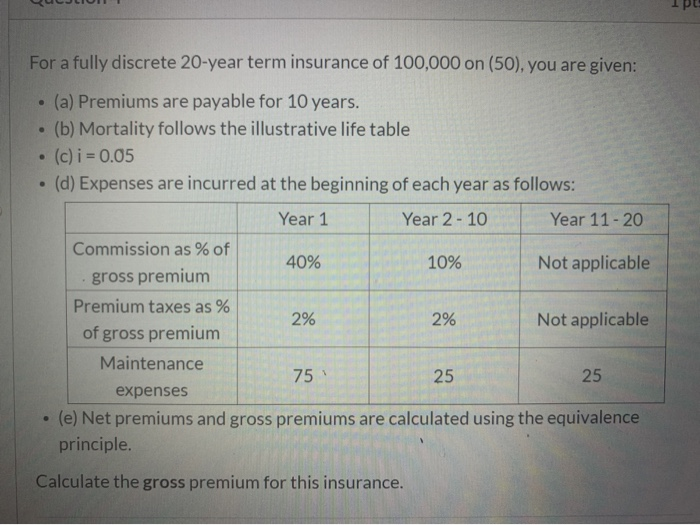

For a fully discrete whole life insurance of $1000 on (50). Initial expenses: $15. Renewal expenses after the first year: $1. The claim settlement expense: $50 is payable when the claim is paid. Mortality follows De Moivre's law Hz = I, where w = 100- Interest rate i = 0.05. Premiums are paid annually at the beginning of each year. Calculate the net premium using the equivalence principle. (Hint #1: Better to find EPV of the life insurance first, then use the Y-Z relation to get the EPV of the life annuity) (Hint #2: Under De Moivre's law, tpx For a fully discrete 20-year term insurance of 100,000 on (50), you are given: (a) Premiums are payable for 10 years. (b) Mortality follows the illustrative life table . (c) i = 0.05 (d) Expenses are incurred at the beginning of each year as follows: Year 1 Year 2-10 Year 11-20 Commission as % of 40% Not applicable gross premium 10% 70% Premium taxes as % of gross premium 2% 2% Not applicable 25 Maintenance expenses 75 25 (e) Net premiums and gross premiums are calculated using the equivalence principle. Calculate the net premium for this insurance. UCLIO 1pt For a fully discrete 20-year term insurance of 100,000 on (50), you are given: (a) Premiums are payable for 10 years. (b) Mortality follows the illustrative life table (c) i = 0.05 (d) Expenses are incurred at the beginning of each year as follows: Year 1 Year 2 - 10 Year 11-20 Commission as % of 40% 10% Not applicable gross premium Premium taxes as % Not applicable of gross premium Maintenance 75 25 25 expenses (e) Net premiums and gross premiums are calculated using the equivalence principle. 2% 2% Calculate the gross premium for this insurance. For a fully discrete whole life insurance of $1000 on (50). Initial expenses: $15. Renewal expenses after the first year: $1. The claim settlement expense: $50 is payable when the claim is paid. Mortality follows De Moivre's law Hz = I, where w = 100- Interest rate i = 0.05. Premiums are paid annually at the beginning of each year. Calculate the net premium using the equivalence principle. (Hint #1: Better to find EPV of the life insurance first, then use the Y-Z relation to get the EPV of the life annuity) (Hint #2: Under De Moivre's law, tpx For a fully discrete 20-year term insurance of 100,000 on (50), you are given: (a) Premiums are payable for 10 years. (b) Mortality follows the illustrative life table . (c) i = 0.05 (d) Expenses are incurred at the beginning of each year as follows: Year 1 Year 2-10 Year 11-20 Commission as % of 40% Not applicable gross premium 10% 70% Premium taxes as % of gross premium 2% 2% Not applicable 25 Maintenance expenses 75 25 (e) Net premiums and gross premiums are calculated using the equivalence principle. Calculate the net premium for this insurance. UCLIO 1pt For a fully discrete 20-year term insurance of 100,000 on (50), you are given: (a) Premiums are payable for 10 years. (b) Mortality follows the illustrative life table (c) i = 0.05 (d) Expenses are incurred at the beginning of each year as follows: Year 1 Year 2 - 10 Year 11-20 Commission as % of 40% 10% Not applicable gross premium Premium taxes as % Not applicable of gross premium Maintenance 75 25 25 expenses (e) Net premiums and gross premiums are calculated using the equivalence principle. 2% 2% Calculate the gross premium for this insurance