Answered step by step

Verified Expert Solution

Question

1 Approved Answer

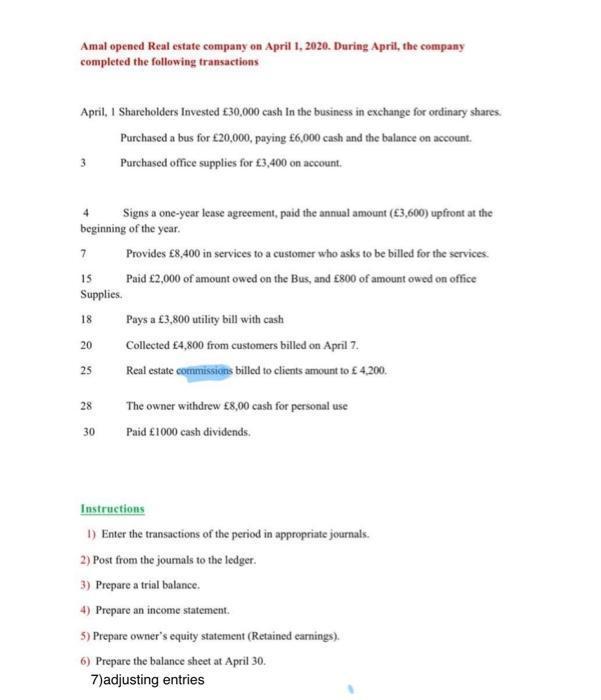

Amal opened Real estate company on April 1, 2020. During April, the company completed the following transactions April, 1 Shareholders Invested 30,000 cash In

Amal opened Real estate company on April 1, 2020. During April, the company completed the following transactions April, 1 Shareholders Invested 30,000 cash In the business in exchange for ordinary shares. Purchased a bus for 20,000, paying 6,000 cash and the balance on account. Purchased office supplies for 3,400 on account. 3 Signs a one-year lease agreement, paid the annual amount (3,600) upfront at the beginning of the year. Provides 8,400 in services to a customer who asks to be billed for the services. Paid 2,000 of amount owed on the Bus, and 800 of amount owed on office 7 15 Supplies. 18 20 25 28 30 Pays a 3,800 utility bill with cash Collected 4,800 from customers billed on April 7. Real estate commissions billed to clients amount to 4,200. The owner withdrew 8,00 cash for personal use Paid 1000 cash dividends. Instructions 1) Enter the transactions of the period in appropriate journals. 2) Post from the journals to the ledger. 3) Prepare a trial balance. 4) Prepare an income statement. 5) Prepare owner's equity statement (Retained earnings). 6) Prepare the balance sheet at April 30. 7)adjusting entries

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

JOURNAL ENTRIES April 1 Cash 30000 and Ordinary Shares 30000 April 1 Bus 20000 Cash 6000 and Accounts Payable 14000 April 1 Office Supplies 3400 and Accounts Payable 3400 April 1 Rent Expense 3600 and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started