Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For a recent year, McDooley's, a family-owned group of restaurants, had the following sales and expenses: Sales for all restaurants Food and paper Payroll

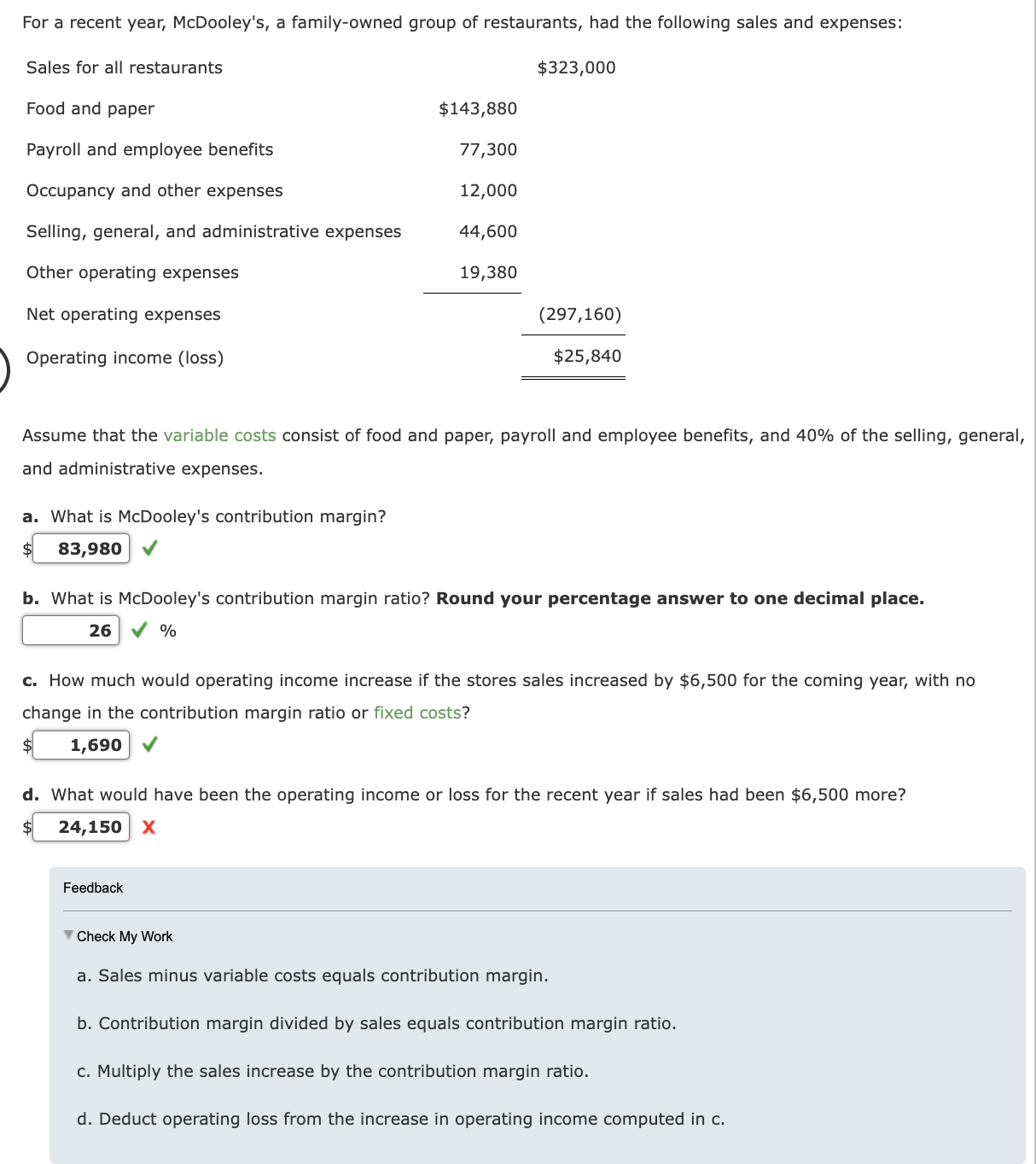

For a recent year, McDooley's, a family-owned group of restaurants, had the following sales and expenses: Sales for all restaurants Food and paper Payroll and employee benefits $323,000 $143,880 77,300 Occupancy and other expenses 12,000 Selling, general, and administrative expenses 44,600 Other operating expenses 19,380 Net operating expenses (297,160) Operating income (loss) $25,840 Assume that the variable costs consist of food and paper, payroll and employee benefits, and 40% of the selling, general, and administrative expenses. a. What is McDooley's contribution margin? $ 83,980 b. What is McDooley's contribution margin ratio? Round your percentage answer to one decimal place. 26 % c. How much would operating income increase if the stores sales increased by $6,500 for the coming year, with no change in the contribution margin ratio or fixed costs? $ 1,690 d. What would have been the operating income or loss for the recent year if sales had been $6,500 more? 24,150 X Feedback Check My Work a. Sales minus variable costs equals contribution margin. b. Contribution margin divided by sales equals contribution margin ratio. c. Multiply the sales increase by the contribution margin ratio. d. Deduct operating loss from the increase in operating income computed in c.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started