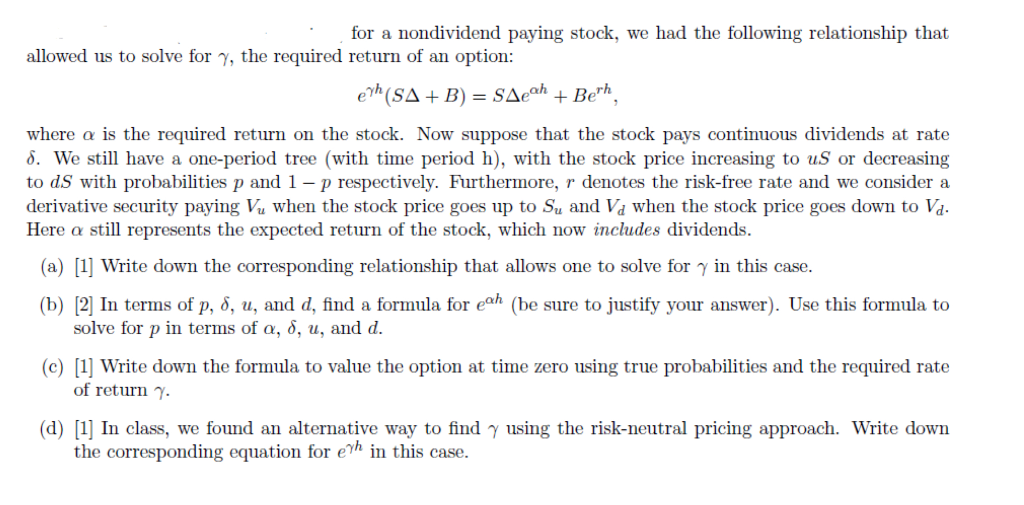

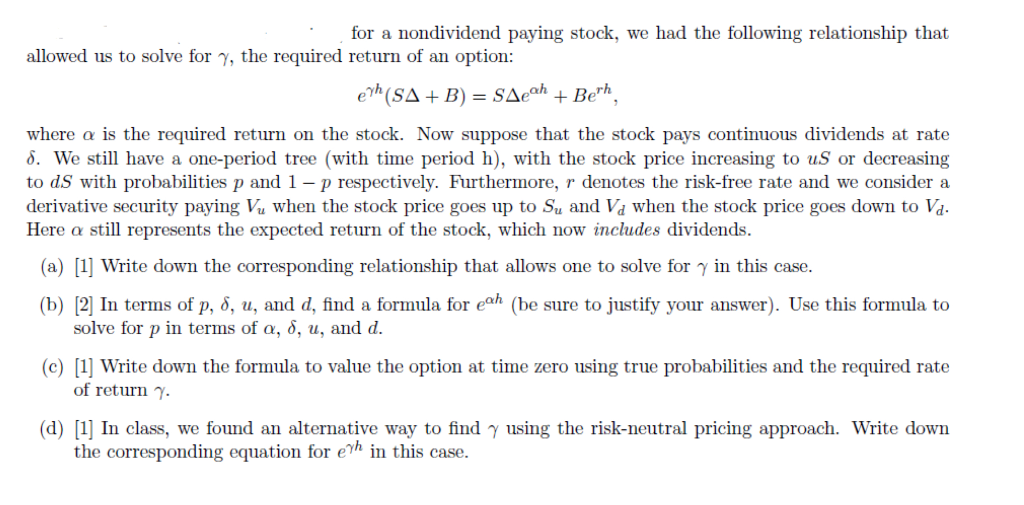

for a nondividend paying stock, we had the following relationship that allowed us to solve for , the required return of an option: where is the required return on the stock. Now suppose that the stock pays continuous dividends at rate 6. We still have a one-period tree (with time period h), with the stock price increasing to uS or decreasing to ds with probabilities p and 1 - p respectively. Furthermore, r denotes the risk-free rate and we consider a derivative security paying Vu when the stock price goes up to Su and Va when the stock price goes down to Va Here still represents the expected return of the stock, which now includes dividends. (a) [1] write down the corresponding relationship that allows one to solve for in this case. (b) 2 In terms of p, , t, and d, find a formula for eah (be sure to ustify your answer). Use this formula to solve for p in terms of , , u, and d. c) [1 Write down the formula to value the option at time zero using true probabilities and the required rate of return . (d) [1] In class, we found an alternative way to find using the risk-neutral pricing approach. Write down the corresponding equation for eth in this case. for a nondividend paying stock, we had the following relationship that allowed us to solve for , the required return of an option: where is the required return on the stock. Now suppose that the stock pays continuous dividends at rate 6. We still have a one-period tree (with time period h), with the stock price increasing to uS or decreasing to ds with probabilities p and 1 - p respectively. Furthermore, r denotes the risk-free rate and we consider a derivative security paying Vu when the stock price goes up to Su and Va when the stock price goes down to Va Here still represents the expected return of the stock, which now includes dividends. (a) [1] write down the corresponding relationship that allows one to solve for in this case. (b) 2 In terms of p, , t, and d, find a formula for eah (be sure to ustify your answer). Use this formula to solve for p in terms of , , u, and d. c) [1 Write down the formula to value the option at time zero using true probabilities and the required rate of return . (d) [1] In class, we found an alternative way to find using the risk-neutral pricing approach. Write down the corresponding equation for eth in this case