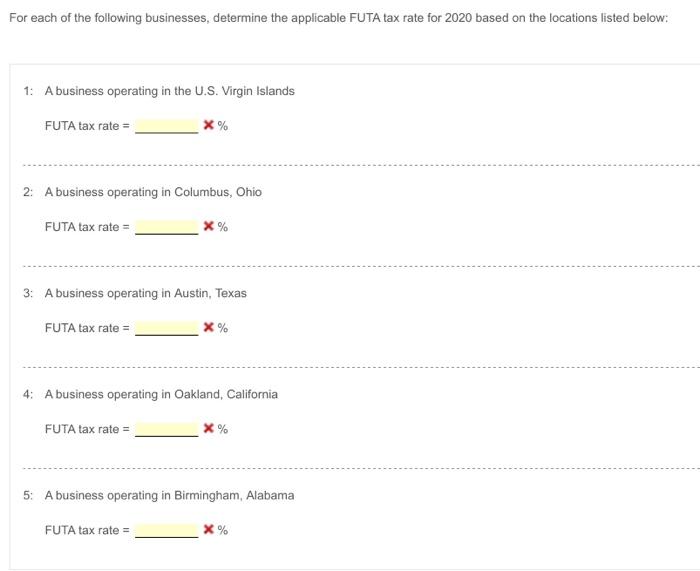

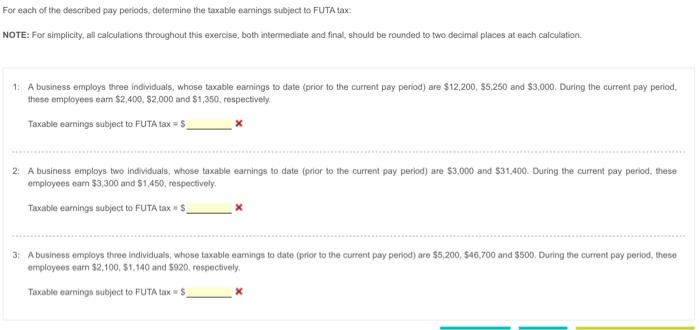

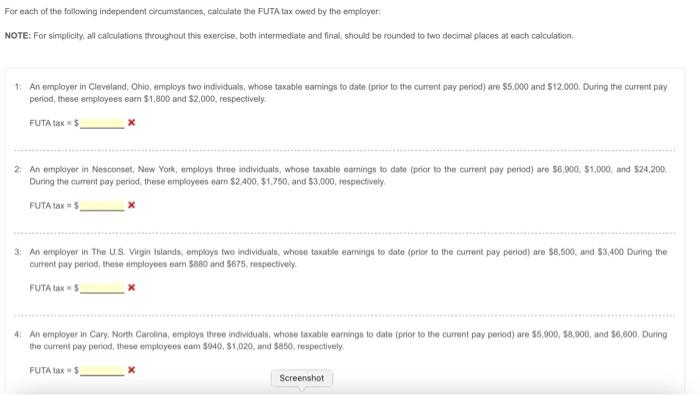

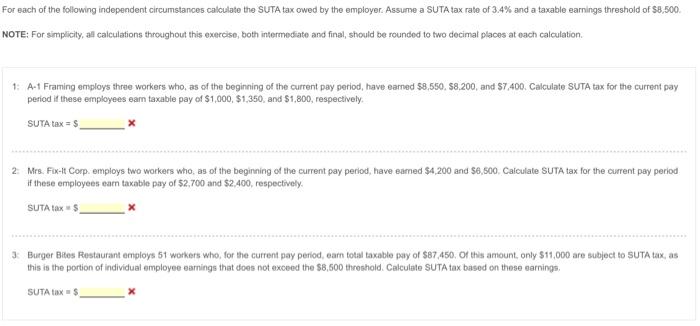

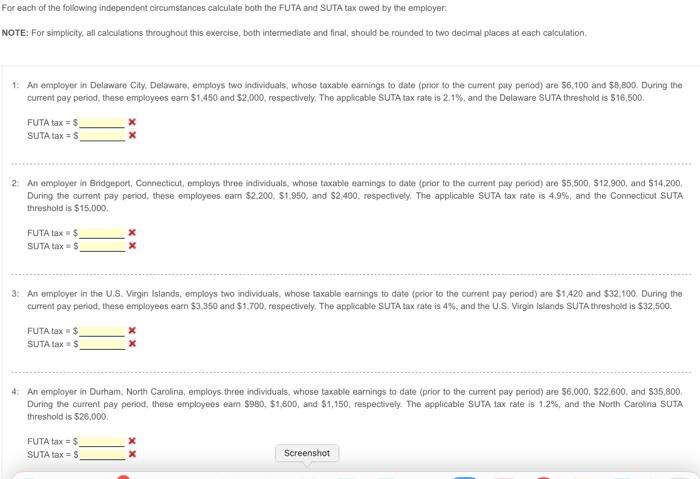

For each of the following businesses, determine the applicable FUTA tax rate for 2020 based on the locations listed below: 1: A business operating in the U.S. Virgin Islands FUTAtaxrate=% 2: A business operating in Columbus, Ohio FUTAtaxrate=% 3: A business operating in Austin, Texas FUTAtaxrate=% 4: A business operating in Oakland, California FUTAtaxrate=% 5: A business operating in Birmingham, Alabama FUTAtaxrate=% For each of the described pay periods, determine the taxable eacnings subject to FUTA tax: NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1. A business employs three individuals, whose taxable eamings to date (prior to the current pay period) are $12,200, $5,250 and $3,000. During the current pay period, these employees earn $2,400,$2,000 and $1,350, respectively. Taxsble earnings subject to FUTA tax =$ 2: A business employs two indivituals, whose taxable earnings to date (prior to the current pay period) are $3,000 and $31,400. During the current pay period, these employees earn $3,300 and $1,450, respectively. Taxable earnings subject to FUTA tax =$ 3: A business employs three individua's, whese taxable earnings to date (prior to the current pay period) are $5,200,$46,700 and $500. During the current pay period, these employees earn $2,100,$1,140 and $920, respectively, Taxable earnings subject to FUTA tax =$ For each of the following independent circumstances, calculate the FUTA tax owed by the employer; NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: An employer in Cleveland, Ohio, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $5,000 and 512.000. During the current pay period, these employees eam $1,800 and $2,000, respectively. FUTA tax=$ x 2: An employer in Nesconset, New York, employs three individuals, whose taxable eamings to date (prior to the current pay period) are $6,900,$1.000, and $2.4,200. During the current pay period, these employees earn $2,400,$1,750, and $3,000, respectively. FUTA tax=$ x 3: An employer in The U.S. Virgin isiands, employs two individuals, whose taxable earnings to date (prior to the current pay period) are \$8,500, and \$3.400 During the current tay period, these employees earn $880 and $675, respectively. FUTA tax =5 x 4. An employer in Cary, North Carolina, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $5,900, s8,900, and \$6,600. During the current pay period, these employees eam $940,$1,020, and $850, respectively. FUTA tax=$ For each of the following independent circumstances calculate the SUTA tax cwed by the employer. Assume a SUTA tax rate of 3.4% and a taxable earnings threshold of \$8, 500 . NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: A-1 Framing eniploys three workers who, as of the beginning of the current pay period, have earned $8,550,$8,200, and $7,400. Calculate SUTA tax for the current pay period if these employees eam taxable pay of $1,000,$1,350, and $1,800, respectively. SUTA tax=$ x 2. Mrs. Fix-lt Corp. employs two workers who, as of the beginning of the current pay period, have eamed $4,200 and $6,500, Calculate SUTA tax for the current pay period if these employees eam taxable pay of $2,700 and $2,400, respectively. SUTA tax=$ x 3. Burger Bites Restaurant employs 51 workers who, for the current pay period, earn total taxable pay of \$87,450. Of this amount, only \$11,000 are subject to SUTA tax, as this is the portion of individual employee eamings that does not axceed the $8,500 throshold. Calculate SUTA tax based on these earnings. SUTA tax =$ or each of the following independent circumstances calculate both the FUTA and SUTA tax owed by the employer: OTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1. An employer in Delarware City. Delaware, employs two individuals, whose taxable eatnings to date (prior to the current pary period) are $6,100 and $8,800. During the current pay period, these employees earn $1.450 and $2,000, respectively. The applicable SUTA tax rate is 2,1\%, and the Delaware SUTA threshold is $16,500. FUTAtax=$SUTAtax=5xx 2. An employer in Bridgeport, Connecticut, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $5,500, $12,900, and $14,200, During the current pay period, these employees earn $2,200,$1,950, and $2,400, respectively. The applicable SUTA tax rate is 4.9%, and the Connecticut SUTA threshold is $15,000 FUTAtax=$SUTAtax=$xx 3: An employer in the U.S. Virgin Islands, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $1,420 and $32,100. During the current pay period, these employees earn $3,350 and $1,700, respectively. The applicable SUTA tax rate is 4%, and the U.S. Virgin lslands SUTA threshold is $32,500. FUTAtax=3SUTAtax=5xx 4: An employer in Durham, North Carolina, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $6,000,$22,600, and $35,800, During the current pay period, these employees eam $980,$1,600, and $1,150, fespectively. The applicable $UTA tax rate is 1.2%, and the North Carolina SUTA threshold is $26,000. FUTAtax=$SUTAtax=$xx