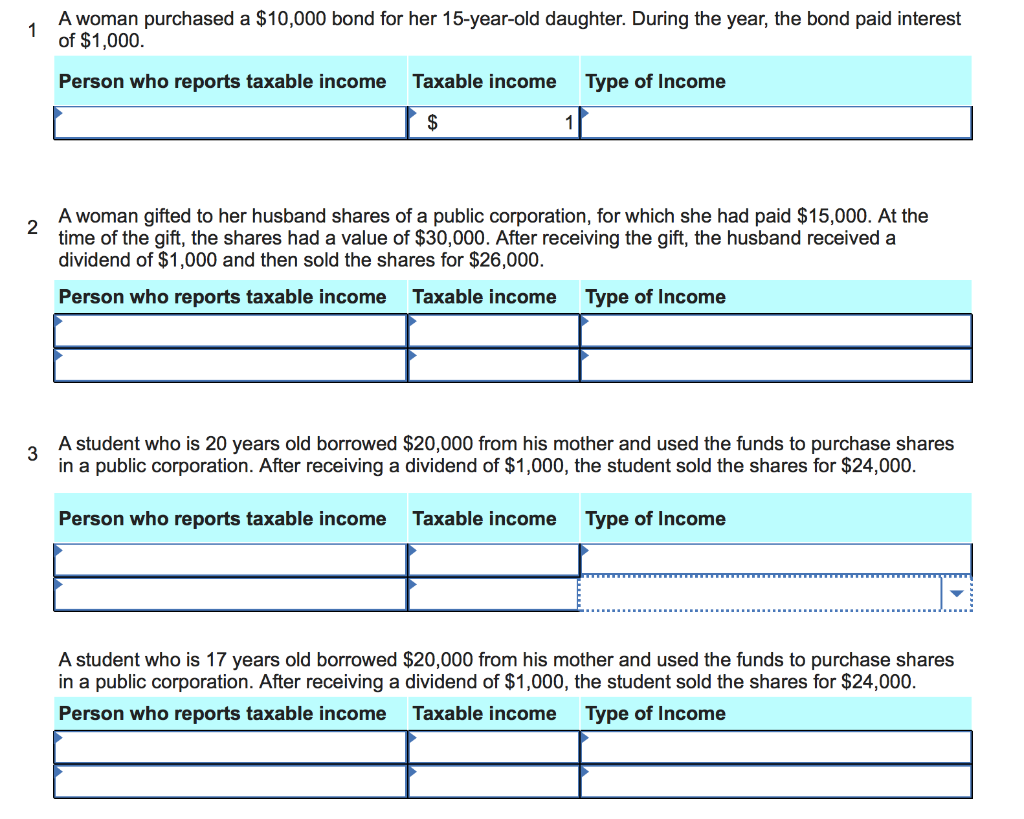

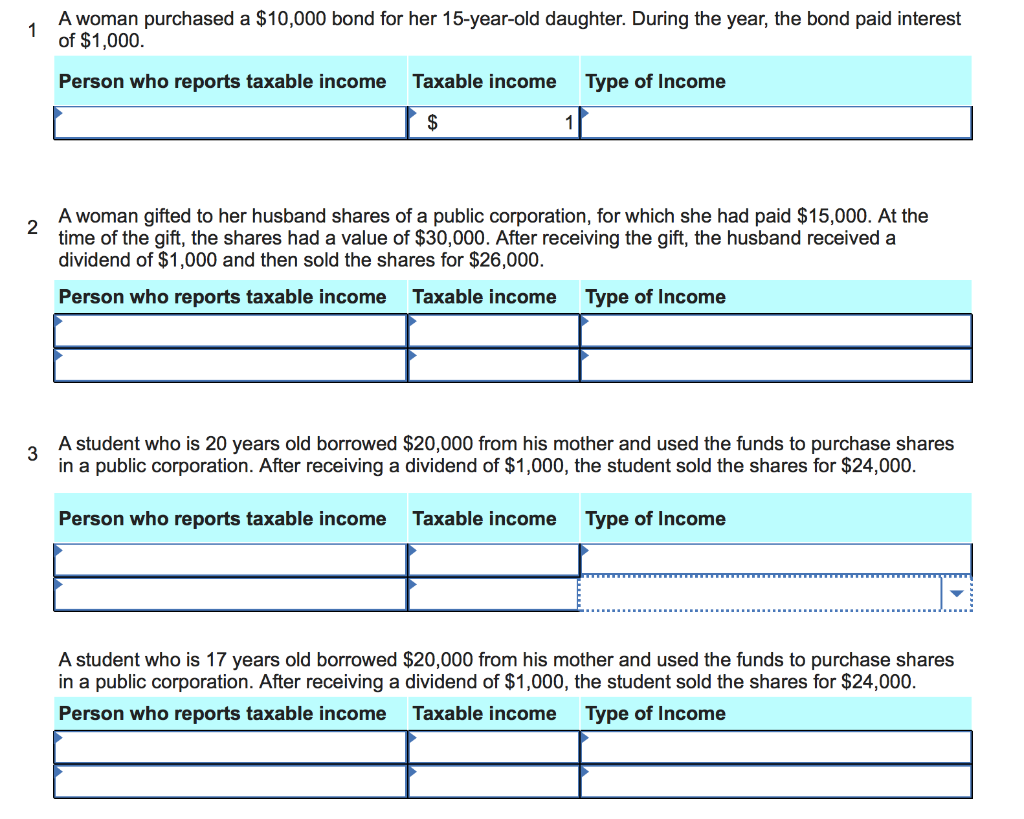

For each of the following independent transactions, determine the minimum amount of net income or loss for tax purposes and the taxpayer to which it applies.

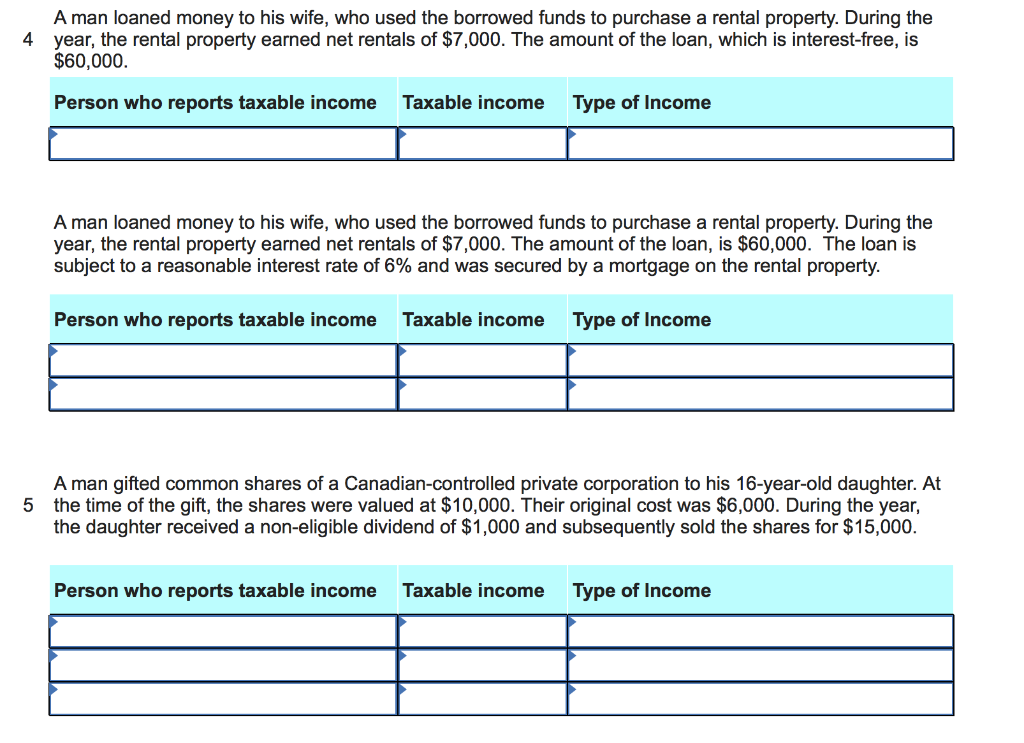

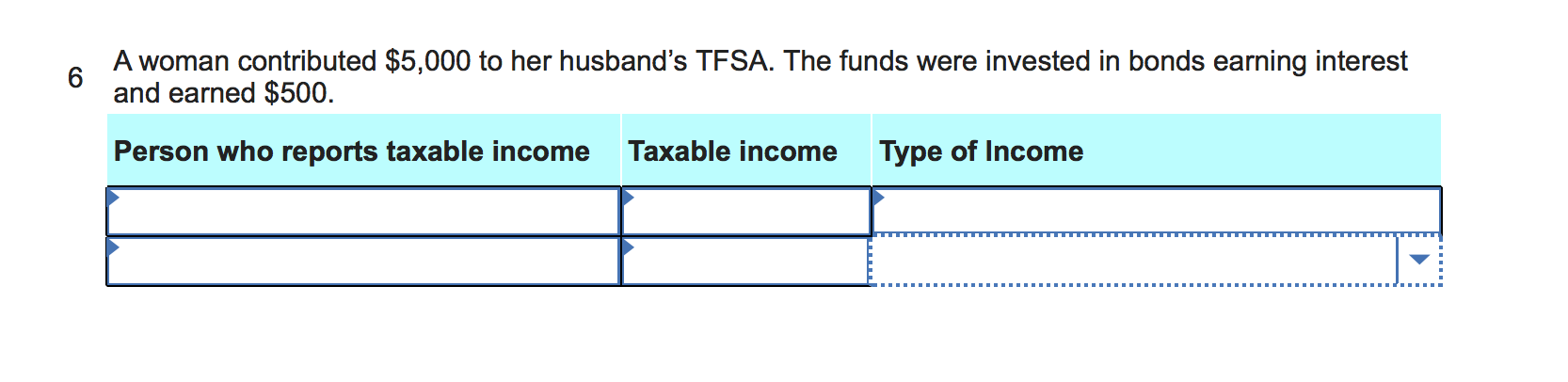

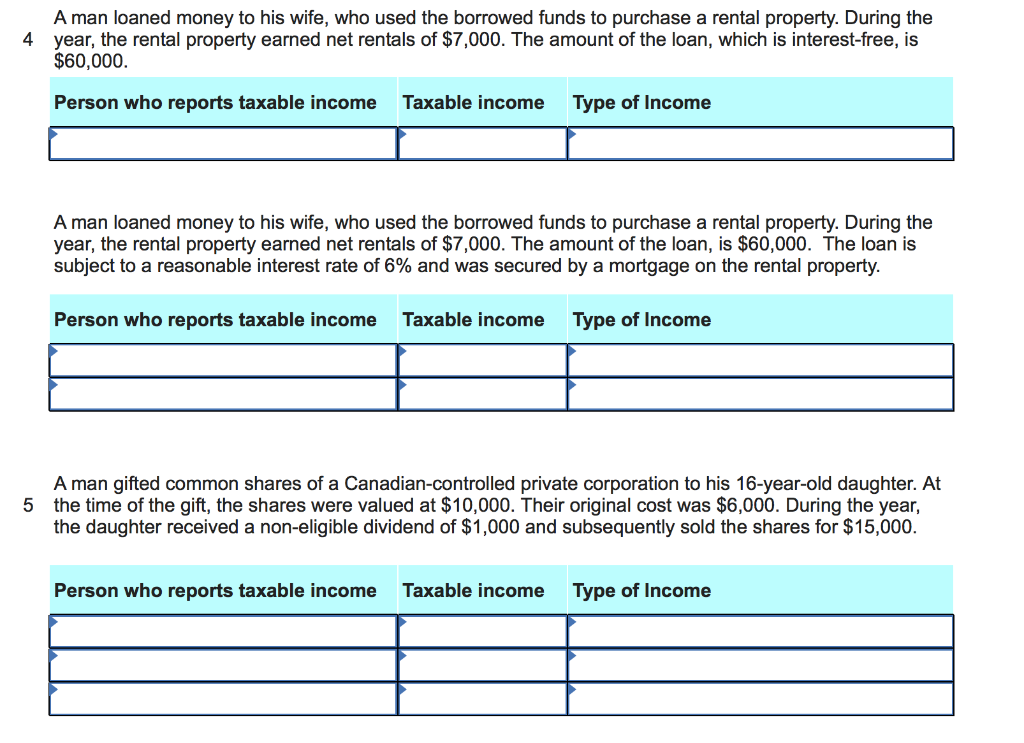

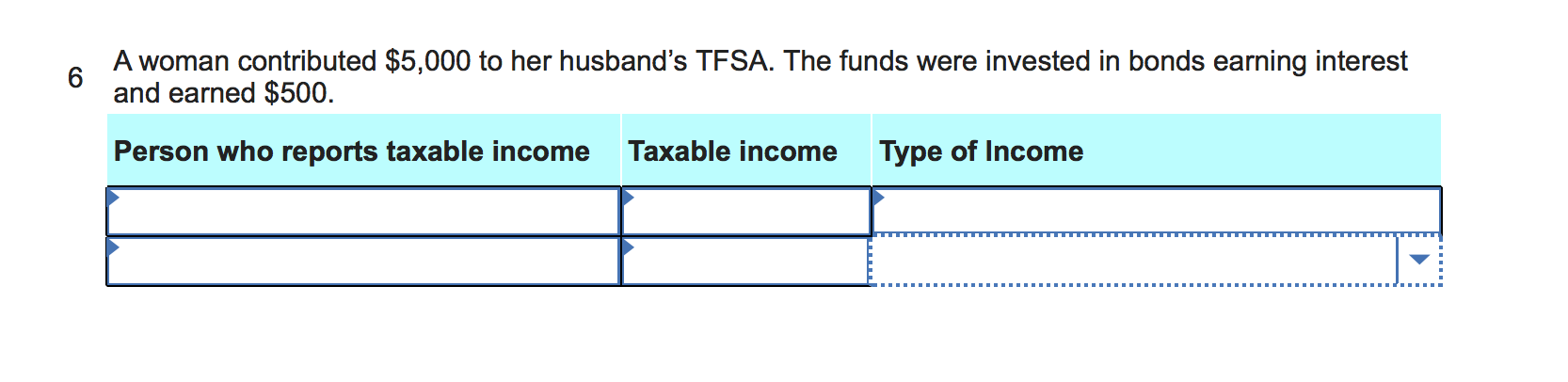

1 A woman purchased a $10,000 bond for her 15-year-old daughter. During the year, the bond paid interest of $1,000. Person who reports taxable income Taxable income Type of Income $ 2 A woman gifted to her husband shares of a public corporation, for which she had paid $15,000. At the time of the gift, the shares had a value of $30,000. After receiving the gift, the husband received a dividend of $1,000 and then sold the shares for $26,000. Person who reports taxable income Taxable income Type of Income 3 A student who is 20 years old borrowed $20,000 from his mother and used the funds to purchase shares in a public corporation. After receiving a dividend of $1,000, the student sold the shares for $24,000. Person who reports taxable income Taxable income Type of Income A student who is 17 years old borrowed $20,000 from his mother and used the funds to purchase shares in a public corporation. After receiving a dividend of $1,000, the student sold the shares for $24,000. Person who reports taxable income Taxable income Type of Income A man loaned money to his wife, who used the borrowed funds to purchase a rental property. During the 4 year, the rental property earned net rentals of $7,000. The amount of the loan, which is interest-free, is $60,000. Person who reports taxable income Taxable income Type of Income A man loaned money to his wife, who used the borrowed funds to purchase a rental property. During the year, the rental property earned net rentals of $7,000. The amount of the loan, is $60,000. The loan is subject to a reasonable interest rate of 6% and was secured by a mortgage on the rental property. Person who reports taxable income Taxable income Type of Income A man gifted common shares of a Canadian-controlled private corporation to his 16-year-old daughter. At 5 the time of the gift, the shares were valued at $10,000. Their original cost was $6,000. During the year, the daughter received a non-eligible dividend of $1,000 and subsequently sold the shares for $15,000. Person who reports taxable income Taxable income Type of Income 6 A woman contributed $5,000 to her husband's TFSA. The funds were invested in bonds earning interest and earned $500. Person who reports taxable income Taxable income Type of Income