Answered step by step

Verified Expert Solution

Question

1 Approved Answer

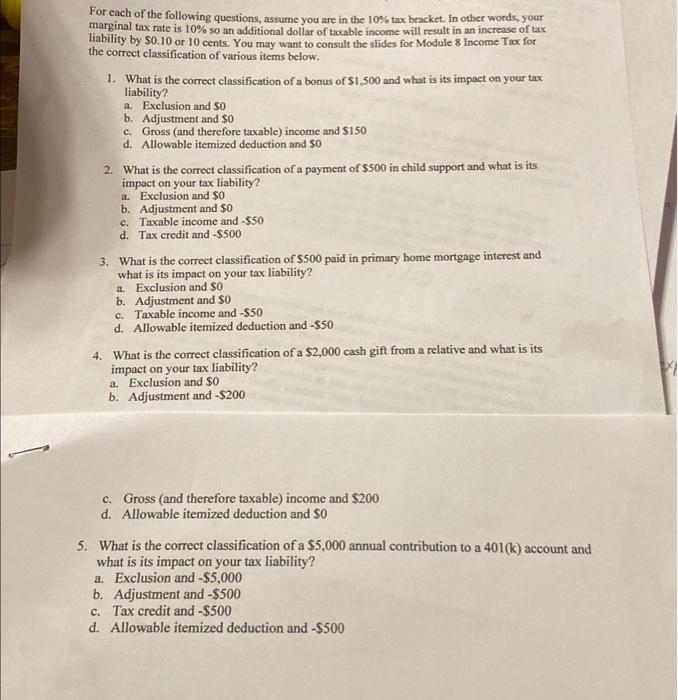

For each of the following questions, assume you are in the 10% tax bracket. In other words, your marginal tax rate is 10% so an

For each of the following questions, assume you are in the 10% tax bracket. In other words, your marginal tax rate is 10% so an additional dollar of taxable income will result in an increase of tax liability by $0.10 or 10 cents. You may want to consult the slides for Module 8 Income Tax for the correct classification of various items below. 1. What is the correct classification of a bonus of $1,500 and what is its impact on your tax liability? a. Exclusion and $0 b. Adjustment and $0 C. Gross (and therefore taxable) income and $150 d. Allowable itemized deduction and $0 2. What is the correct classification of a payment of $500 in child support and what is its impact on your tax liability? a. Exclusion and $0 b. Adjustment and $0 c. Taxable income and -$50 d. Tax credit and -$500 3. What is the correct classification of $500 paid in primary home mortgage interest and what is its impact on your tax liability? a. Exclusion and $0 b. Adjustment and $0 c. Taxable income and -$50 d. Allowable itemized deduction and -$50 4. What is the correct classification of a $2,000 cash gift from a relative and what is its impact on your tax liability? a. Exclusion and $0 b. Adjustment and -$200 c. Gross (and therefore taxable) income and $200 d. Allowable itemized deduction and $0 5. What is the correct classification of a $5,000 annual contribution to a 401(k) account and what is its impact on your tax liability? a. Exclusion and -$5,000 b. Adjustment and -$500 c. Tax credit and -$500 d. Allowable itemized deduction and -$500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started