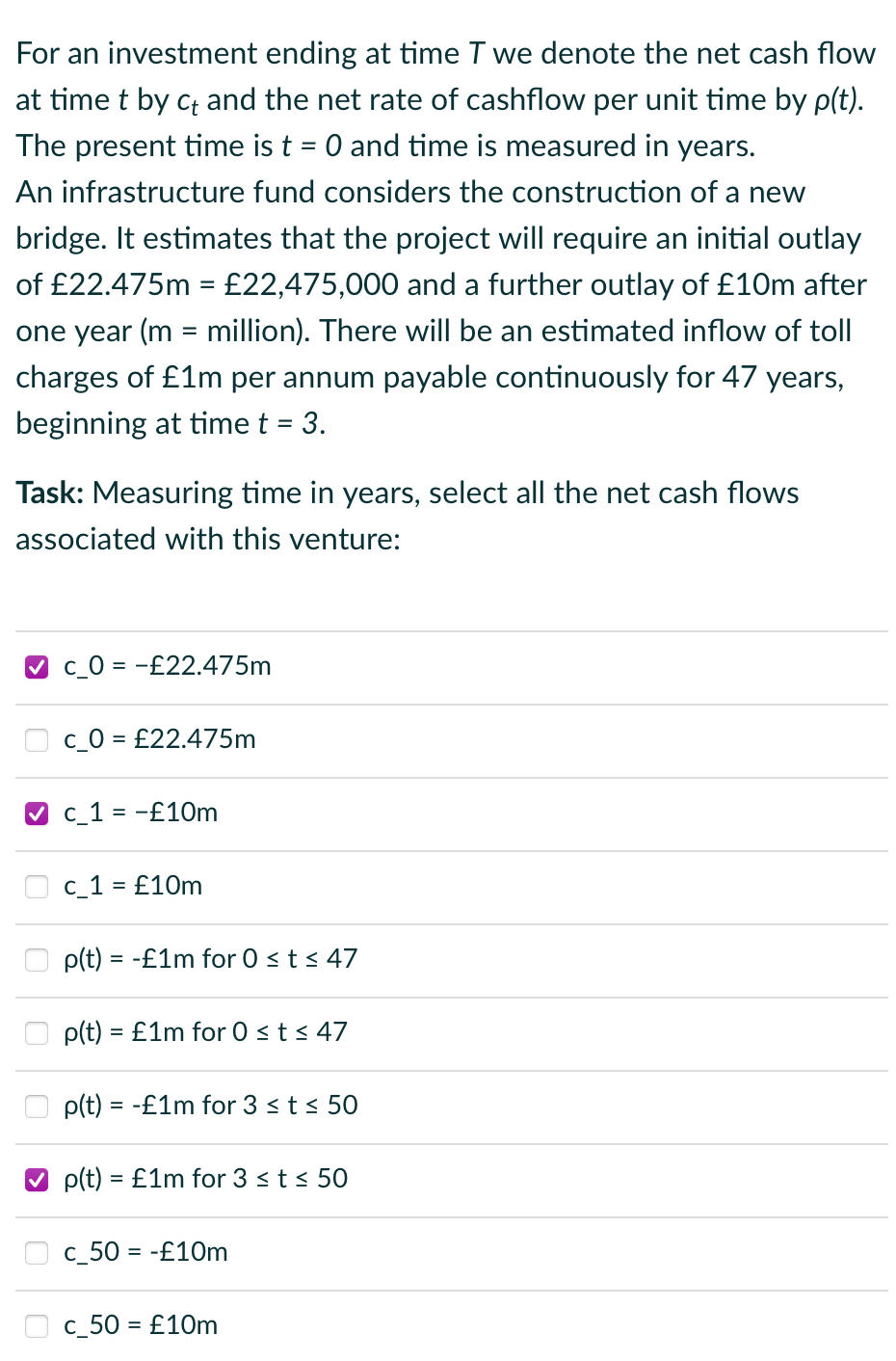

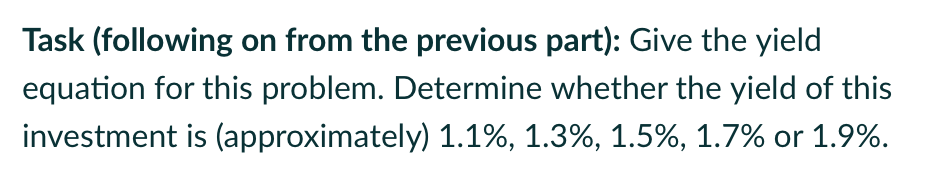

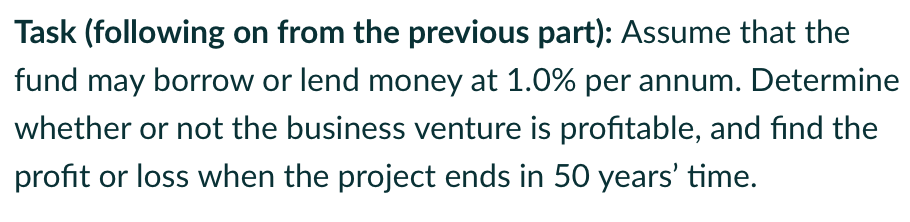

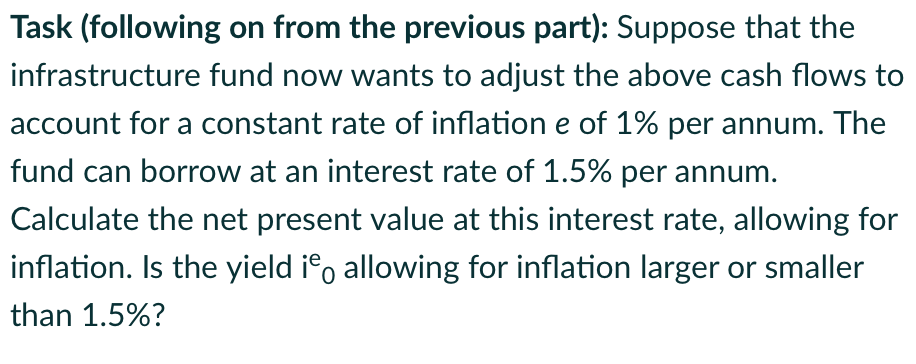

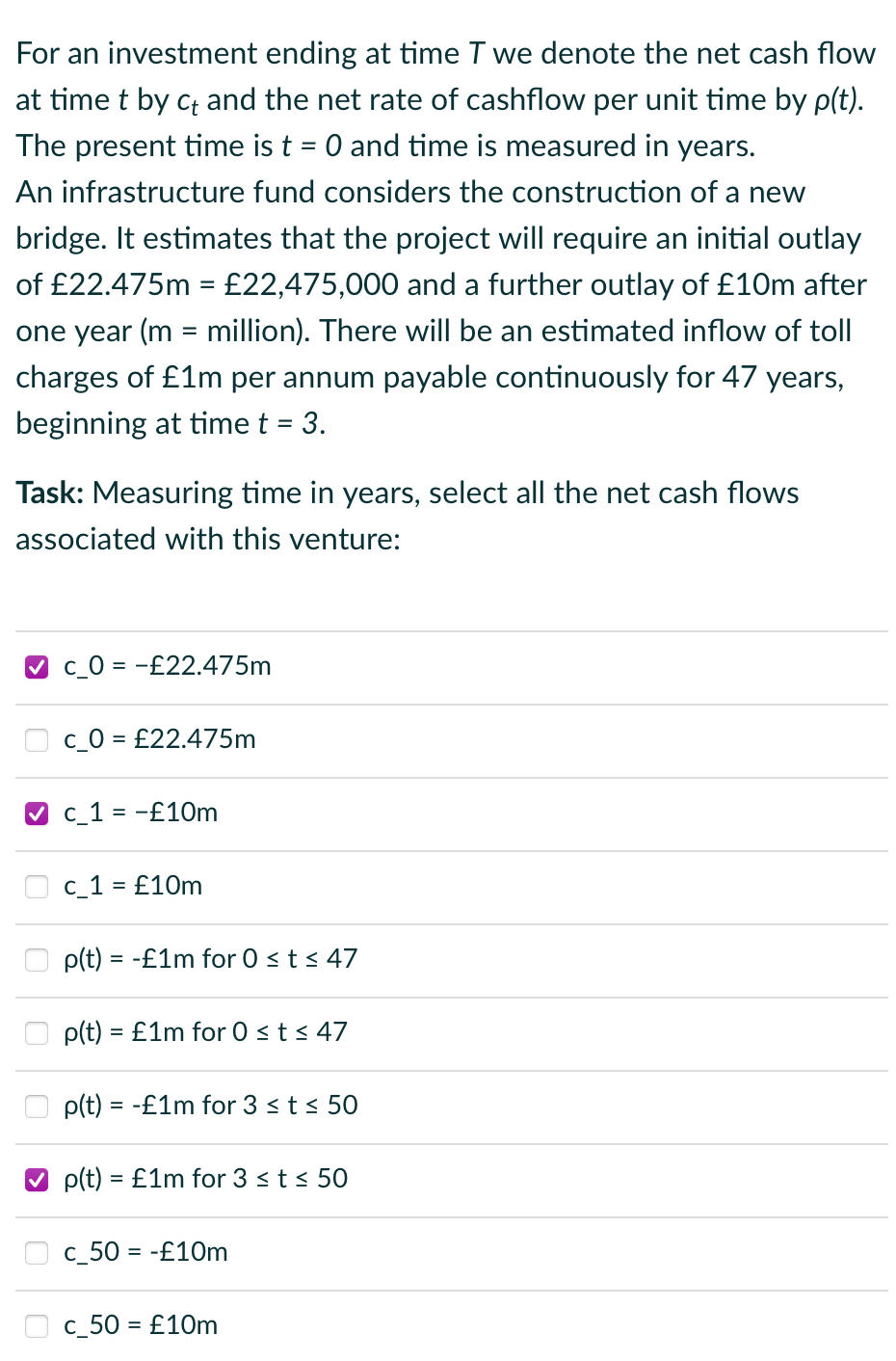

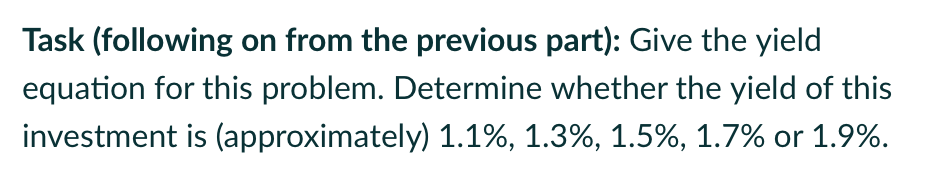

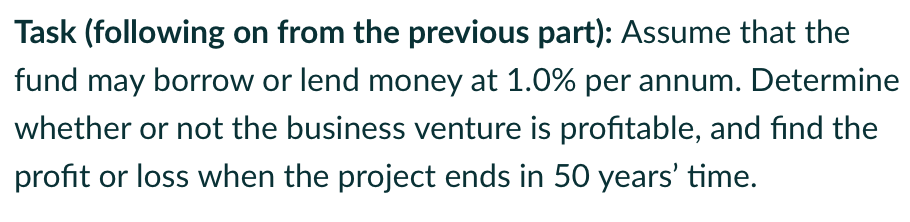

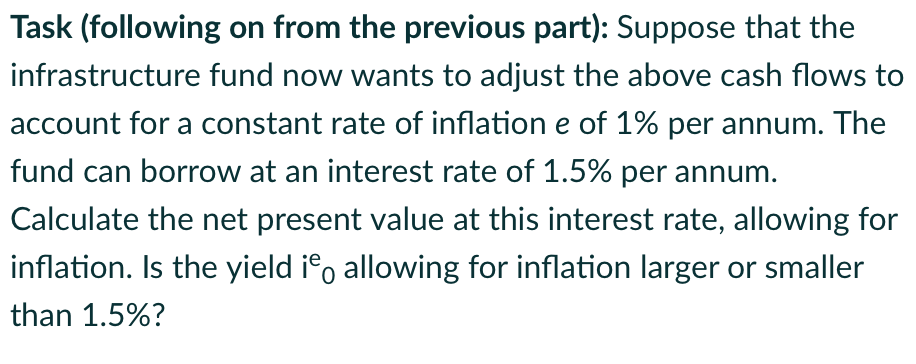

= For an investment ending at time I we denote the net cash flow at time t by ct and the net rate of cashflow per unit time by p(t). Ct The present time is t = 0 and time is measured in years. An infrastructure fund considers the construction of a new bridge. It estimates that the project will require an initial outlay of 22.475m = 22,475,000 and a further outlay of 10m after one year (m = million). There will be an estimated inflow of toll charges of 1m per annum payable continuously for 47 years, beginning at time t = 3. = Task: Measuring time in years, select all the net cash flows associated with this venture: c_0 = -22.475m c_0 = 22.475m C_1 = -10m C_1 = 10m p(t) = -1m for Osts 47 p(t) = 1m for Osts 47 p(t) = -1m for 3 sts 50 =- p(t) = 1m for 3 st> 50 c_50 = -10m Oc_50 = 10m Task (following on from the previous part): Give the yield equation for this problem. Determine whether the yield of this investment is (approximately) 1.1%, 1.3%, 1.5%, 1.7% or 1.9%. Task (following on from the previous part): Assume that the fund may borrow or lend money at 1.0% per annum. Determine whether or not the business venture is profitable, and find the profit or loss when the project ends in 50 years' time. e Task (following on from the previous part): Suppose that the infrastructure fund now wants to adjust the above cash flows to account for a constant rate of inflation e of 1% per annum. The fund can borrow at an interest rate of 1.5% per annum. Calculate the net present value at this interest rate, allowing for inflation. Is the yield i, allowing for inflation larger or smaller than 1.5%? = For an investment ending at time I we denote the net cash flow at time t by ct and the net rate of cashflow per unit time by p(t). Ct The present time is t = 0 and time is measured in years. An infrastructure fund considers the construction of a new bridge. It estimates that the project will require an initial outlay of 22.475m = 22,475,000 and a further outlay of 10m after one year (m = million). There will be an estimated inflow of toll charges of 1m per annum payable continuously for 47 years, beginning at time t = 3. = Task: Measuring time in years, select all the net cash flows associated with this venture: c_0 = -22.475m c_0 = 22.475m C_1 = -10m C_1 = 10m p(t) = -1m for Osts 47 p(t) = 1m for Osts 47 p(t) = -1m for 3 sts 50 =- p(t) = 1m for 3 st> 50 c_50 = -10m Oc_50 = 10m Task (following on from the previous part): Give the yield equation for this problem. Determine whether the yield of this investment is (approximately) 1.1%, 1.3%, 1.5%, 1.7% or 1.9%. Task (following on from the previous part): Assume that the fund may borrow or lend money at 1.0% per annum. Determine whether or not the business venture is profitable, and find the profit or loss when the project ends in 50 years' time. e Task (following on from the previous part): Suppose that the infrastructure fund now wants to adjust the above cash flows to account for a constant rate of inflation e of 1% per annum. The fund can borrow at an interest rate of 1.5% per annum. Calculate the net present value at this interest rate, allowing for inflation. Is the yield i, allowing for inflation larger or smaller than 1.5%